Synchronize Risk and Compliance with Corporate Strategic Goals

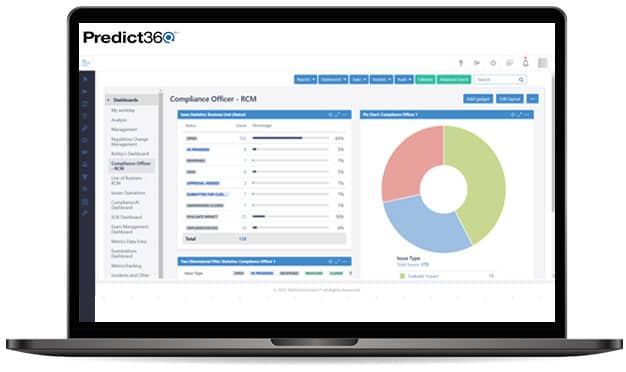

Predict360 is an A.I. (Artificial Intelligence) powered GRC (Governance, Risk, and Compliance) platform that vertically integrates risks and controls, KRIs, regulations and requirements, policies and procedures, audit and examinations, and training in a unified, cloud-based system. Predict360’s SaaS architecture and modern technologies deliver predictive analytics, data insights for predicting risk and streamlined compliance.

Predict360 automates tasks and workflows while improving quality and value of risk and compliance activity execution. The highly configurable platform creates risk and regulatory relationships between organizational activities and provides visibility into where risks intersect, providing stakeholders a deeper, wider, and holistic view of risk and compliance. The unified architecture of Predict360 increases the efficiency of risk and compliance teams, enhances visibility for management, and creates electronic audit trails at the same time.

Every company has its own unique vision and needs, which is why we designed Predict360 to be modular and flexible enough to be molded to your company’s vision and requirements. Businesses can select the modules and functionalities they require from the solution. This reduces bloat both in functional terms and cost terms. Instead of a confusing solution with unneeded features, the employees of your organization get direct access to the tools they need.

Request a Custom Demo

Integrated GRC Modules

Predict360’s modules connect with each other to provide enhanced functionality, analytics, and insights. The available applications include:

- Predict360 Risk Management

- Predict360 Risk Insights with KRI Engine (Insight360)

- Predict360 Compliance Management

- Predict360 Regulatory Change Management

- Predict360 Compliance Monitoring and Testing

- Predict360 Complaints Management

- Predict360 Issues and Incidents Management

- Predict360 Risk Management and Assessments

- Predict360 Regulatory Examination Findings Management

- Predict360 Audit Management

- Predict360 Policy and Procedure Management

- Predict360 Learning Management

- Predict360 Third Party Risk Management

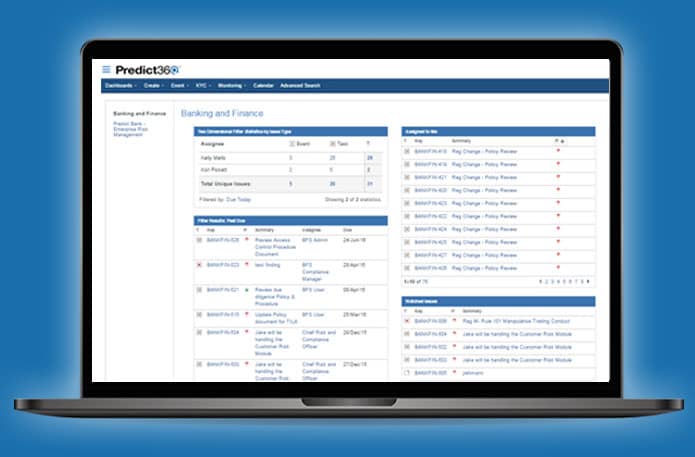

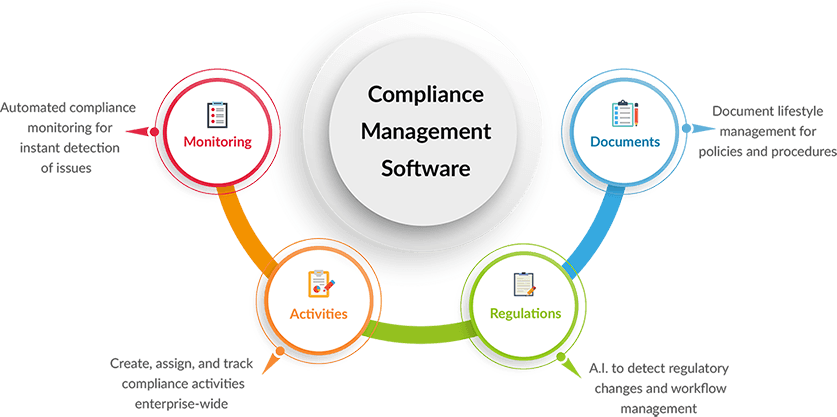

Intelligent Compliance Management

Predict360’s Compliance Management applications enable organizations to collect, store, track and collaborate on all compliance-related activities and regulatory reporting requirements, including compliance monitoring & testing (QA/QC), compliance program reviews, regulatory examinations & findings, regulatory changes, remediation plans & corrective actions, internal & external complaints, hotline reporting, case management and investigations, training plans, document change requests, sanctions and many other types of compliance-related tasks. As such, the system provides a single system of record and a common calendar for all compliance-related activities.

The applications for compliance management include:

Augmented Risk Mitigation

Predict360’s Risk Management applications enable organizations to identify, quantify, monitor, and minimize/mitigate risks. These applications allow businesses to manage the business, credit, interest rate, liquidity, operational, strategic, compliance, reputation, and cyber risks at the business unit level and as enterprise-wide risks.

- Risk Management and Assessments (ERM/RCSA)

- Controls Management

- Issue and Incidents Management

- Operational Risk and Loss Event Management (ORM)

- Risk Insights with KRI Engine (Insight360)

- Internal Audit and Findings Management

- Third-Party and Vendor Risk Management (VRM)

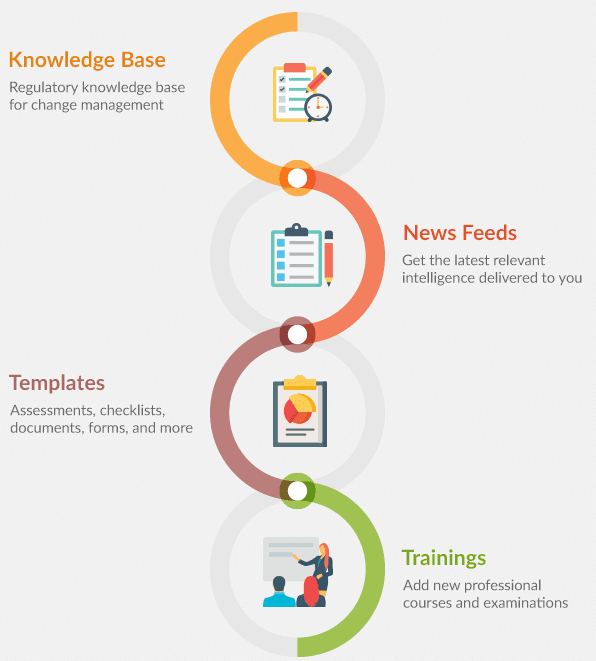

Powerful Content Plugins and Repositories

Predict360’s functionality can be further enhanced through powerful content plugins and best practices repositories made by 360factors and our valued partners in the risk and compliance domain. Available content plugins include:

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist