Home/ Blog / Maximize Retention Rate with AI-Based Customer Churn Prediction

Retaining customers has become just as important as acquiring them, especially for banks and credit unions operating in a competitive, fast-evolving environment. While customer churn is a certain part of any business, failing to understand and address its causes can result in significant revenue loss and weakened customer loyalty. Traditional churn tracking methods often lag behind actual customer behaviors, making it harder to intervene before a client leaves. That’s where AI-powered churn predictions come in to analyze:

- Behavioral patterns

- Support interactions

- Product usage trends

- Renewal risks

AI tools can help financial institutions proactively identify customers at risk. This allows teams to take targeted, timely action that improves loyalty and protects long-term revenue.

Read on to explore what customer churn means, its significance, its causes, and how community banks and credit unions can predict customer churn effectively using modern AI analytics platforms.

Defining Customer Churn

Customer churn, also known as customer attrition or turnover, refers to the percentage of customers who stop doing business with an organization within a specified period. It is commonly expressed as a churn rate, which compares the number of customers lost (after accounting for new acquisitions) to the total customer base during that time.

A high churn rate indicates a significant loss of customers, while a low rate suggests stronger customer retention. Churn is closely tied to customer retention; if one increases, the other typically falls. Understanding both helps businesses assess their overall health and track loyalty trends across their customer base.

The Financial Impact of Rising Customer Churn

The churn has a direct impact on a company’s bottom line. As more customers leave, recurring revenue shrinks, and acquisition costs rise to fill the gaps. For banks and credit unions, this might mean fewer active accounts, lost loan revenue, or reduced product engagement.

Customer churn also reveals operational or service-related weaknesses. When patterns show frequent drop-offs during onboarding or recurring support complaints, it highlights where processes are falling short.

Monitoring churn with predictive insights helps organizations pinpoint friction points in their customers’ journeys. This can be related to:

- Service quality

- Product complexity

- Renewal challenges

Addressing these issues not only reduces churn but also improves the overall customer experience. In today’s financial landscape, where customer expectations are high and loyalty is fragile, identifying churn risk early is essential for long-term growth.

Customer Churn Analysis: Common Reasons for Leaving

To effectively reduce churn, banks and credit unions must first understand why customers decide to leave. These reasons can surface at any stage of the customer journey, from the first interaction with sales to renewal and beyond. Below are the most common causes of customer churn:

1. Sales Misrepresenting Product Capabilities

When sales teams overstate the features or promise outcomes that the product cannot deliver, customers often feel misled. This disconnect sets the stage for early dissatisfaction and a higher likelihood of churning.

2. Friction in the Initial Purchase Process

If the buying process is complex, unclear, or delayed, customers may lose confidence before they even start. Poor coordination or lack of follow-up during this phase often results in weakened trust.

3. Incomplete or Failed Onboarding

Customers who don’t successfully complete onboarding often struggle to realize value. Missing milestones, delayed account activation, or lack of guidance during setup can cause disengagement from the start.

4. Difficulty Using Advanced Features

Even engaged customers may churn if they cannot use key product features effectively. A steep learning curve, unintuitive design, or lack of training materials can drive frustration.

5. Poor Customer Support or Success Interactions

Slow responses, unresolved issues, or impersonal service lead to dissatisfaction. Over time, repeated negative experiences push customers to seek better service elsewhere.

6. Problems with the Renewal Process

Automated renewals that fail, unclear terms, or a lack of reminders can lead to unintentional churn. If renewal requires manual action, any friction in the process can result in contract lapses.

