Risk and Compliance Intelligence Platform

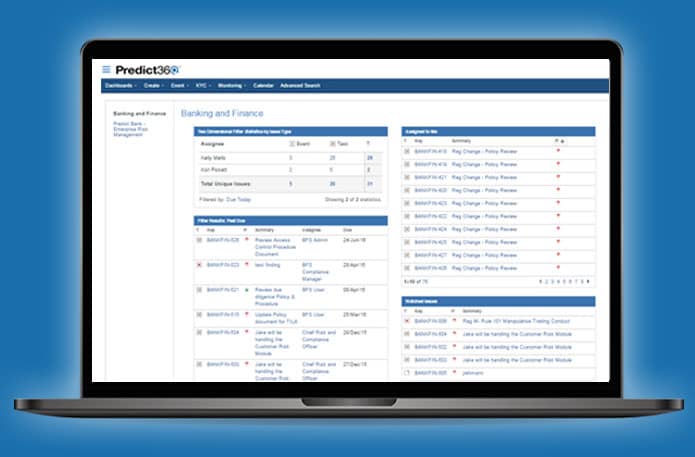

Predict360 automates tasks and workflows, improving the quality and value of compliance and risk activity execution through a singular cloud-based platform. Its AI-augmented technology creates risk and regulatory relationships between various organizational activities. It enhances visibility into where risks intersect through integrated BI tools such as Power BI and Tableau, providing stakeholders with a deeper, wider, and more holistic view of organizational risk and compliance.

Enterprise Risk Management

Risk Management is a crucial exercise undertaken to identify, assess and monitor risks to protect organizations from potential losses. Predict360’s Enterprise Risk Management suite ensures that the organization always has visibility of its internal and external enterprise risks through business intelligence-powered dashboards.

Compliance Program Management

Every business knows the importance of compliance but achieving desired compliance levels remains challenging. Predict360’s Compliance Management applications allow organizations to develop, assess and monitor an enterprise compliance framework that can keep the organization up to date with the complex and changing regulatory environment.

Predict360 Is Soc 2 Type II Certified

Financial Services Risk Management and Compliance

Financial organizations have been subject to some of the strictest regulatory frameworks for businesses, especially after the 2008 Financial Crisis and Covid-19. Financial services are the backbone of any economy, so governments want to ensure their risks are mitigated, and compliance levels are optimum. Financial services risk management and compliance is thus a critical domain for financial organizations.

Predict360’s modern risk and compliance solution simplifies both domains and turns them from cost centers into value-generating parts of financial institutions.

Banking Risk Management and Compliance

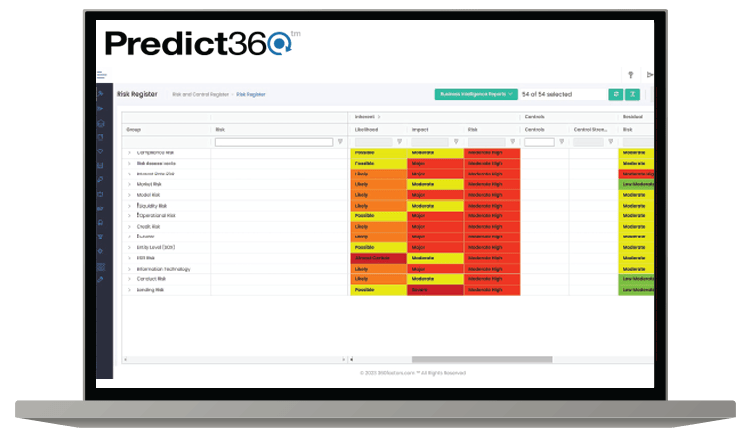

According to the Bank of England, the three largest risks banks take are Credit Risk, Market Risk, and Operational Risk. With market conditions becoming even more difficult after economic crises, banks are now facing increasing pressures from new types of competition in the form of FinTechs. In such pressure-laden conditions, banks need to assess, control, and manage their risks and regulatory requirements more efficiently than before, to stay ahead of their competition.

Predict360’s Risk and Compliance Management solution is endorsed by the American Bankers Association, the largest trade group representing banks in America. Predict360’s proprietary risk library, augmented by our partner risk libraries such as the ABA Risk Library and Crowe’s Risk and Compliance Control Library, allows banking organizations a level of risk and compliance control unparalleled within the industry.

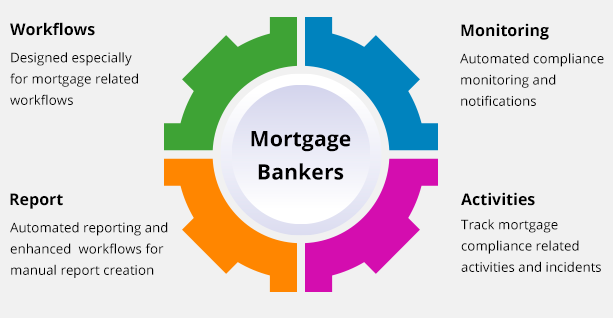

Mortgage Risk Management and Compliance

Mortgage businesses have been recovering slowly after bearing the brunt of the 2007-2008 global financial crisis, which was sparked by the collapse of the housing market in the United States. The lack of proper regulation and control of mortgage lending and financial services led to excessive risk-taking by the industry, which resulted in the housing market’s collapse.

To tackle this situation, the government enacted regulations and controls to ensure the mortgage industry does not exceed its risks and prevent future losses. Mortgage lenders are now subject to strict regulations and know the importance of proactively ensuring compliance with regulations and managing risks. Predict360’s risk and compliance management solution serves big-picture data to executive boards and provides predictions and insights to ensure organizations can detect systemic instabilities.

Money Services Risk Management and Compliance

Money service businesses are an important part of the financial system and help ensure that unbanked communities have access to the financial network. However, it is also one of the most overlooked sectors within the financial world. Money services need dedicated risk and compliance management solutions because their business nature means their business processes and concerns, and their respective regulatory environment is often very different from other types of financial organizations and institutions. Predict360’s Money Services risk management and compliance management solutions bring risk and compliance solutions to MSBs and provide them with the tools and services they need to meet all their risk and compliance requirements.

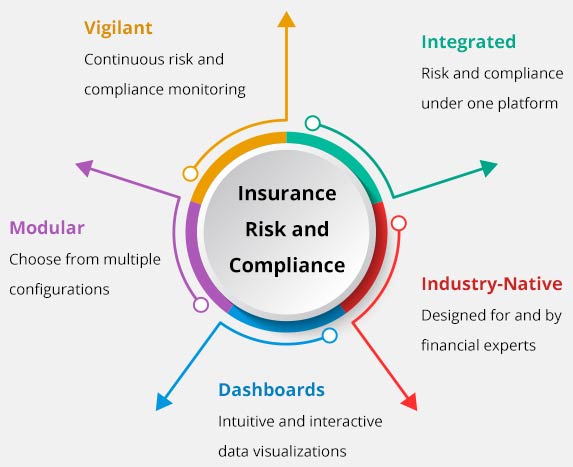

Risk Management and Compliance in Insurance

Insurance is one of the most important parts of the financial sector because it adds stability to the economy. Insurance businesses provide other businesses with the financial security they need to succeed, which is why risk management and compliance in the insurance industry are perhaps more crucial.

Insurance businesses must ensure their risk management and compliance with industry regulations are rock solid as the market’s volatility can multiply their risks manifold. Predict360’s cloud-based risk and compliance management solution allows insurance businesses to assess and perform risk reviews to help the organization, as the ultimate risk owner, connect the dots on key issues.

Integrated Risk and Compliance in Banks

Integrated Risk Management is a modern approach to risk and compliance management that uses enabling technologies to create a set of practices and processes backed by a risk-aware culture to improve decision-making and performance. This approach creates value for an organization through an integrated view of managing its unique risks.

Predict360’s AI-based predictive analytics, along with its industry-leading libraries, allows organizations to identify, evaluate, prioritize risks, and implement mechanisms to mitigate them. Predict360’s comprehensive workflows allow banks the best means to track and inform their stakeholders of the organization’s risk response and complaince initiatives.

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist