Home/ Blog / Credit Union Risk Management in 2026: Critical Risks and How to Respond

Credit unions going into 2026 are operating in a competitive risk environment shaped by economic shifts, operational pressures, and growing technological difficulties. As the financial landscape continues to change, financial institutions must be prepared for effective credit union risk management with greater control. Rising interest rates continue to affect balance sheet performance, particularly for institutions with exposure to long-term, fixed-rate assets. At the same time, liquidity concerns are growing as funding strategies are tested by changing deposit behaviors and supervisory expectations.

Cybersecurity risks are also becoming more frequent and sophisticated. As credit unions expand their use of cloud-based digital infrastructure and third-party service providers, they face increased exposure to:

- Ransomware

- Phishing

- Data breaches

- DDoS attacks

Adding to the challenge, many credit unions operate with limited resources while striving to meet the increasing demands of oversight. Successful credit union risk management requires more than a reactive approach. It calls for a standardized credit risk assessment process, centralized visibility, and proactive issue resolution.

Four Key Risk Areas Facing Credit Unions in 2026

Read on to understand more about the four critical risks that credit unions must address in 2026, and how to mitigate potential fallout in these areas.

| Overview | |

|---|---|

| Risk | Action |

| Interest Rate Risk | Measure and manage interest rate exposure through “S” component of CAMELS, which evaluates sensitivity to market risk. |

| Credit and Liquidity Risk | Evaluate the adequacy of available funding sources and strengthen contingency plans. |

| Cybersecurity Risk | Enhanced cybersecurity examination program, better risk assessments for banks and credit unions, plus integration of automated tools. |

| Third-Party and Vendor Risk | Increase focus on third-party oversight in the absence of regulatory blind spots. |

1. Interest Rate Risk

Interest rate risk remains a prominent concern for credit unions. The tightening of U.S. monetary policy in recent years has led to increased market risk exposure. Credit unions with concentrations in fixed-rate, long-term mortgages, particularly those that originated when rates were at historic lows, are experiencing greater pressure on:

- Capital

- Asset quality

- Earnings

High-interest-rate environments can also heighten liquidity risk and strain earnings performance. The NCUA has emphasized the importance of measuring and managing interest rate exposure by evaluating market risk.

2. Credit and Liquidity Risk

The economic outlook is shifting, with projections indicating slower GDP growth and moderately higher inflation. These conditions can contribute to:

- Reduced loan demand

- Increased risk of delinquency

Credit unions are also navigating changes in deposit behavior, which can impact funding stability. In response to these dynamics, the NCUA is reinforcing expectations for robust credit risk oversight and liquidity planning. Examiners are evaluating not only policies and procedures but also the adequacy of available funding sources and the strength of contingency plans under various scenarios.

3. Cybersecurity Risk

A robust cybersecurity risk management process overcomes several persistent and evolving challenges. The consequences of cyber incidents can be severe, potentially threatening institutional safety and soundness. In response, the NCUA is enhancing its cybersecurity examination program, incorporating risk assessment for banks and credit unions along with automated tools to improve their risk management. The introduction of the 72-hour Cyber Incident Notification Rule underscores the growing importance of timely detection and reporting.

4. Third-Party and Vendor Risk

Third-party vendors and credit union service organizations (CUSOs) now deliver a wide range of essential services, including information technology, data hosting, lending, and compliance. However, the NCUA lacks direct supervisory authority over these providers, creating a regulatory blind spot. This limits the agency’s ability to assess risk mitigation efforts and enforce corrective actions. As credit unions continue to rely on vendors for mission-critical functions, oversight gaps could pose systemic risks. Institutions must remain vigilant in managing these relationships despite the absence of formal regulatory enforcement mechanisms, making third-party oversight a key component of effective credit union risk management.

