Home/ Blog / 7 Essential Risk Insights and Trends to Navigate the Uncertain Business Landscape

In a world of unpredictability, the rules of the business landscape constantly change. New challenges and opportunities can emerge almost on a daily basis, reflecting a reality that’s both fascinating and risky in terms of risk insights and trends. Modern businesses must confront and overcome an ever-changing maze of complexities, from technological innovations to global economic shifts. The ability to identify, understand, and adapt to these changes is no longer just an advantage—it’s a necessity.

As we venture deeper into this new era of uncertainty, risk management has become a central theme that resonates across all industries and markets. But what does this mean for today’s business leaders, and how can we navigate the potential pitfalls that lie ahead?

Business leaders and risk managers must be aware of the latest risk insights and trends to stay ahead in this uncertain landscape. These insights are derived from quantitative data – such as financial metrics – and qualitative analysis, including expert judgments, market research, and historical analysis.

In this blog, we’ll explore seven essential risk insights and trends that are shaping our world.

What are Risk Insights

Before we jump into seven risk insights and trends, let’s understand what they are. Risk insights refer to understanding and interpreting risks affecting an organization, industry, or market. This involves identifying, analyzing, and evaluating potential uncertainties and problems in the operating environment. It goes beyond mere data analysis and provides a nuanced perspective on the risks’ underlying causes and potential impacts.

In financial businesses, risk insights offer a valuable tool for making decisions. They help businesses uncover hidden vulnerabilities, forecast future trends, and craft strategies to mitigate or capitalize on risks using risk indicators.

The Importance of Risk Insights for Effective Risk Management

Risk insights and trends are paramount in the domain of effective risk management. They serve as the foundation upon which businesses construct their strategies to navigate an uncertain landscape. Positioned at the heart of risk management, risk insights provide a comprehensive understanding of the potential threats and opportunities that an organization might encounter, allowing for informed decision-making processes.

Risk insights go beyond merely identifying risks. They delve deeper, offering a granular analysis of root causes, potential impacts, and the likelihood of occurrence. A deeper understanding is crucial as it aids businesses in developing policies and prioritizing workflows based on risk insights and trends. Businesses are able to channel resources to areas of greater vulnerability or where the potential fallout might be most damaging, thus minimizing the impact and probability of risks.

Risk insights provide a focused lens, highlighting areas where an organization can leverage potential advantages. By understanding the landscape thoroughly, businesses can spot areas of growth and innovation and even turn certain risks into opportunities by being better prepared than competitors through risk assessment tools.

Furthermore, risk insights and trends are pivotal in strengthening an organization’s reputation. In a world where a single misstep can lead to significant reputational damage, being perceived as an entity that understands, anticipates, and effectively manages risks can enhance stakeholder trust. This trust, whether from investors, customers, or partners, is invaluable and can directly influence an organization’s bottom line.

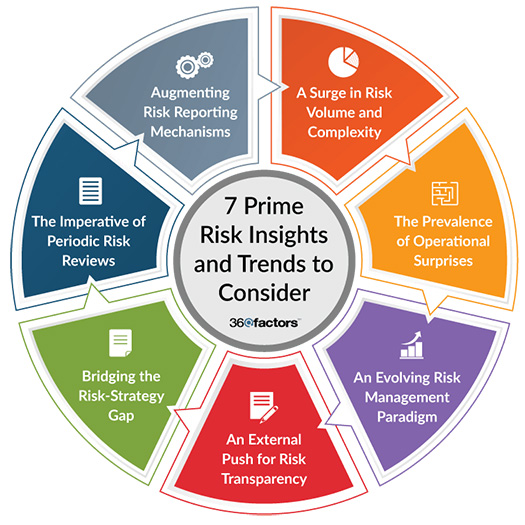

7 Prime Risk Insights and Trends to Consider

Risk, a term that often invokes anxiety in the corporate world, is an inherent element of the modern business landscape. Businesses that need to catch up with the evolution of risk insights and trends often need guidance, as they face setbacks that can sometimes be insurmountable.

Here’s a deep dive into seven prime risk insights and trends that every organization should be cognizant of:

1. A Surge in Risk Volume and Complexity

Our modern business ecosystem is becoming progressively intricate. A survey from NCSU emphasizes this fact, where 59% of executives acknowledged a substantial increase in the volume and complexity of risks over the preceding five years. This statistic is even more staggering for larger entities, with two-thirds of large organizations and public companies echoing the sentiment.

The focal areas of risk insights and trends encompass potential disruptions from innovations, economic fluctuations, and evolving consumer demographics. In this nuanced environment, leveraging sophisticated risk analysis software and automation becomes imperative to manage risks effectively.

2. The Prevalence of Operational Surprises

It’s alarming that 68% of organizations admit that they have faced an unanticipated operational setback in recent years due to unpredictable risks. Such figures underline the necessity for a heightened, proactive approach to risk management, ensuring such “surprises” are kept at bay. This is where the critical role of risk insights and trends becomes evident to avoid unanticipated uncertainties.

3. An Evolving Risk Management Paradigm

There has been an evident disconnect between the increasing intricacies of risk and the maturity of risk management procedures. Despite the apparent increase in risk complexity, only about a quarter of respondents believe their risk management systems are “robust” or “mature.” This disparity presents an opportunity: businesses can seize this chance to refine their risk management systems through the integration of state-of-the-art processes and technologies.

4. An External Push for Risk Transparency

Transparency is becoming the order of the day. External entities, from investors to regulators, are pushing for more precise disclosure of risk exposures which can be achieved through risk insights and trends analysis. 59% of the organizations surveyed acknowledged external pressures to shed light on their risk predictions of vulnerabilities, a trend that’s even more pronounced among larger public entities.

5. Bridging the Gap Between Risk Management and Strategic Planning

Risk management isn’t merely a reactionary protocol; it should be linked with an organization’s core business strategy. Many organizations need to catch up on this integration.

To harness the power of risk management, it must be incorporated seamlessly into strategic planning, ensuring that risk insights and trends are meticulously considered when formulating new initiatives.

6. The Imperative of Periodic Risk Reviews

Risk assessments, often approached as annual or semi-annual events, are rapidly becoming obsolete in addressing real-time threats. When a traditional risk assessment identifies and implements a counteraction to a threat, the business landscape may have transformed, making the identified risk outdated or introducing new, unforeseen challenges.

By adhering to obsolete risk assessment models, these organizations run the risk of being blindsided by unanticipated threats or changes in the market. Instead, they should focus on real-time risk insights tools to stay on top of unforeseen risks.

7. Augmenting Risk Reporting Mechanisms

Enhancing risk reporting is one of the key tenets of risk insights and trends. Effective risk management depends on solid reporting and many businesses need help with this. They’re unhappy with how they report their Key Risk Indicators (KRIs); essential signs of potential risks that might affect the company.

Traditional Key Performance Indicators (KPIs) look at past results. They tell you what has already happened but KRIs are different. They help you look ahead and see what might happen in the future, giving you a chance to prepare and react in time.

The problem is that many businesses need clarification on their KRI reporting. They need to get updated risk insights and trends tools that help them understand potential risks before they materialize to take action. This is a significant issue in the financial sector where the business environment changes quickly, and new risks can arise suddenly.

Conclusion

Businesses operating in an environment marked by dynamic shifts, exceptional challenges, and a landscape stuffed with risks are at a crucial crossroads. The findings from our blog underscore the significance of being proactive, informed, and adaptable when it comes to risk management.

The true challenge lies in the implementation and ongoing management of risk practices that are both robust and responsive. The seven essential risk insights and trends shed light on current trends, highlighting gaps in many organizations’ risk management frameworks, and this is where Predict360’s Risk Insights offers a transformative solution.

Predict360 Risk Insights is a cutting-edge risk assessment software that utilizes Artificial Intelligence (A.I.) to detect current risks operating beyond acceptable limits and forecast emerging risks. Here’s what makes Predict360 Risk Insights stand out:

- Visual Dashboard and Reports

- Risk Taxonomy/Library Integration

- Robust Key Risk Indicator (KRI) Engine

- Comprehensive Data Feeds

- Linkage with External Metrics (FRED, FFIEC)

- In-Depth Trending and Velocity Analysis

- Predictive Analytics

- Tableau BI Integration for Incisive Reports

The platform’s ability to analyze data in real time and predict future risk insights and trends allows organizations to be proactive rather than reactive. They can anticipate what’s coming and prepare in advance, turning what might have been threats into opportunities.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.