Home/ Blog / Enhancing ERM Through the Effective Use of KRI Risk Management

Financial enterprises must function flexibly, facing risks in several business activities, such as relationships with third parties. With the enhancement of cloud services and automation, risks associated with third parties have become one of the most significant threats to financial organizations.

Enterprise risk management (ERM) can help businesses overcome this challenge. ERM framework comprises the stages of identification, evaluation, and reduction of risks. An essential component of ERM is the creation of metrics known as “key risk indicators” or KRIs. ERM’s core lies in these “key risk indicators” (KRIs).

KRIs are carefully established metrics that evaluate an organization’s most compelling risks. KRI risk management, backed by risk appetite statements and the organization’s risk management strategy, acts as an early warning of potential risks in different areas of the enterprise. Thus, ERM assures stakeholders that risks can be monitored and diminished instantly.

Brief Overview of KRI Risk Management

Evaluating and managing risks is paramount in the sophisticated web of modern business operations. As financial institutions navigate through the complications of digital transformation, global partnerships, and evolving market dynamics, the need for a robust risk management framework has become evident. The core of this ERM framework is the adoption of KRI risk management.

KRIs are not just simple metrics but the pulse of an organization’s risk health. These indicators, backed by the organization’s risk appetite statements and overarching risk management strategy, serve as an early warning system. They alert businesses to potential risks, allowing them to take proactive measures before these risks escalate into significant threats.

In this age of technological advancement, with the proliferation of automation and cloud services, risk prediction has emerged as one of the most pressing challenges enterprises encounters. KRI risk management is essential for tracking these and other risks, ensuring stakeholders have transparent and appropriate insights into potential uncertainties. Businesses can integrate incredible risk analysis software in their ERM framework for compelling insights.

The Role of KRIs in Enterprise Risk Management

Enterprise Risk Management is a comprehensive approach to identifying, assessing, and mitigating risks. It’s the shield that protects an organization from unforeseen challenges and ensures its longevity and success. Within the ERM framework, KRIs act as the guards, continually monitoring and reporting on possible risks.

KRIs are instrumental in several ways:

Monitoring Controls and Exposures

KRI risk management offers insights into the effectiveness of controls, risks, and potential exposures. They serve as tools that highlight areas of concern, allowing businesses to take corrective actions promptly.

Overseeing Risk Appetite

All financial institutions have a risk threshold, the decided value beyond which risk becomes unacceptable. KRIs assist in monitoring the risk appetite, as they are primarily used in conjunction with the thresholds to ensure that the company works within its risk tolerance.

Operational Monitoring

Contrary to widespread belief, KRI risk management is best monitored closer to the operational level rather than just at the higher levels of management. This ensures that potential risks are identified and addressed at the grassroots , preventing them from snowballing into more significant issues.

Constructing Senior Management Reporting

One of the challenges with KRIs is aggregating specific business or process measures for senior management. However, with the right approach, KRI risk assessment tools can provide a holistic view of the organization’s risk profile, enabling informed decision-making at the top.

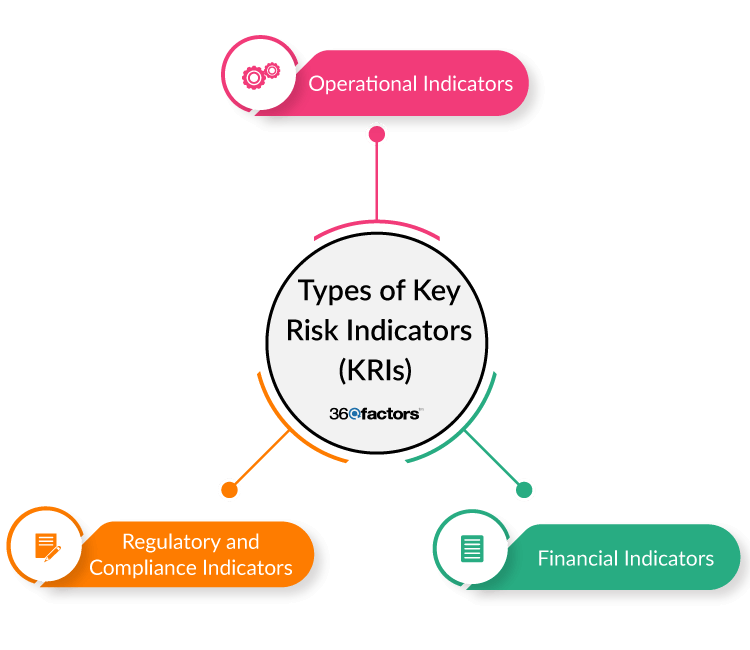

Types of Key Risk Indicators

An effective KRI risk management approach gives businesses the metrics to monitor potential risks that might adversely impact an organization’s performance. KRIs can be categorized based on different aspects of a business:

Operational Indicators:

These KRIs identify risks arising from the day-to-day activities of an organization.

Examples:- Percentage of Delayed Projects in Progress: Measures the organization’s management and planning effectiveness.

- Number of System Capacity Overloads: Indicates the number of times systems exceed their established maximum capacity.

Financial Indicators:

These KRIs assess financial risks related to market dynamics, competition, and regulatory changes allowing businesses to create a robust KRI risk management framework.

