The insurance sector is witnessing rapid regulatory oversight, particularly with the growing societal focus on the importance of Environmental, Social, and Governance (ESG) principles. Traditionally, the insurance sector has primarily concentrated on risk mitigation and financial security for businesses. However, the evolving socioeconomic and environmental concerns of regulators have made it necessary to focus on a broader perspective.

Insurance businesses must prepare to navigate a complex terrain where risks extend beyond financial markets to encompass the ecological, societal, and governance realms. At its core are increasing expectations of a new generation of employees, customers, and investors. Meanwhile, global initiatives and collaborations are also shaping the expectations placed upon insurers.

In this blog, we will consider the implications of ESG regulations for risk management in the insurance sector and how insurers can devise a robust strategy to overcome new, emerging challenges.

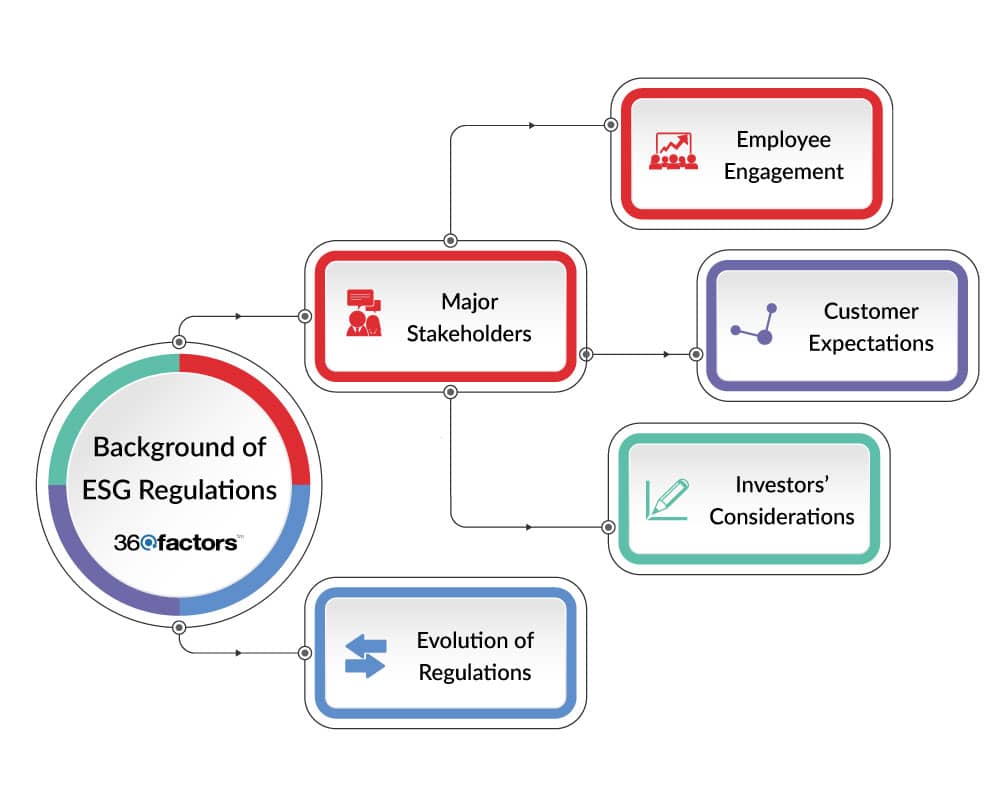

Background of ESG Regulations

In response to the evolving expectations of stakeholders, regulatory bodies are increasingly recognizing the need to integrate ESG considerations into the fabric of corporate governance and business operations.

Employee Engagement, Customer Expectations, and Investors’ Considerations

The impetus behind the surge in ESG regulations stems from the realization that businesses are not isolated entities but integral parts of the larger societal framework. Employees are key stakeholders who seek more than just a paycheck from their employers. They are drawn to organizations that reflect their values, are committed to environmental sustainability, and actively contribute to social well-being. Companies that embrace ESG principles not only attract top talent but also foster a sense of purpose among their employees.

Similarly, we live in an era where consumers wield considerable influence through their purchasing decisions. Meeting customer demand is no longer a transactional affair. We are witnessing a trend where customers seek products and services that align with their ethical values and contribute positively to society. Insurance companies must recognize this shift and reevaluate their product offerings and communication strategies to resonate with socially conscious consumers.

Investors are also recalibrating their approach to risk and return. ESG factors are becoming integral to investment decisions, with shareholders increasingly scrutinizing companies for their environmental impact, social responsibility, and governance practices. The rise of investment in sustainable and responsible business models reflects a growing awareness that companies with strong ESG profiles are not only better equipped to weather risks but also positioned for long-term success.

