The Challenge

- Siloed Approach To Risk – very few banking firms have mature and structured processes and reporting on GRC that brings together an integrated and orchestrated view of GRC processes and information. Most organizations have fragmented approach where some aspects of enterprise and operational risk are more mature than others but fail to have an overall coordinated strategy where distributed business units and processes maintain their own data, modeling, frameworks and systems. This results in functional departments and business unit’s areas focus on their own view of risk and not the aggregate picture, unable to recognize substantial and preventable losses

- Existing GRC Tools That Cannot Be Replaced– When banking firm approaches risk in scattered silos that do not collaborate, there is no opportunity to be intelligent about risk as risk interrelates and compounds to create a larger risk exposure than each silo is independently aware of. This happens because organization have existing governance, risk, information security, compliance and audit tools and legacy governance and risk structures which is hard to replace immediately with an overarching integrated governance, risk, Information, compliance and audit management system because of various reasons including resistant to adopting new technologies.

The Solution

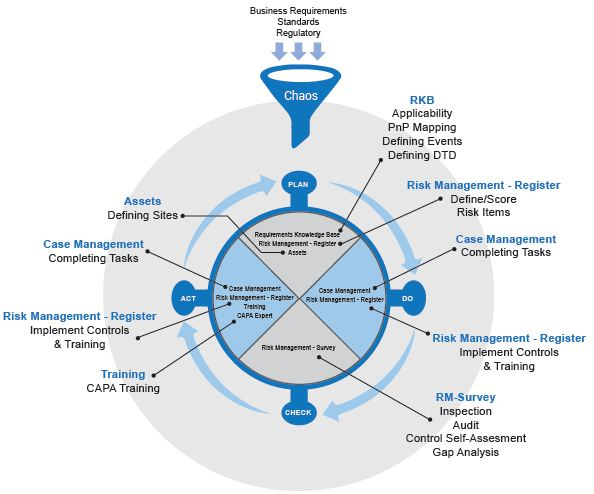

- GRC Business Intelligence tool to sit on your enterprise landing data zone- While data is powerful, it is akin to raw material in construction. To achieve the desired outcome, one must refine and compose the raw material into something useful. Analytics are that critical step in unlocking and revealing the insights within data. Since legacy Governance, risk and compliance tools within each business unit are going to be hard to displace and a tough sell to all business unit manager to replace their individual tools with an integrated governance, risk, information security and compliance management system all at once, an ideal solution can be to have a tool like Predict360 to sit on top of an enterprise landing data zone which can tie various risk and compliance data from all the business units through a common information and technology architecture to support overall risk management activities as well as you can get a view of the inter relationships of risk , compliance, action plans across all the business, understand the depth and breadth of risk and predict risk using artificial intelligence technology and leveraging all the risk data feeds.

Value

- Banking CRO’s need to invest in automaton– You will become an intelligent organization once you understand the risk exposure to each process, project or an asset and how it intersects with other risks within each business unit and aggregate the risk to get enterprise perspective on risk without replacing all the existing tools that the functional managers and business units are using to meet their day to day risk & compliance needs. This alleviates the change management issue and less disruption to the organization.

- It will further allow the banking intuition to be competitive and gain efficiencies in an environment where margins are thin, balancing growth through introduction of new business models and costs of doing business is increasing to meet regulatory demands.

A Case Study

Challenge:

- EVP of Innovation of one of the top ten banks in US was interested in having an aggregated risk from multiple inputs, governance structures and risk models so that they get a better understanding of relationships of risks, its interdependencies where it intersects, get a holistic enterprise view of the risk so it becomes easy to assess impact of various decisions to each business unit.

- Another challenge they had is that implementing a company-wide integrated governance, risk, information and compliance management platform was not an option and a tough sell to business unit leaders internally – Legacy tools, historical governance cultures, exposing their risk, compliance and action plans to other departments, managing their egos were among the reasons that were legitimate concerns.

Solution:

This required a Governance, Risk and Compliance intelligence approach — This top tiered bank had recognized their challenges and build an enterprise data landing zone. Predict360, 360factors GRC Intelligence platform build on artificial intelligence technology was designed to sit on an enterprise landing data zone which can tie various risk and compliance data from all the business units through a common information and technology architecture to support overall risk management activities.