The Challenge

- Examiners typically observe in adequate or poorly-documented manual solutions using excel or home grown tools with inconsistent taxonomies causing inaccuracies and incompleteness within audit, test and compliance process.

- Lack of integrated regulatory requirements into the banking operation processes

- No sophisticated way of mapping regulations to the banking policies, procedures, lending documents and disclosures.

- Examiners typically have a hard time in getting to financial organization to show proof that people are reading policies and converting the required into an action plan?

The Solution

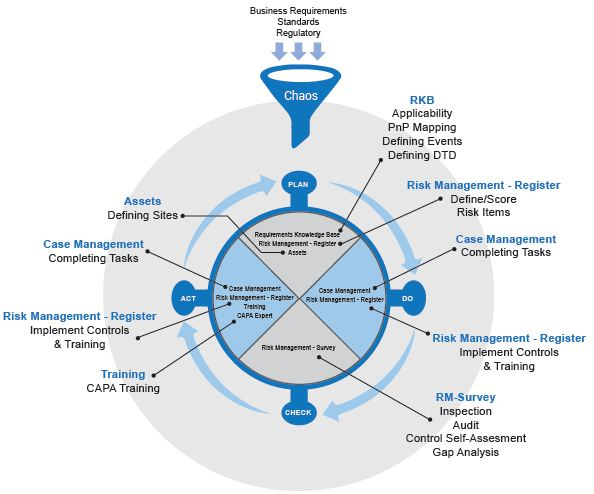

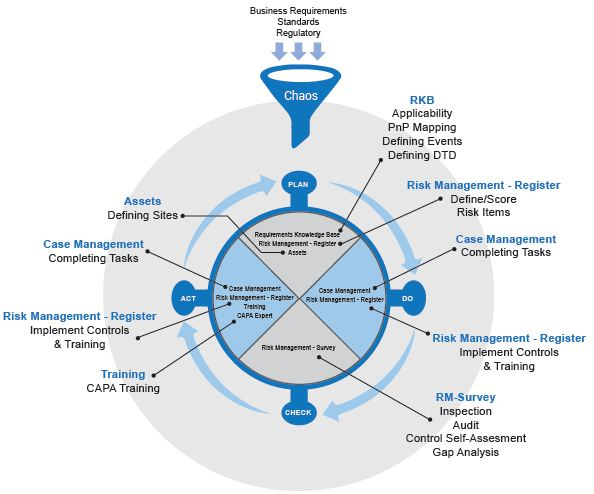

- Regulatory compliance software based on Artificial Intelligence (AI) that has Requirements Intelligence Library with common taxonomy and centralized for multiple departments that are subject to regulatory scrutiny

- Operational risk and compliance software based on artificial intelligence that can automate mapping of lending regulations to banking policies, procedures, internal controls, risks and audits

- Implementing a big data approach to regulatory change management will not only allow Integration of current regulatory requirements into financial processes, but will enables the financial firm to make solid decisions with predictable outcomes

Value

Automation of concept mapping policies and procedures with the regulations and sending out automated alerts and tasks when regulations or policies change, drives operational efficiency, reduce cost, increases quality and happy consumers.