Home/ Blog / How to Navigate Fraud Risks and Build Resilience in the Insurance Sector

The insurance sector plays a pivotal role in safeguarding individuals and businesses against various risks, providing financial protection and peace of mind. However, like any industry, the insurance sector is not immune to risks, and one of the critical challenges it faces is the prevalence of fraud. In this blog, we will delve into the major types of risks that affect the insurance sector and explore why the industry is prone to combatting fraud. Additionally, we will discuss effective strategies that insurance firms can adopt to build resilience against fraudulent activities.

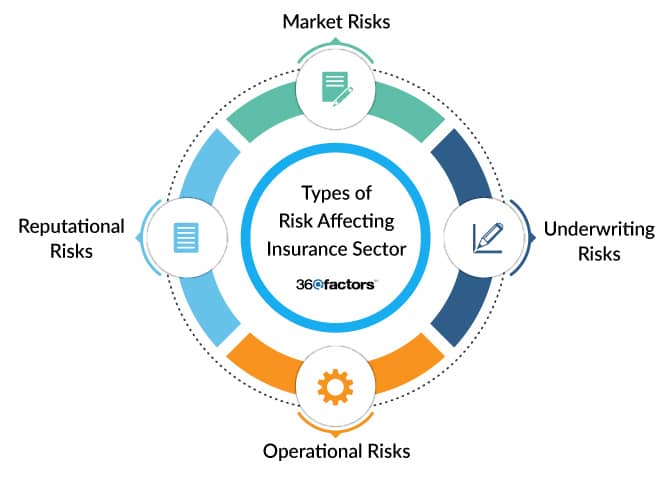

Major Types of Risks Affecting the Insurance Sector

The insurance sector faces various risks, which can be categorized into the following four areas.

Market Risks

Market risks within the insurance sector are multifaceted, arising mainly from external economic factors that can significantly impact an insurance company’s financial stability.

- Market interest rate fluctuations

- Investments can be subject to market volatility

- Broader economic shifts, recessions or economic downturns

Underwriting Risks

Underwriting risks stem from the process of assessing and assuming risk associated with policyholders. Misjudgements in this regard can have significant financial implications for insurance businesses. Some examples of errors that lead to adverse outcomes for the organization include:

- Errors in evaluating the risk profile of policyholders

- Poorly defined or outdated underwriting guidelines

- Concentrating risks within specific markets or industries without sufficient diversification

Operational Risks

Operational risks are inherent to the internal processes and systems of an insurance company and can disrupt its day-to-day operations. Some common examples of exposure to this type of risk include:

- Technical glitches, cyberattacks, or system malfunctions

- Mistakes made by employees in claims processing, customer scrutiny, or policy administration

- Inefficiencies or gaps in operational processes

These kinds of errors may result in delayed claim settlements, customer dissatisfaction, and increased operational costs for the organization.

Reputational Risks

Reputational risks are associated with how an insurance company is perceived by the public, its clients, and its stakeholders. The ways in which these types of risks arise can be due to:

- Inadequate customer service, unresolved complaints, and unsatisfactory claims experiences

- Unethical business practices, non-compliance with regulations, or involvement in controversial activities

- Any adverse event that garners public attention through media or social platforms

These mistakes lead to reputational damage that can linger for months or years to come for most organizations, making it more sensible to manage risks proactively rather than reactively.

Why is Fraud Happening in the Insurance Industry?

A recent report from Deloitte found that fraudulent activity is on the rise in the insurance sector. According to the Insurance Fraud Survey, which released data collected from interviews with senior leaders in the sector, an overwhelming majority of them witnessed a significant increase in fraud post-Covid. Fraud in the insurance industry can occur for several reasons. Understanding the motivations behind them is crucial for developing effective countermeasures. Read on to learn more about these underlying reasons.

Financial Gain

The lure of financial gain remains a primary motivator behind insurance fraud. Fraudsters may see insurance policies as a quick and relatively straightforward way to obtain substantial sums of money, either through inflated claims or staged incidents. Individuals facing financial hardships are more likely to resort to insurance fraud to alleviate their economic struggles. The promise of a financial windfall through fraudulent claims can be tempting.

Opportunity and Rationalization

Some individuals may engage in insurance fraud when they believe there is an opportunity to exploit weaknesses in the system. This could include:

- Gaps in oversight

- Lax internal controls

- Situations where detection is less likely

Perpetrators rationalize their fraudulent activities, convincing themselves that their actions are justified under the circumstances. This internal rationalization can make individuals more prone to committing fraud when presented with an apparent opportunity.

Increase in Digitization

As the insurance industry continues to be influenced by a transformation in technology, fraudsters see this as an opportunity to exploit vulnerabilities in digital systems. The increased reliance on online processes and cloud systems can create new avenues for fraud, such as identity theft or hacking. Unlike face-to-face interactions, the digital landscape allows for a certain degree of anonymity, making it easier for fraudsters to engage in illicit activities without the fear of immediate identification.

Remote Working

The shift towards remote work during the COVID-19 pandemic created new challenges in terms of supervising employees and ensuring adherence to established protocols. This reduced oversight has created opportunities for internal fraud, where employees may take advantage of the remote working environment. The line between personal and professional life can blur in a remote working setting. This ambiguity may lead some individuals to rationalize fraudulent actions, believing that the boundaries are more flexible when working from home.

Weakened Controls

In situations where internal controls for insurance underwriting or insurance claims are weak or inadequately enforced, individuals may find it easier to engage in insurance fraud. Weak controls can provide the necessary cover for fraudulent actions to go unnoticed. When oversight controls are weak, there is a perception among employees and external actors that the likelihood of facing consequences for fraudulent behavior is minimal. This perception can embolden individuals to attempt fraudulent activities.

Common Types of Insurance Fraud

While organizations may be aware of how fraud becomes possible, it is also important to note the most common types of insurance fraud. These may include:

- Falsifying claims, where policyholders exaggerate or fabricate claims to receive undeserved payouts

- Staged accidents, where criminal networks orchestrate accidents to generate fraudulent claims

- Identity theft, where fraudsters use stolen identities to purchase insurance policies or make false claims

How Can Insurance Firms Respond to Fraud

Addressing fraud in the insurance sector requires a multi-faceted approach, incorporating advanced technologies and robust internal controls. Read on to learn some of the best ways organizations can respond to fraud.

Implement Robust Fraud Detection Systems

Leveraging advanced data analytics and AI technologies can help identify patterns indicative of fraud. This allows compliance teams to detect these issues quicker and more accurately. Machine learning algorithms are proving effective as they continuously evolve and adapt to new fraud patterns, enhancing the effectiveness of fraud detection systems.

Strengthen Internal Controls and Compliance Measures

Insurers should focus on training employees about the risks of fraud and instil a culture of integrity to prevent internal fraud. They must conduct frequent audits and reviews of internal processes to uncover vulnerabilities and strengthen controls. Insurers must also utilize risk assessment, monitoring, and mitigation software, as well as compliance management tools, to prepare more effectively against risks and compliance breaches.

Collaboration and Information Sharing Within the Industry

Collaboration with otherchange of best practices and insights to stay ahead of emerging fraud trends. Sharing information about known fraudsters and suspicious activities through databases can help insurers collectively combat fraud in this sector.

As evident from Deloitte’s survey, many insurance firms realize that fraudsters and cybercriminals already use advanced technology to commit fraud. It is imperative that insurance businesses adopt technology as well to mitigate organizational risks.

Platforms like https://www.360factors.com/predict-360/Predict360 Risk and Compliance Management can play a crucial role in fraud detection and risk assessment by harnessing the power of advanced technologies. Its modules offer support in:

- Risk Insights

- Risk control assessments

- IT Risk Assessment

- Internal audit and findings management

- Compliance management

- Regulatory change management

- Policy and procedure management

The platform provides comprehensive support for the insurance sector to identify, categorize, monitor, and mitigate risks while ensuring compliance with regulations.

Navigating risks including fraud risk requires a proactive and comprehensive approach from insurance businesses. By staying vigilant and adopting a holistic strategy, insurance firms can not only detect and prevent fraud but also fortify their position in a dynamic and competitive market.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.