How ESG Regulations Are Evolving in the US and the West

In the United States and Western countries, the evolution of ESG regulations is characterized by a move towards comprehensive reporting and disclosure. Regulatory bodies are recognizing that transparency is critical to fostering trust among stakeholders. The US Securities and Exchange Commission (SEC) is actively exploring ways to enhance climate-related disclosures, acknowledging the material impact of climate risks on businesses.

Regulatory frameworks are also extending beyond mere reporting obligations. There is a growing emphasis on integrating ESG considerations into the fiduciary duties of companies and investment managers. This evolution signifies a shift from perceiving ESG as a voluntary, philanthropic endeavor to acknowledging it as a fundamental aspect of risk management and corporate governance.

Considerations of ESG Regulations for Risk Management

Insurance businesses must understand how ESG considerations intertwine with risk management to get a better grasp of how to integrate ESG into their underwriting and pricing strategy.

How ESG Factors Influence Risk Assessment for Insurance Businesses

Environmental risks have become an integral component of the risk profile for insurers. Climate change, natural disasters, and resource depletion pose real threats that can have far-reaching implications on underwriting, claims management, and overall business sustainability. Insurers must assess their exposure to climate-related risks and incorporate them into their risk modeling processes.

Social factors, including demographic shifts, community resilience, and societal health, are critical elements in risk assessment. The COVID-19 pandemic and lockdowns underscored the interconnectedness of global health crises and business continuity. Insurers must evaluate the resilience of their portfolios in the face of unforeseen social disruptions, aligning risk mitigation strategies with societal well-being.

Governance, traditionally associated with internal controls and corporate governance structures, is evolving to include considerations of ethical conduct, diversity, and transparency. Companies with robust governance practices are more resilient and better equipped to navigate the complexities of the modern business environment. Insurers are recognizing that governance lapses can have reputational and operational repercussions, making it imperative to integrate governance-related risk assessments into their frameworks.

Integration of ESG Criteria in Insurance Underwriting and Pricing

ESG considerations should not be confined to risk assessments alone but play a role in shaping underwriting and pricing strategies. Insurers must consider ESG criteria to determine the risk profiles of potential policyholders. For example, a company with robust sustainability practices may be deemed a lower risk, while one with a high environmental impact might be charged higher premiums.

Similarly, businesses that demonstrate a commitment to social responsibility may be rewarded with more favorable premiums, reflecting their lower risk profile, while those with socially contentious practices may face higher premiums. Businesses with transparent governance structures can also be rewarded with favorable pricing, as they indicate a lower likelihood of governance-related disruptions.

5-Step Strategy for Successful ESG Regulatory Compliance

Here’s a 5-step strategy to successfully implement ESG regulatory compliance. While the exact method of implementation may differ from one insurer to another, this 5-step strategy covers the overall scope:

Identify Challenges and Opportunities for ESG Implementation

- Conduct a thorough assessment of current operations to identify areas of alignment and misalignment with ESG principles.

- Explore opportunities to leverage ESG factors for innovation and competitive advantage.

Evaluate the Impact of ESG Regulations on Investment Portfolio.

- Scrutinize the investment portfolio to ensure alignment with ESG goals.

- Explore sustainable investment opportunities that align with the insurer’s values.

Introduce ESG-friendly Products That Align with Social Values

- Develop insurance products that address ESG concerns and resonate with socially conscious consumers.

- Communicate the ESG features of these products to enhance customer awareness and engagement.

Ensure Transparency as Required for ESG Disclosure

- Implement robust reporting mechanisms to meet transparency requirements.

- Demonstrate a commitment to accountability and ethical business practices through clear ESG disclosures.

Collaborate Across Industry with Insurers to Promote Sustainable Practices

Conclusion

As insurers grapple with the dynamic interplay of regulatory mandates, stakeholder expectations, and global imperatives, the significance of ESG principles has become apparent as a catalyst for innovation, strategic differentiation, and long-term success.

ESG has come to the forefront of risk management, encouraging insurers to expand beyond traditional metrics and embrace a holistic approach to assessing and mitigating risks. The integration of ESG criteria into underwriting and pricing strategies is a seismic shift, where businesses are not only responding to societal and environmental imperatives but are proactively leveraging these considerations to drive competitive advantage.

In this context, the role of advanced enterprise risk and compliance management solutions, such as the Predict360 platform, has become significant. Such platforms provide insurers with the tools needed to navigate the complexities of ESG regulatory compliance, ensuring seamless integration into core business operations.

Through robust analytics, reporting capabilities, and real-time risk assessments, insurers not only meet regulatory expectations but also demonstrate to stakeholders that they are at the forefront of sustainable and responsible business practices.