Home/ Blog / Responsible AI in the Financial Sector: Build Strategic Advantage Through Compliant AI Adoption

Compliance has rapidly evolved from a regulatory obligation into a strategic function within financial institutions. As regulatory complexity increases and expectations from regulators, customers, and stakeholders rise, firms are under pressure to ensure faster, more accurate, and transparent compliance operations. This is where AI in the financial sector is beginning to play a transformative role.

With much of financial services work being language-based, artificial intelligence in finance is uniquely positioned to streamline compliance by automating documentation, accelerating regulatory change tracking, and enhancing oversight. Institutions are using these tools to reduce operational burdens, proactively manage risk, and improve decision-making on a scale.

Yet, the power of Generative AI (GenAI) brings new responsibilities. When AI influences compliance outcomes, institutions must ensure their outputs are explainable, fair, and aligned with evolving regulatory standards. Responsible AI adoption, built on transparency, accountability, and governance, is now essential to prevent unintended consequences such as bias, compliance gaps, or reputational risk.

As AI in the financial sector continues to transform the compliance function from reactive control to strategic enabler, institutions that lead responsibly will gain more than just regulatory trust. In this blog, we will explore the importance of AI in compliance management, how to set the stage for responsible AI in compliance, and trends defining the future of compliant AI.

Why Financial Services Are Leading the AI Revolution

A Data-Driven Push Toward AI

The financial services sector is at the forefront of the AI revolution, driven by a convergence of data availability, regulatory complexity, and industry competition. In 2023 alone, financial institutions invested $35 billion in AI technologies, with projections indicating that this figure is expected to nearly triple to $97 billion by 2027. This level of commitment underscores a clear priority: unlocking operational efficiencies, mitigating risk, and driving innovation at scale.

One primary reason for the rapid adoption of AI in the financial sector is the language-heavy nature of the work. Whether drafting contracts, processing customer inquiries, or analyzing regulatory updates, a significant portion of daily tasks involve interpreting and generating language. This makes the industry a natural fit for GenAI.

Importance of AI in Compliance Management

Compliance management is among the most impactful areas of artificial intelligence in financial services. As organizations face increasing regulatory scrutiny and mounting volumes of documentation, AI is streamlining how they manage policies, monitor audit trails, and track regulatory changes in real-time. GenAI tools can automatically summarize new regulations, flag changes, and assist employees by generating compliant responses and documentation.

By automating these traditional, manual, and time-consuming tasks, institutions are reducing overhead and improving compliance, accuracy and responsiveness. From back-office functions like document analysis to front-end tasks like regulatory reporting, Gen AI enables a more intelligent and agile compliance infrastructure in the financial sector. This transformation is not about replacing humans but empowering them with innovative tools to manage complexity more effectively and strategically.

Setting the Stage for Responsible AI in Compliance

As AI becomes more deeply embedded in financial institutions’ operations, governance is no longer optional. Regulatory bodies worldwide are rapidly tightening requirements to ensure that AI systems are deployed responsibly. Landmark efforts, such as the European Union’s AI Act and the U.S. AI Bill of Rights, emphasize AI decision-making transparency, fairness, and accountability. Domestically, agencies such as the Office of the Comptroller of the Currency (OCC) and the Securities and Exchange Commission (SEC) reinforce expectations for explainable and ethical AI practices.

For compliance teams, this means that the governance of AI in the financial sector must be built into the fabric of their operations. Responsible AI practices are essential to maintaining the integrity of decisions related to regulatory reporting, risk management, and internal controls. By prioritizing fairness and explainability, financial institutions meet regulatory expectations and build trust with customers, investors, and stakeholders.

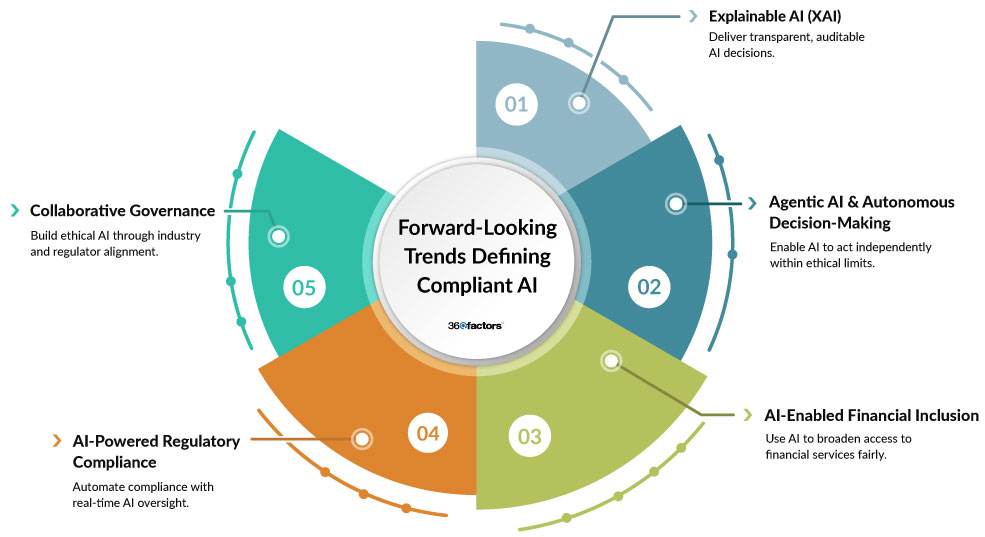

Forward-Looking Trends Defining the Compliant AI

As generative AI in finance matures, organizations must meet current compliance expectations and anticipate the next wave of innovation. A forward-looking approach to Responsible AI includes several key trends reshaping how financial services manage compliance, risk, and fairness.

Explainable AI (XAI)

Explainable AI is emerging as a business-critical capability in regulated industries. As regulatory expectations for transparency grow, financial institutions must ensure that their AI models can justify how decisions are made. From loan approvals to fraud detection, AI in the financial sector systems must produce outputs that are not only accurate but also interpretable by auditors, regulators, and internal stakeholders. Institutions investing in XAI are better positioned to build customer trust and reduce compliance risk while creating more defensible AI systems.

Agentic AI and Autonomous Decision-Making

The evolution toward agentic AI in financial services capable of making autonomous decisions within defined boundaries presents new opportunities and risks. While these systems promise to streamline operations and accelerate responsiveness, they demand tighter governance. Institutions must ensure that agentic models are ethically aligned and constrained by regulatory guardrails, especially in high-stakes decisions involving financial access or risk exposure.

AI-Enabled Financial Inclusion

One of the most promising outcomes of Responsible AI is its potential to reduce bias and promote financial inclusion. By enhancing credit risk models and leveraging non-traditional data sources, AI in the financial sector can expand access to financial products for underserved populations. This includes thin-file borrowers and individuals historically excluded from traditional monetary systems. Ensuring fairness in these models is an ethical imperative and a strategic opportunity for growth and differentiation.

AI-Powered Regulatory Compliance

Manual compliance processes are quickly becoming obsolete. The future of compliance lies in AI-driven automation, where real-time monitoring, reporting, and self-auditing are embedded into financial operations. These capabilities allow institutions to proactively detect anomalies, flag potential violations, and maintain continuous alignment with evolving regulations—all while reducing overhead.

Collaborative Governance

As AI in finance continues to scale, regulatory and ethical alignment can no longer be achieved in isolation. A trend toward collaborative governance is gaining momentum, where financial institutions, regulators, and technology providers co-develop standards for Responsible AI in the financial sector. Shared frameworks and industry-wide best practices will be essential to ensure scalable, compliant, and trustworthy AI systems.

Turning Vision into Action: Predict360 Role in AI-Driven Compliance for Financial Services

As financial institutions strive to embed Responsible AI into their operations, the ability to align technology with governance, efficiency, and real-time insight is no longer optional. Predict360 Compliance Management Software for Financial Services delivers on this need by unifying compliance oversight, reducing operational friction, and embedding intelligence into every layer of the compliance process.

Built as a centralized platform, this financial compliance management software streamlines compliance monitoring, activity tracking, document management, and policy updates within a single, cloud-based environment. Its executive dashboards provide real-time intelligence to help teams identify risks early, act decisively, and continuously align with regulatory expectations. From smart task assignments to automated control validations, the platform empowers organizations to raise compliance performance while reducing manual workload and costs.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.