Loan Performance Analytics

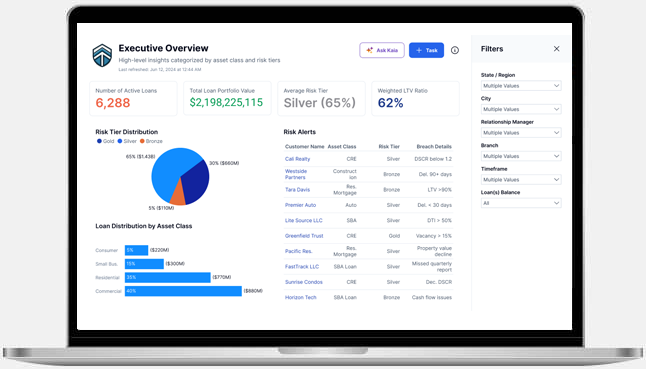

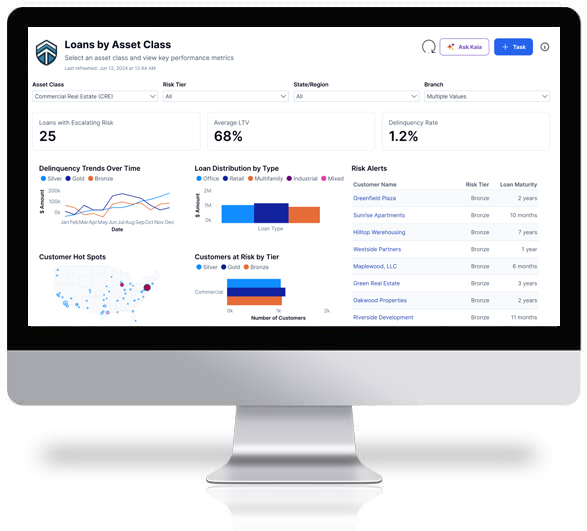

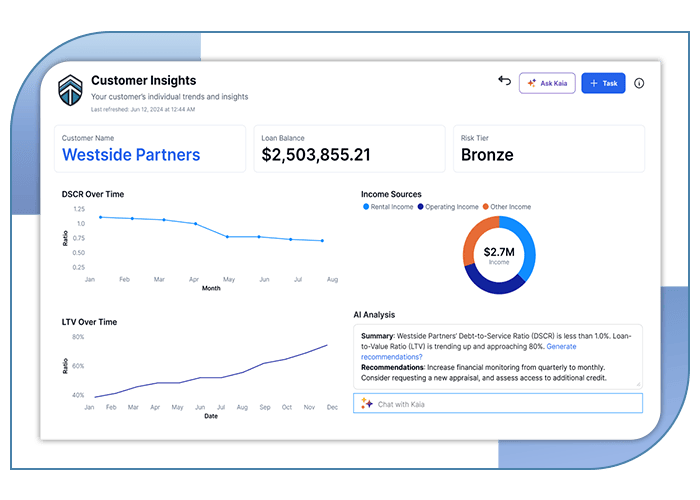

- Automatically classify loans into risk tiers (Gold, Silver, Bronze) based on borrower data and loan metrics

- Analyze 100% of supporting documents—appraisals, financial statements, contracts, and more

- Detect missing or inconsistent information across all asset classes, including CRE, residential, and consumer loans

- Get instant alerts for declining performance indicators like DSCR, LTV, and delinquency trends

- Prioritize loans that need attention

Why It Matters

- Prevent Defaults: Identify Bronze-tier loans early and reduce charge-off rates

- Save Time: Eliminate manual reviews and automate document-driven risk assessments

- Gain Portfolio Visibility: Monitor real-time risk signals and borrower behavior in one place

- Support Compliance: Simplify audit trails and regulatory reviews with consistent AI-driven logic

- Improve Profitability: Make smarter lending decisions with predictive insights across asset classes

How It Works

1. Scan & Extract

AI reviews all loan documentation and pulls key financial and risk data.

2. Analyze & Detect

The system checks for discrepancies, missing files, and risk trends.

3. Classify & Alert

Each loan is assigned a risk tier (Gold, Silver, Bronze) with a confidence score. Alerts prompt timely action.

Turn Data into Actionable Loan Intelligence

Connect with an ExpertWhy Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist