Risk and Compliance Platform for FinTech

FinTech services and apps are disrupting the financial sector by delivering financial services faster and through more channels than traditional financial organizations. However, FinTech businesses also need to manage the other side of the coin to succeed, compliance. Additionally, FinTech services that collaborate with banks and other financial institutions bring them under the regulatory purview of the financial regulators. Predict360 simplifies compliance and risk management for FinTech entrants in the financial sector.

Request a Custom Demo

Overcoming FinTech Risk and Compliance Challenges

Predict360 enables FinTech businesses to solve significant risk and compliance challenges, including:

- Ensuring regulatory compliance reporting requirements when working with banks and other traditional financial institutions

- Managing regulatory risks that differ state by state and adapting to regulatory changes quickly

- Achieving real-time compliance visibility and predictions for emerging risks

FinTech Risk Management with Predict360

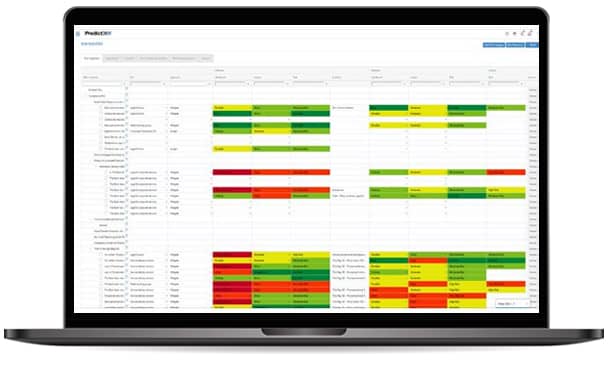

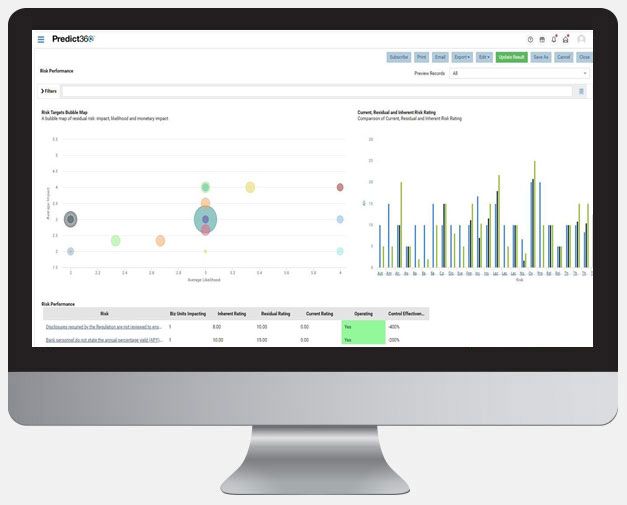

FinTech businesses provide exciting new opportunities for banks and other financial institutions, but they also introduce unknown risks. Predict360 simplifies FinTech risk management by centralizing all risk management processes and analytics under one platform and displaying risk metrics on executive dashboards. FinTech managers gain an in-depth view of risks across the organization, how they relate to compliance requirements, and how the controls are performing. In addition, the modular nature of Predict360 enables FinTech businesses to expand the features and content to enable their growth in the financial sector.

Connect with an Expert

FinTech Compliance With Predict360

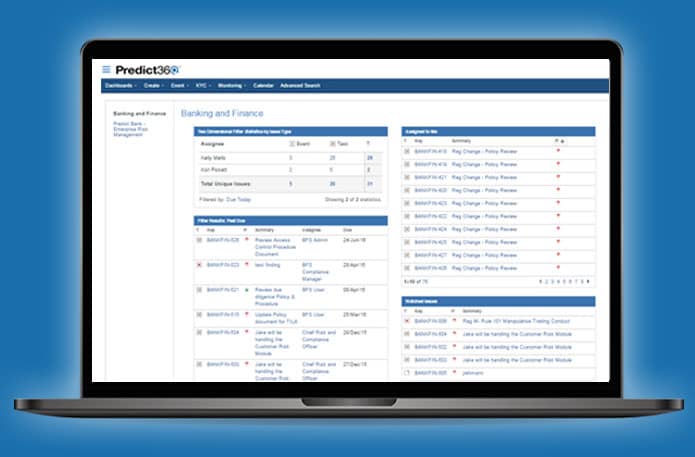

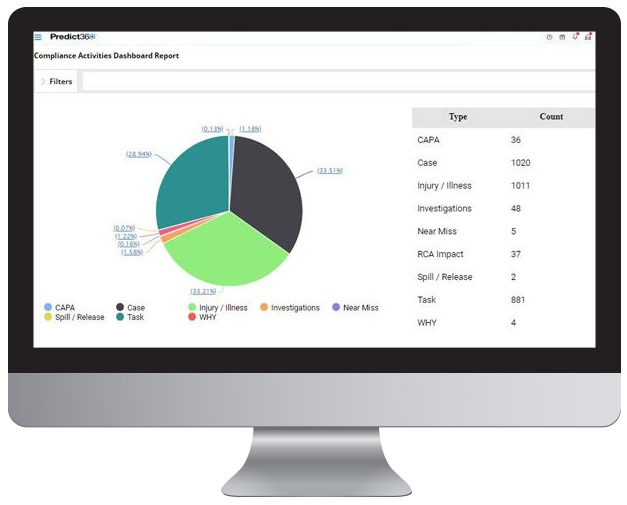

Managing compliance can be a daunting task for FinTech businesses that do not have the experience of operating under regulatory scrutiny in the financial sector. Predict360 automates and streamlines FinTech compliance processes, giving FinTech businesses a robust compliance framework that makes compliance requirements and task management visible to all stakeholders. In addition, the Predict360 platform monitors compliance levels, analyzes compliance data, and reworks compliance workflows to enable FinTech businesses to continue being innovative and disruptive.

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist