Deliver Valuable Financial Performance Insights to Your Executive Stakeholders

Predict360 Peer Insights, powered by Bank IQ, empowers banks and credit unions to stay ahead of peers with insightful and highly intuitive benchmarking intelligence. Banks can specify their peer banks and have full control over viewing their performance relative to their specified peers. Key features include:

- Complete financial dataset for 14,000+ U.S. commercial banks, savings institutions, credit unions, and bank holding companies, including regulatory 031, 041, 051, Y9C, 5300 call reports, 10K / 10Q SEC fillings, and more.

- Compare against specific peers or one of (or multiple) curated peer groups systematically

- Use an appropriate peer group suggested by default, or create your custom set of peers

- Uncover your bank’s competitors’ latest data, trends, and relative performance

- Filter institutions by your criteria and easily export them to a custom peer group

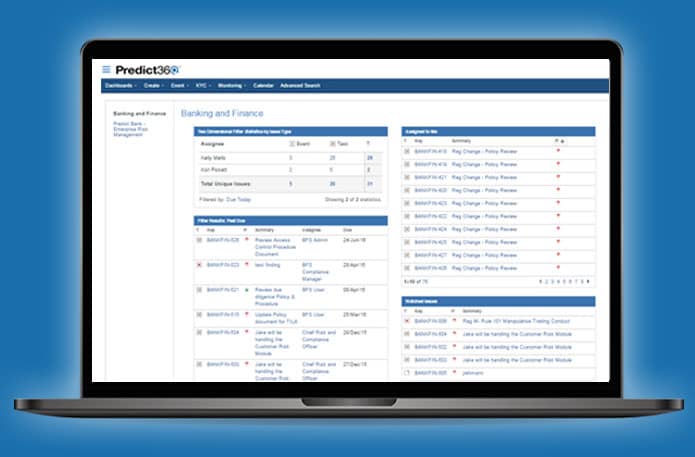

Analyze Data and Generate Financial Reports in Minutes

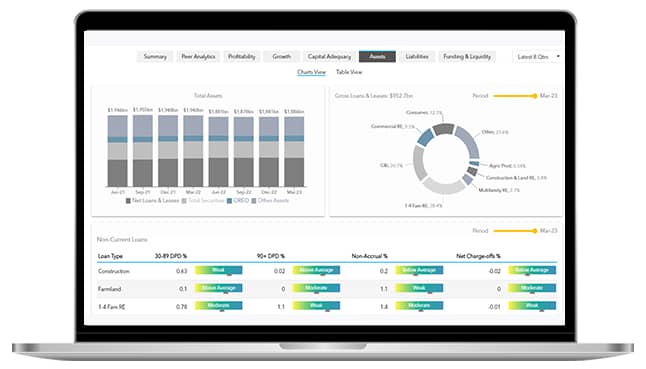

Predict360 Peer Insights, powered by Bank IQ, enables financial organizations to quickly select and analyze key performance metrics across multiple intuitive categories:

- Quickly get what you need from banks’ financial data sets with analytics grouped by topics that are relevant to you

- Uncover your competitors’ strategy and latest trends by understanding their accounts composition, profitability, growth, capital adequacy, asset quality, yields and spreads, funding, liquidity, and many more Key Performance and Risk Indicators

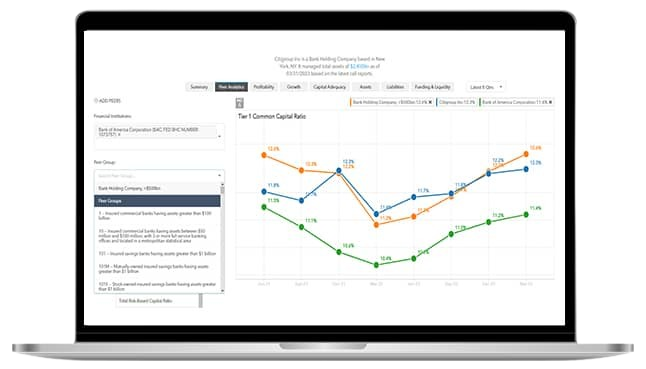

Search, Summarize Data, and View Trends with a Streamlined UI

Generate easy-to-use reports and summaries for board and executive reporting.

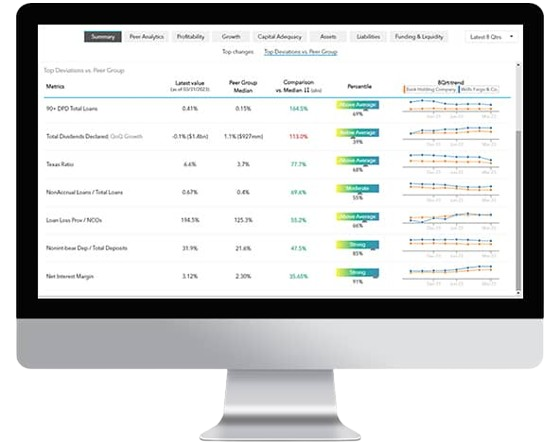

- Discover the most relevant changes, trends, and deviations vs peers at your fingertips

- Get bank and peer performance summarized in an intuitive snapshot

- Focus on outperforming your peers and remediating areas of opportunity instead of wasting time collecting, standardizing, and analyzing a sea of data sets

- Discover the best acquisition targets with Bank IQ’s screening tool

- Empower your search with filters for the institutions’ key metrics and characteristics

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist