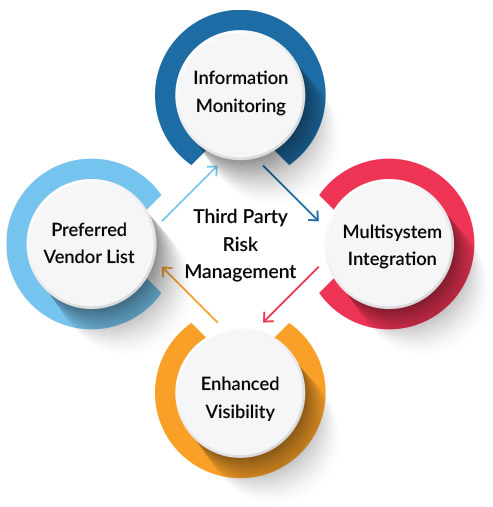

Looking to enhance your Third-Party Risk Management program based on the Final Guidance of the FDIC, OCC, and FRB?

Discover how Predict360 applications and partner content can streamline your third-party oversight according to regulatory best practices.

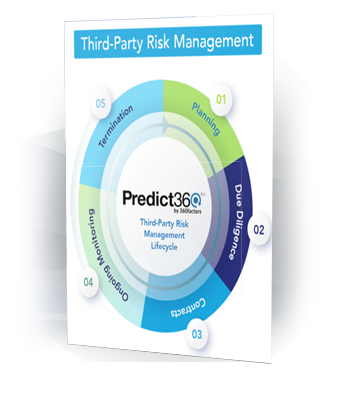

1Planning

Organize and manage your third parties in a risk register so that you can evaluate third-party risk through an enterprise risk management lens. Perform an initial risk assessment for third parties as part of the evaluation phase.

Predict360 Solutions

2Due Diligence

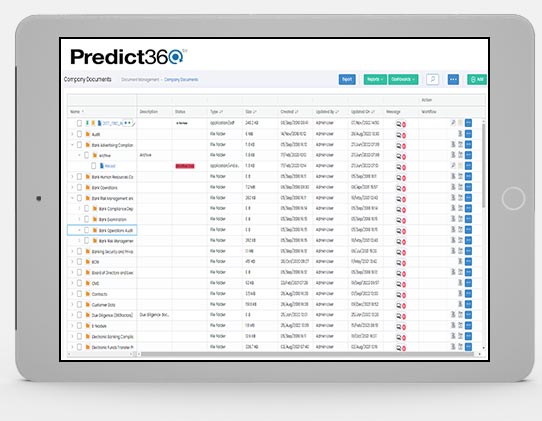

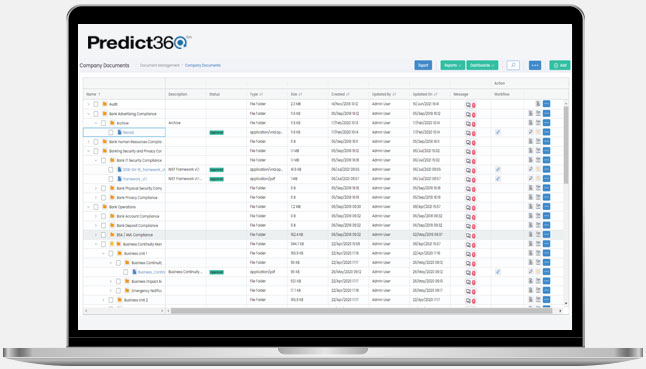

Request, evaluate, and store third-party documents, such as SOC Reports. Utilize third-party risk intelligence to assess third-party financial, cyber, ESG, OFAC, complaints, and more. Securely store the evaluated third-party documents in a centralized document management system for future reference. Maintaining these documents is critical for ongoing monitoring.

Predict360 Solutions

3Contracts

Manage third-party documentation, contracts, requests, and related activities and tasks. Establish a process for centralizing and tracking all third-party documentation and contracts. A designated team member should oversee the management of third-party documents and contracts, preferably through a centralized risk management system, making sure it incorporates request handling, task monitoring, and related activities.

Use your document management system to store signed contracts, documentation, ongoing requests from third parties, and any tasks that need attention.

Predict360 Solutions

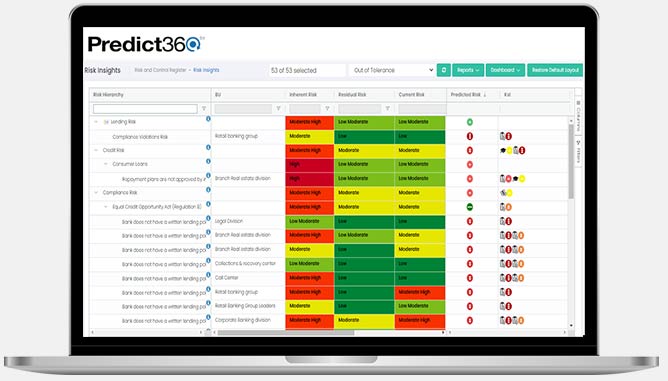

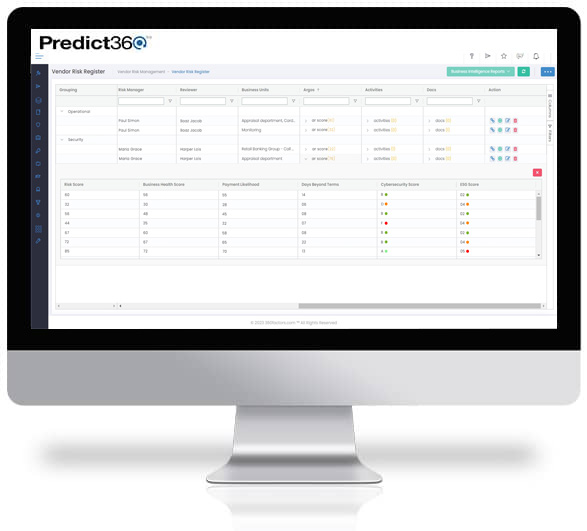

4Monitoring

Manage ongoing risk assessments and risk intelligence metrics, perform compliance testing, manage third-party issues and complaints, and analyze third-party risk trends.

Schedule periodic risk assessments within your third-party risk management tool and continuously track third-party risk metrics through integrated risk intelligence tools such as Argos’ AR Surveillance. Monitor critical risk metrics for any changes or new developments.

Schedule and conduct regular compliance testing of your third parties, such as security assessments, policy reviews, or audits. Analyze risk trends across your third parties by comparing metrics and testing results over time. Look for patterns that could signal emerging or growing risks to prioritize. Present trend analyses to leadership along with any high or increasing risks requiring attention. Recommend risk mitigation strategies as needed.

Predict360 Solutions

- 360factors Community Risk Library

- Optional Crowe Risk Curator

- Optional ABA Risk Library

- Optional FIS Risk Library

Predict360 Vendor Risk Management

Predict360 Compliance Monitoring & Testing

5Termination

Offboard third parties with configurable workflows and document management processes. Develop standardized, configurable offboarding workflows for terminating third-party relationships. Include clear steps for notification, transitioning responsibilities, records handoff, and final exit procedures.

Predict360 Solutions

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

Predict360’s out-of-the-box applications designed specifically for banks our size along with their banking content was a significant influence in our selection of 360factors.

John Dunne EVP Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist