Managing insurance enterprise risk and compliance of all the compliance functions through a single platform increases operational excellence and operating income.

The Challenges

- Whether in property and casualty or life and health insurance, organizations are subject to thousands of new regulations. Antiquated and legacy homegrown tools or configuring existing ERP tools to streamline GRC has proven to be ineffective.

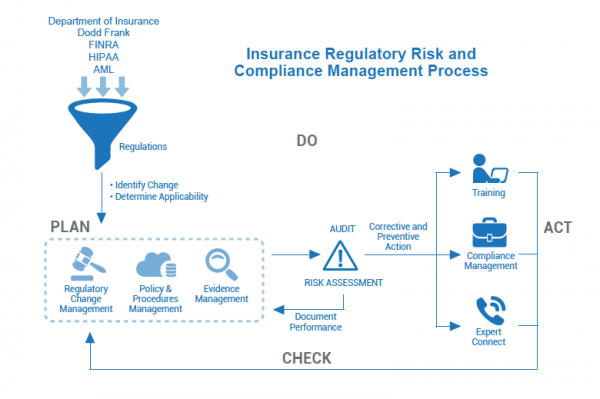

- Insurers are challenged to effectively interpret and identify applicable regulations, convert them into business requirements, and streamline them into compliance corrective and preventive actions.

- All departments within the organization such as Finance, Operations, IT and Legal are all using different and multiple compliance tools, and as a reactive measure, insurance firms are investing more in human resources and contractors across multiple departments which increases cost, creates silos and mistrust in risk and compliance data, preventing executives from making intelligent decisions.

Our Solution

Insurers are realizing that proactive investment in enterprise Governance, Regulatory Risk and Compliance automation software is yielding satisfactory ROI in terms of operational excellence, sustainability and business growth.

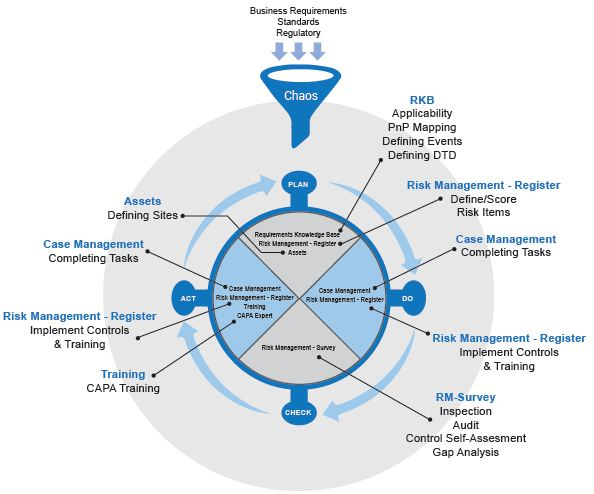

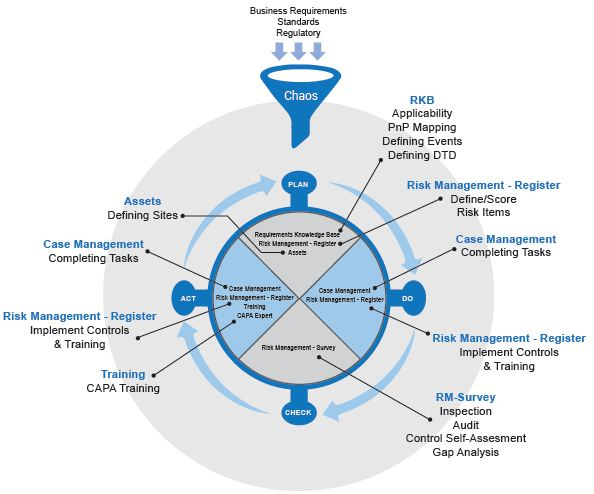

360factors has built a unique Enterprise Regulatory Risk and Compliance platform that will aggregate risks from all compliance departments, break down silos and provide preconfigured workflows to manage specific compliance functions.

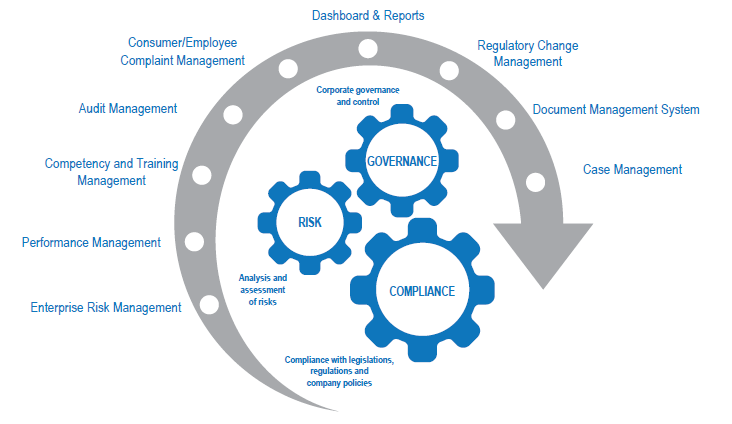

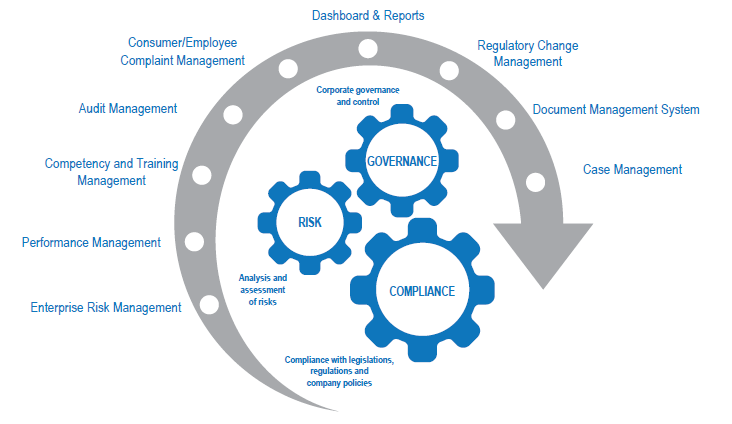

Predict360 is an integrated governance, risk and compliance software that enables insurance companies to improve their operational efficiencies, mitigate their risks, maintain compliance with internal/external requirements and standards, and preserve their brand through a single platform.

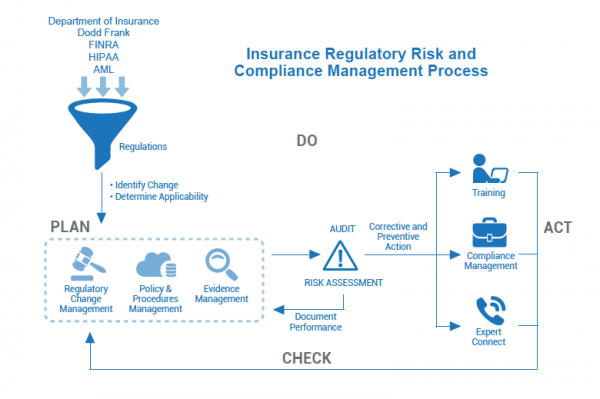

- Regulatory Change Management module maintains regulations that impact all of your departments at the federal, state/provincial level, provides clarity in interpretation, automates applicability and maps all internal controls to the regulations.

- Streamlines the management of your corrective and preventive actions which safeguard you from obvious risks: penalties, fines, litigation and negative business impact.

- Automates preparedness for regulatory scrutiny with a closed loop risk assessment, audit trails, training, document management, corrective and preventive action, robust reporting, and risk profiling.

It further meets the following capabilities and business needs for each compliance function within the organization: