The Challenge

- Understanding the “WHY” before you do anything is very critical in every aspect of your professional and personal life. The irony is that banking professionals do not understand “Why behind every applicable regulations. Most of them know which regulations are applicable, but don’t understand that the three “I’s- Intent of the law, interpretation of the law and implementation of the law- This is the number reason as to why most of the organization fail in operational risk management.

- You as an examiner observe this all day long- As regulations / standards are changing, it warrants a change to lending policies, procedures, loan related documents and disclosures process – manual mapping of regulations to policies, procedures, loan origination documents and disclosures and then updating policies and procedures to meet regulatory requirements is daunting task if done manually.

- Another challenge that examiners observe is when the regulations change, financial instructions don’t have a sophisticated system to push the changes in regulations to the rest of the organization so people are not caught off guard.

The Solution

- As bank examiners continue to see lenders struggle with the intent, interpretation and implementation of the new regulation such as TRID, a revised HMDA rule, Flood rule changes, and proposed CFPB servicing rules, to name a few, Examiners need to have aware that some organizations like 360factors have been able to keep up with the accelerations of regulations and have created a Regulatory change management software based on Artificial Intelligence (AI) with Regulatory / Standards and Requirements Intelligence Library with common taxonomy and centralized for multiple departments

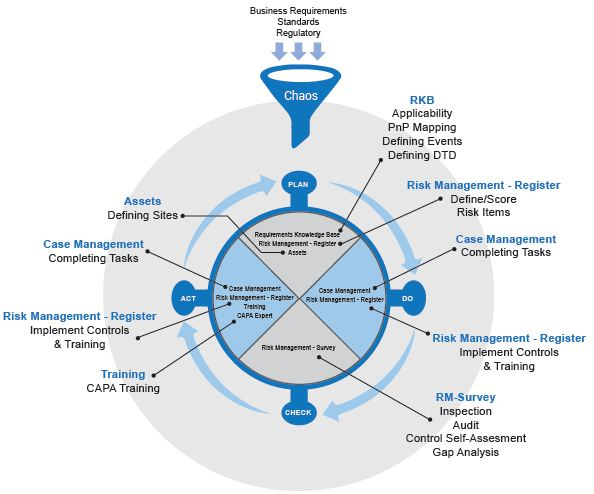

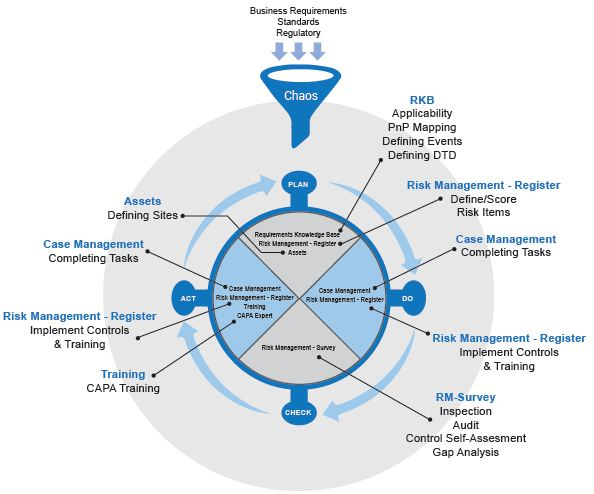

- Regulatory compliance software based on artificial intelligence technology automates the mapping of sections of your banking policies and procedures with regulations and their internal controls. As the regulations change or the policy or procedure changes, the system sends out alerts to the users that there was a change in regulation or the policy as well as assigns a task.

Value

- Automating the process of mapping regulations such as HMDA, Flood, FDCPA, CFPB to name a few to internal controls or operational controls helps build internal consensus around internal controls library and a common taxonomy which is hard to get through manual and disjointed tools such as excel, share point and other home grown non intuitive tools.

- Having a Banking Risk and Compliance management that as a regulatory change management automation with a repeatable governance process can drive operational efficiency, reduce cost of examination and increases quality

A Case Study

Challenge: A large financial intuition manually takes regulatory feeds saved it in excel and implemented sharepoint for their policies and procedures and that is how they addressed their regulatory change management. Their challenge was that their current solution was not able to provide translation of those regulations, they had no way to distinguish between previous vs current regulations, relied on external SME’s on the intent, interpretation and implementation of the laws. They felt like they were always caught off guard by examiners.

Solution: predict360 is an operational risk and compliance mgmt. software built on artificial intelligence and one of its key module is regulatory change management module which uses artificial intelligence technology to create a centralized regulatory library. It enables consistent taxonomy, concept map of specific regulations to policies & procedures, disclosures and to internal controls, automate the translation of the regulations as well as create an applicability of regulations process as to which regulations apply to which location, branch or even an asset.