The Challenge

- When regulations change frequently, compliance and risk professionals are left to use poorly-documented manual solutions like MS Excel or home grown tools with inconsistent taxonomies causes inaccuracies and incompleteness between the risk and financial process.

- Lack of integrated regulatory requirements into the banking operational processes.

- No sophisticated way of risk and compliance staff to map regulations to the policies, procedures and then convert the required into action plan- It is expected from them to figure out what specific controls are required to address regulatory requirements through manual process, typically leading to a buildup of labor-intensive control activities with uncertain effectiveness.

The Solution

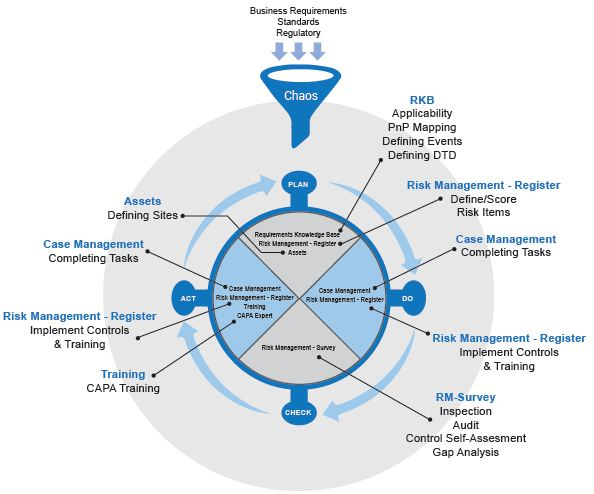

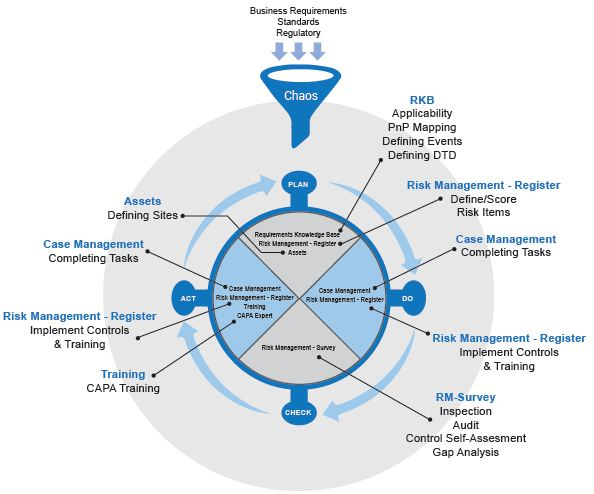

- Regulatory change management software based on Artificial Intelligence (AI) that houses regulations, standards, requirements Library with common taxonomy that is mapped to policies and procedures and internal controls. When the regulations or policies change, the system should have an automated change management process sending alerts and automated task to specific groups.

- Big data approach to regulatory change management not only allows Integration of current regulatory requirements into banking processes, but enables you to make solid decisions with predictable outcomes.

Value

- Automation of concept mapping policies and procedures with the regulations and sending out automated alerts and tasks when regulations or policies change, drives operational efficiency, reduces cost, increases quality and ensures happy employees.

A Case Study

Challenge: A tier 2 bank with $10 B plus in assets was using share-point for their policies & procedures, Thomson reuters for their regulatory library, outlook for their task management system and docusign for e-signature. Their challenge was that they had three different systems and none of the systems talked to each other. They wanted a system that would automate selected users to be alerted and tasked when the lending regulations or policies changed.

Solution: Since Predict360’s regulatory change management software, policies procedures mgmt. and internal controls library is an integrated tool and built-on artificial Intelligence technology, we were able to demonstrate if the regulations change or when new policy uploaded into the system, it breaks down the sections within policies and maps them to the regulations and send alerts and assigns tasks and action plans through automation.

- Policy, procedure and disclosure document is all integrated product with Docu-sign for eSignature including a workflow to accept, review, version control, e-sign and maintains audit trail.

- As the banking policies are implemented and as activities are performed, they are concept mapped to other artifacts in the system: Regulations/Internal requirements -> polices -> procedures -> CIP /EDN -> Controls – > Tasks.

If you would like a complimentary 60-minute consulting session on how to automate action plans when policy & regulation changes using artificial intelligence, please fill out the form.