Examples:- Paid Invoices: Indicates cash flow risks related to timely customer payments.

- Outstanding Payables: Measures the organization’s efficiency in settling its dues.

- Value at Risk: Represents the potential loss in value of a risky asset or portfolio over a defined period.

Regulatory and Compliance Indicators:

These KRIs monitor an organization’s adherence to laws, regulations, guidelines, and specifications relevant to its business.

Examples:- Number of Regulatory Violations: Indicates the number of times the organization failed to meet regulatory standards.

- Compliance Training Completion Rate: This KRI improves the overall KRI risk management process by measuring the percentage of employees who have completed mandatory compliance training.

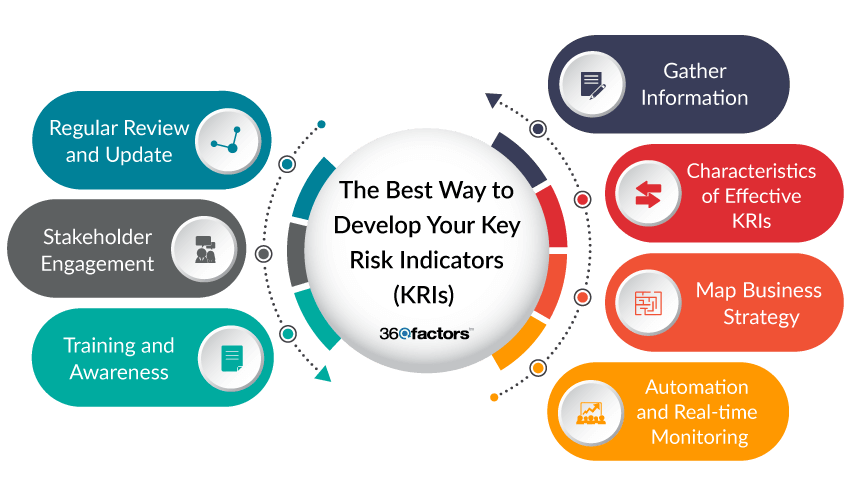

The Best Way to Develop Your Key Risk Indicators

KRIs are essential metrics that help organizations identify, assess, and mitigate potential risks that impact their objectives. Developing effective KRIs is crucial for a robust risk management strategy. Here’s a guide on the best ways to establish your KRIs:

Understand Your Needs:

An effective KRI is tailored to the specific needs of the company. It’s essential to clearly understand the organization’s objectives, processes, and potential risks for successful KRI risk management.

Gather Information:

The more information available for risk assessment, the more precise the organization’s risk landscape becomes. To set up KRIs, engage with different departments, conduct surveys, employ an effective risk assessment tool, and gather data to understand potential risks better.

Characteristics of Effective KRIs:

KRIs should be:

- Quantifiable: They should be measurable in numbers or percentages.

- Reliable: The data should be reliable and consistent.

- Verifiable: There should be a way to verify the accuracy of the KRI.

- Predictable: They should provide foresight into potential risks.

- Relevant: They should be directly related to the associated risk.

Map Business Strategy:

Define the company’s objectives and the processes required to meet those objectives for KRI risk management. Understanding these elements allows you to map potential risks or obstacles to business goals. Mapping the business strategy, objectives, and associated risks makes it easier to determine the most relevant key risk indicators.

Automation and Real-time Monitoring:

Automation plays a pivotal role in monitoring KRIs. Tools and software can enable real-time evaluation of risk metrics, allowing for continuous modification of risk management strategies. For instance, platforms like Predict360 can simplify the KRI risk management process, making it more efficient and effective.

Regular Review and Update:

The business environment is dynamic, and risks evolve over time. Regularly review and update key risk indicators to ensure they remain relevant and effective for identifying potential risks.

Stakeholder Engagement:

Engage with stakeholders, including employees, management, and external partners, to gather feedback on the KRIs. Their insights can provide valuable information on the effectiveness of the KRIs and areas for improvement.

Training and Awareness:

Ensure that all relevant personnel are trained and aware of the KRI risk management process. This ensures consistent understanding and application across the organization.

Conclusion: Leveraging KRIs with Predict360 Risk Insights

Key Risk Indicators (KRIs) guide organizations through potential pitfalls and ensure they remain on the path to success. However, businesses need to do more than merely identify KRIs. The real challenge lies in continuously monitoring, analyzing, and acting upon these indicators to mitigate risks effectively. Enter Predict360 Risk Insights for real-time predictive analytics.

Predict360 Risk Insights is a cutting-edge platform designed to elevate your KRI management to the next level. Here’s how it can transform your approach to KRI risk management:

Real-time Monitoring: Predict360 offers real-time monitoring of KRIs, ensuring you’re always ahead in identifying potential risks.

Advanced Analytics: With its powerful analytics engine, Predict360 allows deeper analysis of your KRIs, helping you understand the underlying patterns and trends.

Integration Capabilities: Predict360 risk assessment software seamlessly integrates with various data sources, ensuring your KRIs are always backed by the most up-to-date information.

Customizable Dashboards: Tailor your KRI dashboards according to your needs. Whether you want a high-level overview or a deep dive into specific indicators, Predict360 has got you covered.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.