Integrating BSA/AML compliance efforts to achieve maximum efficiency.

The Challenges

- The rapid speed of innovation in the banking industry and a continued regulatory focus on BSA/AML compliance including accurately assessing inherent BSA/AML risk is becoming increasingly difficult.

- Innovations like electronic cash, including mobile payments and pre-paid cards, provide numerous benefits to customers and bankers, but the change in delivery systems often increases the risks of what previously were lower-risk services.

- In 2012, various regulatory agencies assessed fines and penalties against a number of institutions that in aggregate exceeded $3.2 billion. This represented the largest amount in BSA/AML and Office of Foreign Assets Control (OFAC) penalties ever imposed over a one-year period.

Our Solution

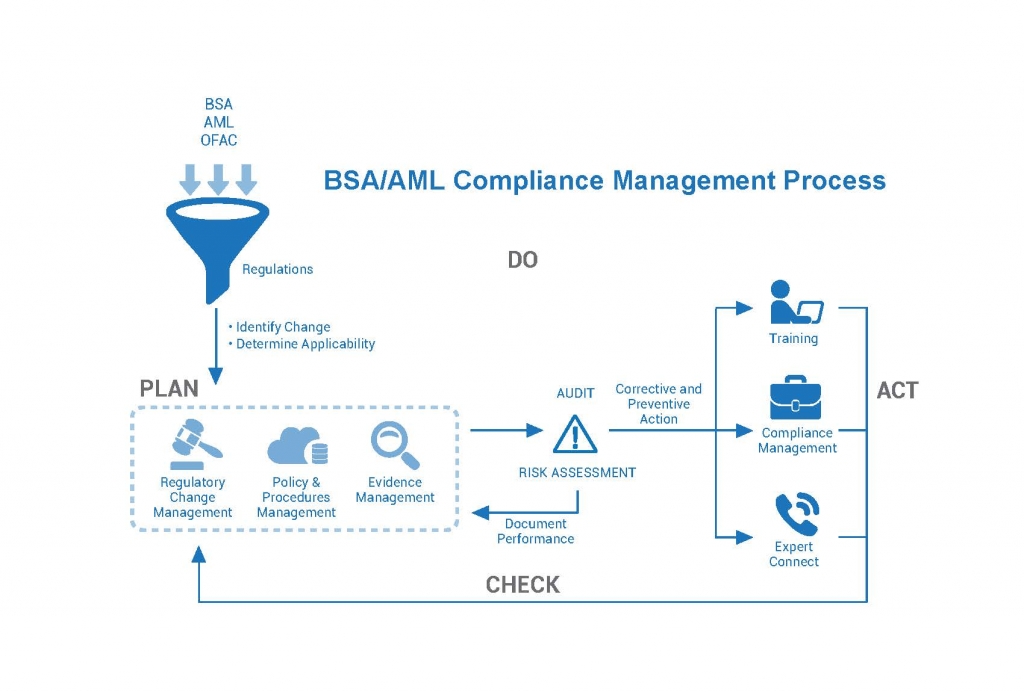

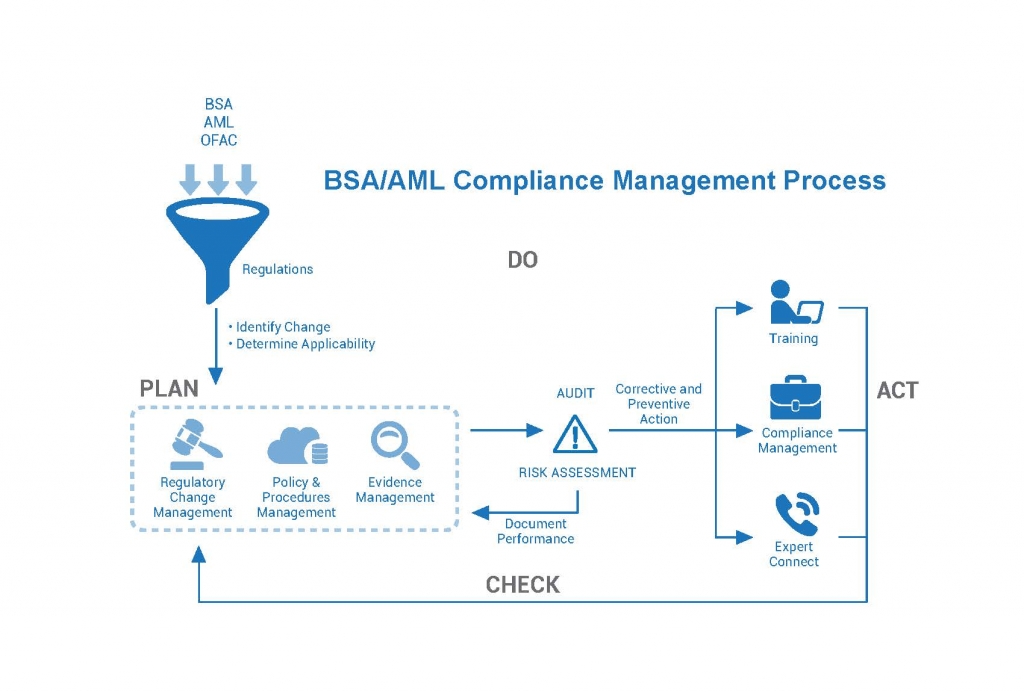

360factors provides a regulatory risk and compliance management software platform and advisory services to help regulate BSA/AML, OFAC complaints management, and other compliance needs through a simple yet effective regulatory risk and change management model and methodology.

We offer two unique solutions:

Option 1

In managed services, you pay a flat fee to license the software along with services from our Bank Secrecy and Anti-Money Laundering experts to provide the framework to develop the required assessments of BSA/AML, OFAC compliance risks across the organization.

Option 2

You can secure advisory services on a short and long term project basis to help improve the effectiveness and efficiency of your BSA/AML compliance effort.

Our experts follow a consistent Regulatory Risk and Compliance Management methodology.

Our Software

Our regulatory compliance experts and advisers use Predict360, a regulatory risk and compliance software to streamline advisory services as a competitive differentiator. It vertically integrates all modules which allow organizations to manage their BSA/AML, OFAC complaints management, and other compliance programs based on federal and state regulations through a single platform.

- Keeps your compliance program effective and up-to-date. It allows you to train your workforce and to implement the program on an ongoing basis to address the specific regulatory requirements of your organization so you can accurately assess inherent BSA/AML risks.

- Increases efficiency in documenting your transactional process through automation of incoming and outgoing transaction processes and enhancing risk management. It has search capabilities that allow fast access to transaction information as your evidence is stored in the system and then is mapped to every regulation that it applies to.

- Closes gaps in your BSA/AML compliance program to protect your organization from costly penalties and fines, reputational risks, negative business impact and compliance deficiencies through the rollout of corrective and preventive actions.