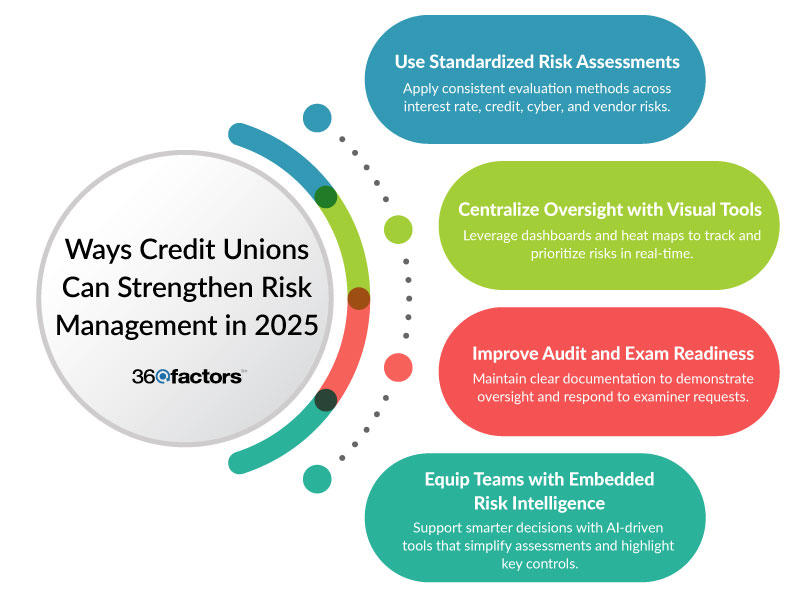

How Credit Unions Can Strengthen Risk Management in 2026

Learn more about how your organization can strengthen its risk management framework in the coming year, to mitigate the above concerns.

Standardized Risk Assessments Across Key Areas

Using consistent, preloaded risk assessments across high-priority areas such as interest rate risk, credit risk, liquidity, cybersecurity, and vendor risk helps credit unions evaluate exposures in a structured and repeatable manner. Standardization improves clarity in scoring, simplifies comparisons across departments or periods, and ensures alignment with the examiner’s expectations. It also supports better documentation and audit readiness by creating a clear trail of how risks are defined, assessed, and scored.

Centralized Oversight with Dashboards and Heat Maps

Centralized dashboards and visual tools such as heat maps provide leadership with real-time insight into emerging risks. These tools support credit union risk management by consolidating risk data from across the organization into a single view. This enables:

- More effective monitoring

- Trend analysis

- Prioritization of risks

Small businesses, banks and credit unions can use these visuals to make more informed decisions, allocate resources more effectively, and respond quickly when risk levels escalate.

Enhanced Audit and Exam Readiness

Maintaining a complete record of risk assessments, control evaluations, and corrective actions is essential for passing regulatory exams and internal audits. A structured approach to documentation enables credit unions to demonstrate accountability, fulfill board oversight obligations, and provide timely responses to examiner inquiries.

Empower Teams with Embedded Risk Intelligence

Equipping teams with intelligent, integrated AI tools like Ask Kaia enables faster and more informed decision-making. These tools provide contextual guidance, reveal relevant controls, and support the completion of assessments with greater accuracy and less manual effort. As credit union risk management becomes increasingly complex, embedded intelligence helps reduce staff burden while enhancing consistency and response quality throughout the organization.

Strengthen Effective Risk Management with Predict360 Essentials

The evolving risk landscape in demands effective risk management solutions that simplify oversight, support regulatory compliance, and reduce manual workload. Predict360 Essentials is designed specifically for U.S. credit unions and small business banks with assets under $3 billion. Predict360 Essentials ensures clarity and consistency by standardizing assessments across key areas such as:

- Interest rate

- Credit

- Liquidity

- Cybersecurity

- Vendor risk,

Real-time dashboards and heat maps provide centralized visibility, enabling leaders to identify trends and take prompt action quickly. Integrated issue tracking and documentation tools support audit and exam readiness, while Ask Kaia AI enhances decision-making with contextual guidance and control suggestions. From managing daily oversight to preparing for exams, Predict360 Essentials helps streamline credit unions’ risk management, eliminate guesswork, and maintain confidence that their most critical exposures are covered.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.