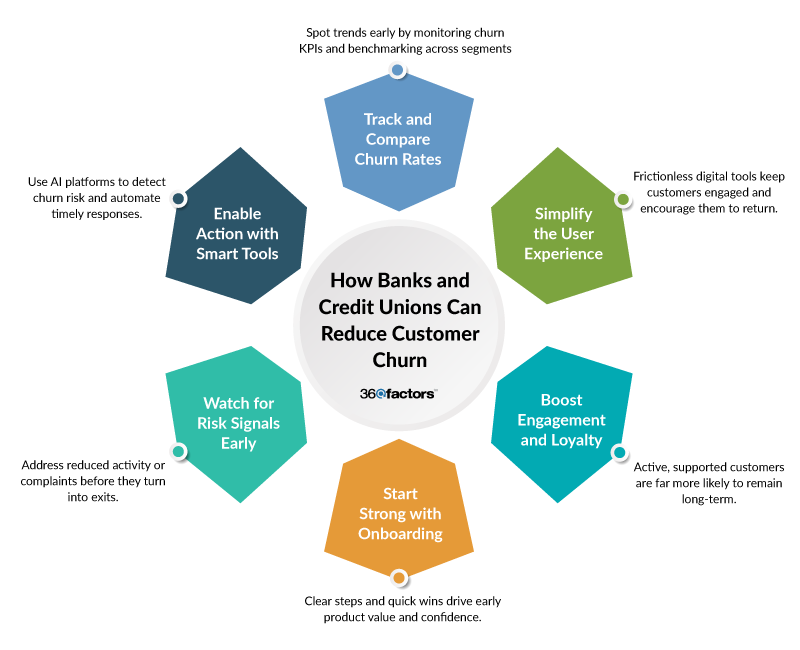

How Banks and Credit Unions Can Reduce Customer Churn

Reducing customer churn requires a proactive approach across multiple touchpoints in the customer journey. For banks and credit unions, the following customer retention strategies are crucial for enhancing retention and fostering stronger relationships.

| Monitor and Benchmark Customer Churn Metrics | Regularly tracking churn rates and related KPIs to spot the signs of customer churn early. |

| Improve Usability and Customer Experience | Improve the usability of digital channels to reduce friction and encourage repeat engagement. |

| Promote Engagement and Customer Success | Set clear success milestones and provide resources to help customers achieve them boosts satisfaction. |

| Strengthening Onboarding and Product Adoption | Guide customers through onboarding with clear steps, support, and timely follow-ups. |

| Prepare for Escalations and Renewal Risk | Establish protocols for issue resolution and monitoring account activity for churn signals, such as reduced login frequency or repeated service requests. |

| Using Software Tools to Support Customer Churn Reduction | Combine customer data with automation to enable effective churn management through predictive retention insights. |

How AI-Based Customer Churn Prediction Enhances Retention

AI-based customer churn prediction is changing how banks and credit unions approach retention. Instead of waiting for customers to leave, AI identifies early signs of disengagement by analyzing behavioral data, such as:

- Usage patterns

- Support activity

- Transaction frequency

These insights enable teams to intervene more effectively and retain a higher percentage of customers. AI also allows dynamic segmentation, which helps update customer profiles in real-time based on changing behaviors. Financial institutions can therefore deliver more personalized experiences that cater to current needs.

Stay Ahead of Customer Churn with Lumify360 AI Analytics

Staying ahead of customer churn requires more than just tracking numbers; it takes real-time visibility into customer behavior and the ability to act quickly. Lumify360 AI-driven customer insights give banks and credit unions the insights they need to identify and reduce churn before it impacts revenue.

By analyzing transaction patterns, engagement signals, support interactions, and product usage trends, Lumify360’s AI-driven insights uncover early signs of dissatisfaction or disengagement. This allows teams to segment customers dynamically, receive automated alerts when behaviors indicate risk, and personalize outreach based on each customer’s journey.

| Feature | Description | Benefit for Churn Prevention |

|---|---|---|

| AI-Powered Predictive Modeling | Uses machine learning algorithms to analyze historical behavior and transaction patterns. | Identifies customers with a high probability of leaving before they churn, allowing for proactive intervention. |

| Real-Time Churn Alerts | Monitors customer activity streams for specific “disengagement signals”. | Triggers instant notifications to relationship managers when a customer’s health score drops. |

| Kaia™ AI Companion | An AI chat agent is embedded in the platform to allow users to query the data. | Empowers non-technical staff to perform complex churn analysis without waiting for data scientists to run reports. |

| Data Enrichment | Combines internal customer data with external datasets. | Provides a view of why a customer might leave by correlating their behavior with broader market factors. |

| Intelligent Segmentation | Automatically groups customers based on lifetime value, risk level, and behavioral profiles. | Enables the creation of personalized retention offers specifically for high-value segments, optimizing marketing ROI. |

| Actionable Workflow Engine | A built-in system to assign tasks, track resolution status, and manage “cases”. | Ensures that when a churn risk is identified, a specific task is assigned to a staff member to resolve it. |

AI analytics provide the clarity and control needed to boost retention and protect revenue across the board. Instead of relying on manual reports or delayed feedback, financial institutions gain continuous, actionable insights that help retain high-value customers.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.