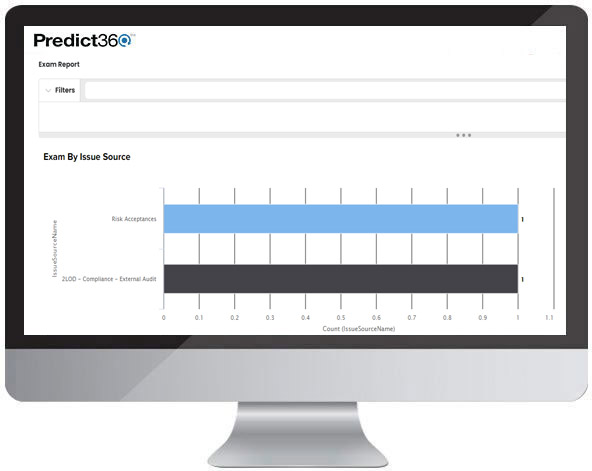

Efficient Exams and Actionable Findings

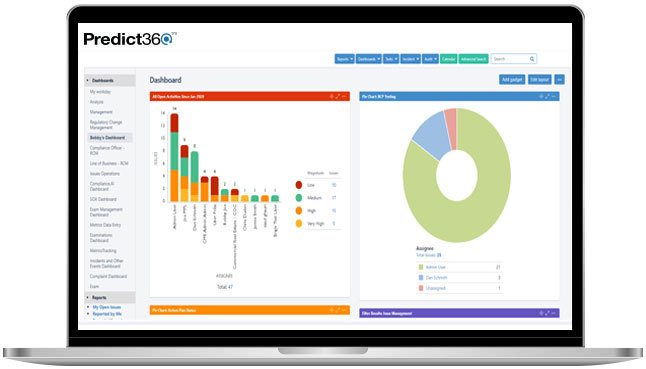

Predict360’s Regulatory Exams and Findings Management solution automates many tasks and workflows while improving quality and value of compliance and risk activity execution through a single platform. The technology creates risk and regulatory relationships between all activities in an organization and provides visibility into where risks intersect – providing stakeholders a deeper, wider and holistic view of risk and compliance.

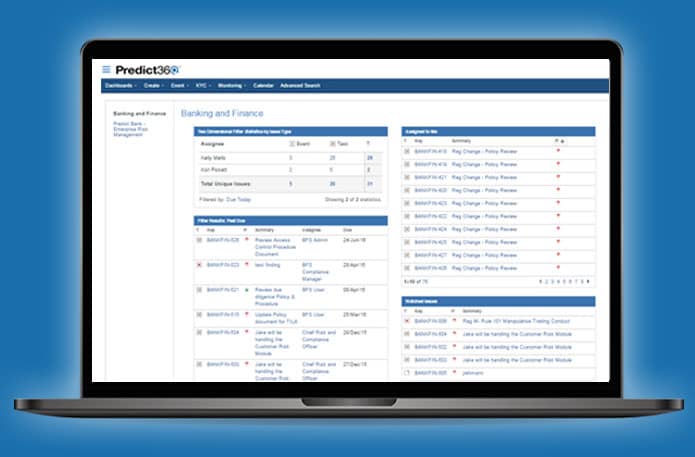

Predict360 empowers the risk, compliance, and auditing professionals who manage regulatory examinations to deliver better results while using fewer resources. Management can assign tasks, manage exams, assess findings, and more all within a single platform allowing for unprecedented collaboration and efficiency. Key features include:

- Web forms that allow interaction with third parties, capture critical request details, and intelligently route requests

- Improved collaboration between employees because the platform provides due date notifications, request routing, escalations, actions items, and other important workflow items

- Intelligently record findings brought forward by regulatory examiners and keep a record of the commitments and actions items created in the process

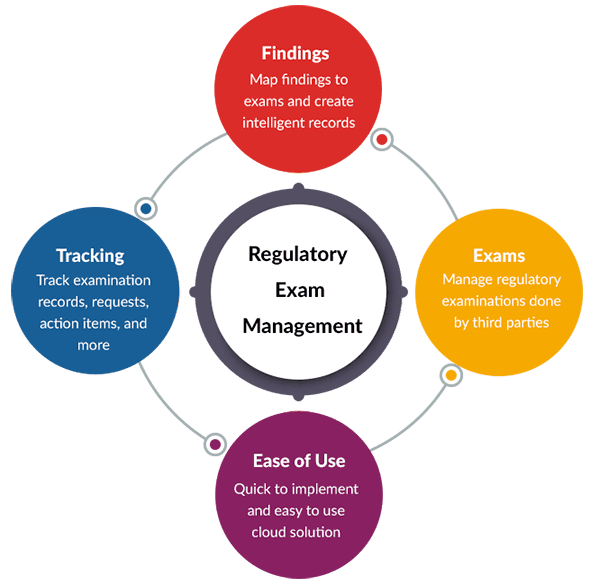

Streamline Regulatory Exam Processes

Intelligently designed tools and features that allow your organization to subvert the usual inefficiency traps in regulatory exams:

- Identifying ownership of team members who will respond to the regulatory examination

- Tracking all activities and tasks of various internal and external parties, including the documents requested by examiners

- Managing due dates, notifications and escalations of any commitments from a team member

- Capturing all supporting documentation and work papers, including storing all the documents requested by and provided to examiners

Regulatory Exams and Findings Management Challenges

- A significant challenge in preparing for regulatory exams is organizing and maintaining the voluminous paperwork generated during different phases of the exam, such as scoping and planning the exam, managing the exam, concluding the exam, and regulatory reporting.

- The majority of firms collect data manually on spreadsheets or documents — a process that is not only inefficient but also prone to inaccuracies and inadequate data that might be challenged by examiners.

- Without a centralized database, firms struggle to track, retrieve, and present information to examiners during the review process, which slows down the process.

- Businesses often do not have visibility into the tasks being carried out across the enterprise for regulatory exams, which can result in delays and errors.

Enhanced Accountability

Predict360 doesn’t just improve the examination workflow – it also helps improve the way findings are recorded, managed, and responded to:

- Track findings and recommendations at an individual level and assign them to different business units with action plans and completion commitments

- In addition, any sub-tasks (action items) related to the regulatory examination and/or to the associated findings can be linked

- Associate tasks and other action items directly to the regulatory examination and the findings that are associated with or the cause of that task

- The platform ensures that there is a record and an electronic audit trail of all action items and responses; thereby ensuring accountability and transparency

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

Predict360’s out-of-the-box applications designed specifically for banks our size along with their banking content was a significant influence in our selection of 360factors.

John Dunne EVP Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist