About Lumify360™

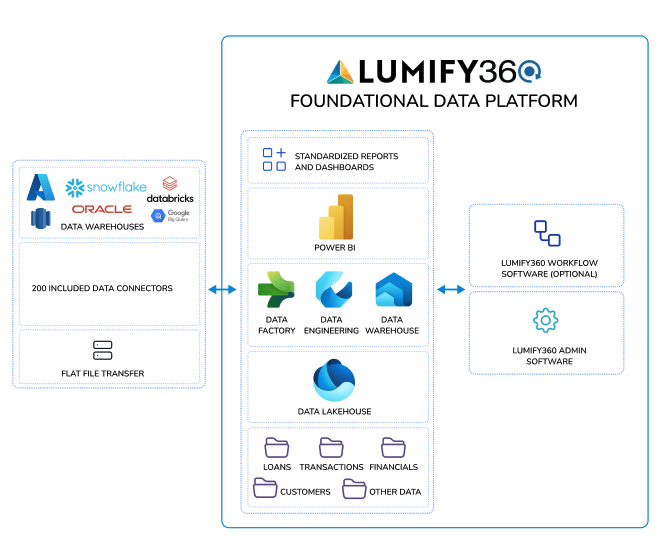

Lumify360™ is a modern data analytics platform that predicts business performance by transforming siloed data for real-time decision-making. Built for mid-market organizations, Lumify360 delivers full-fledged capabilities traditionally reserved for large enterprises, including a data lake, Power BI visualizations, data connectors, a workflow engine, robust data governance, and Kaia—an integrated AI companion that makes analyzing data and providing recommendations accessible to everyday users in a secure fashion.

Illuminate your mission-critical decisioning data with Lumify360, where analytics meet action to ignite success.

Request a Custom Demo

Challenges

Customer data is out there, but it’s difficult to consolidate, enrich, and correlate it in a way that empowers timely and confident decisions. This is because internal and external data are siloed, unstructured, and outdated. Once data is modeled and transformed into visualizations, opportunities to take proactive action have passed. And, if this weren’t frustrating enough, boards of directors and executives often still require subject matter experts to explain data meaningfully.

- Financial organizations can go it alone with home-grown solutions that take data engineers and analysts months or years to develop or partner with analytics platforms.

- When considering analytics platforms, there’s often a mismatch between the size and complexity of today’s data and the agility of legacy platforms to transform it into meaningful analytics at the speed of now.

- Even with homegrown or legacy solutions, financial organizations must often rely on data analysts and SMEs to explain the data’s meaning.

Why Lumify360:

- Lumify360 overcomes these challenges with its robust, modern technology stack. It connects to any online or offline data source and transforms it into real-time, enriched data sets – often for the cost of one data engineer.

- Because of Lumify360’s native Power BI integration, financial organizations can easily port Lumify360’s visualizations into their internal Office applications and keep reports refreshed.

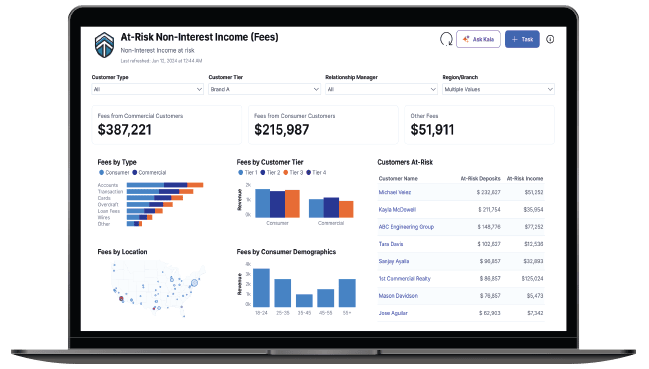

- Offers standardized reports for fee income, profitability, credit concentration, customer insights, peer performance, cash flow, branch performance, and more. Optional machine learning module available for predictive insights.

- With Kaia, Lumify360’s integrated AI companion, all users can instantly get the insights they need or dig deeper into analytics without relying on data analysts or subject matter experts.

Benefits

- Connect to any other loan platform, core, middleware, or other data sources, such as Databricks, Snowflake, S&P, Moody’s Analytics.

- Dig deeper into your analytics with Kaia, an integrated AI companion that is trained on large banking and financial services data sets, such as the CFR, Fred, and FFIEC. Explore data visualizations without relying on subject matter experts or data analysts.

- Assign and take action on analysis, trends, and exceptions and ensure timely offline data collection with a configurable workflow and notification engine.

- Easily embed and refresh visualizations in Office365 applications with our native Power BI reporting integration.

- Partner with 360factors, the banking technology experts with a strong track record of serving banks, credit unions, and financial services companies through our technologies and partner network.

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist