Home/ Blog / Generative AI in the Finance Industry in 2025

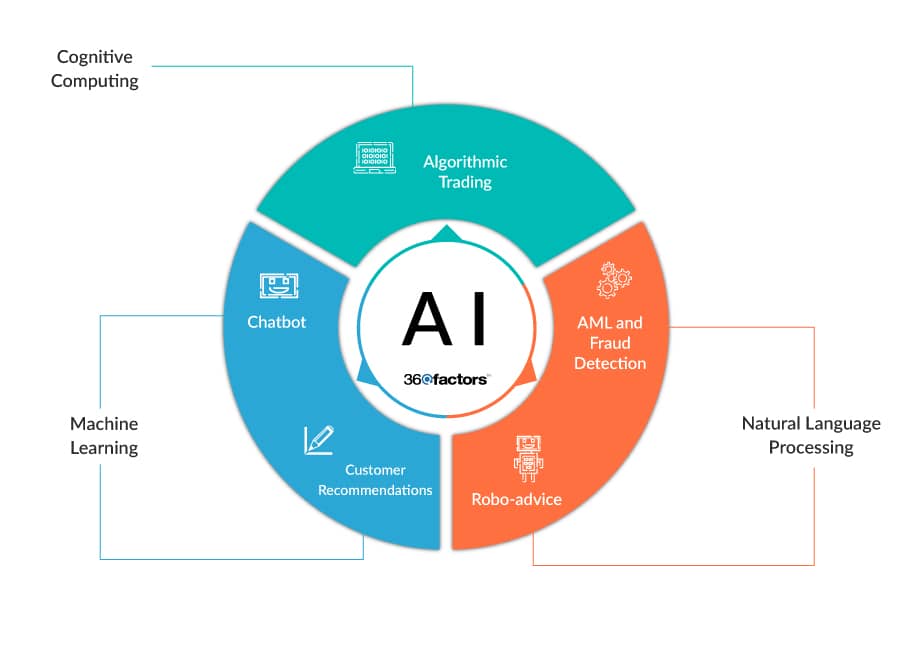

The evolution of generative AI in finance is deeply rooted in advancements in deep learning, with neural networks taking center stage as the architectural backbone. The building blocks of this technology include large language models (LLM), natural language processing (NLP), and machine learning (ML).

With its ability to comprehend and generate human-like text and analyze enormous volumes of data, AI in the finance industry is a formidable force reshaping the financial sector. As the volume of data grows beyond human processing capability in the banking and financial services industry, there is a need for advanced analytical tools that can be complemented through AI.

2025 has been a pivotal year, with a significant upswing in businesses adopting or investing in this technology. Industry giants like Morgan Stanley, Bloomberg, and Goldman Sachs, among others, are already looking into useful applications of generative AI in their financial operations.

This technology offers an array of possibilities that could transform conventional practices. Opportunities range from improved decision-making and personalized services to innovative product development and marketing.

However, as with any technological leap, there are risks and challenges in adopting AI in banking, necessitating carefully exploring its application in the financial domain. Challenges include:

- Heightened competition

- Regulatory scrutiny

- Cyber threats

Some of the risks encompass data privacy concerns, operational disruptions, potential exploitation, and the ever-looming threat of cyber-attacks.

The Effects of Generative AI Growth in Financial Services

Previous machine learning models were focused on simple tasks such as classification and regression, relying on extensive datasets to make predictions. Generative AI, in contrast, takes a leap beyond these capabilities, enabling systems to create novel, synthetic data points that share characteristics with the training data.

Techniques such as Generative Adversarial Networks (GANs), Variational Autoencoders (VAEs), and Transformers have been pivotal in achieving unprecedented levels of sophistication in content generation. But how do these techniques work?

Key Components Explained

Generative models leverage neural networks to learn complex patterns and relationships within the data, enabling them to generate novel outputs.

Generative Adversarial Networks (GANs)

GANs combine a generator and a discriminator. The generator creates synthetic data, and the discriminator evaluates its authenticity. This dynamic refines and improves the generator’s ability to produce increasingly realistic outputs.

Variational Autoencoders (VAEs)

VAEs focus on learning the probabilistic distribution of data. This technique facilitates the generation of diverse and high-quality outputs.

Transformers

The Transformers’ attention mechanism allows models to focus on specific parts of the input data, enabling more coherent and context-aware content generation.

Some of the major achievements of AI in the finance industry include:

- Fraud detection and prevention

- Automated document processing

- Customer service chatbots

- Risk assessment and control management

- Financial forecasting and prediction

- Regulatory change management

- Reporting, credit scoring, and predictive analytics

What is Causing the Rapid Adoption of AI in Finance?

The development of AI in finance has only increased in 2025 with banks and financial organizations becoming more serious about investing in this technology.

Historically, AI adoption in finance focused on rule-based systems for automating routine tasks, risk assessment, and fraud detection. However, the limitations became evident as financial data grew in complexity and volume. This paved the way for machine learning, where algorithms could adapt and learn patterns from data.

Over the years, the financial sector witnessed the application of machine learning techniques such as regression models and neural networks, leading to advancements in predictive analytics and algorithmic trading.

As generative AI technologies continue to mature, the financial industry is seeing a leap beyond predictive capabilities. The current focus is now venturing into the realm of:

- Content generation

- Creativity

- Personalized customer interactions

Current Landscape and Adoption Trend

Financial institutions are integrating AI into their operations to extract actionable insights from vast datasets, enabling more informed decision-making. The adoption trend extends across various facets of financial services, including:

- Wealth management

- Risk assessment

- Customer service

- Compliance

Generative AI plays a central role in risk management, fraud prevention, and the creation of innovative financial products.

AI in Financial Services Use Case

In 2024, HSBC found its organization facing mounting challenges in detecting financial crime across its massive global operations. The bank needed to monitor billions of transactions across millions of customer accounts to identify potential money laundering activities while managing compliance with increasingly complex AML (Anti-Money Laundering) regulations.

Traditional rule-based transaction monitoring systems were generating excessive false positives. This required extensive manual investigation, creating delays in risk detection and regulatory reporting.

This led to HSBC’s strategic decision to implement an AI-powered anti-money laundering system. The implementation required:

- Integration with existing case management systems

- Establishing model governance frameworks to ensure regulators had confidence in the AI-only approach

- Training compliance teams on the new AI-powered workflows

- Developing audit trails and documentation processes for regulatory inspections

Results and Impact

The implementation of generative AI technology delivered exceptional, measurable results that transformed HSBC’s compliance operations, such as:

- A 2–4x increase in confirmed suspicious activity detection

- Identification of money laundering patterns that traditional systems missed

- An over 60 percent reduction in false positive alerts

- Reduced processing time for analyzing billions of transactions

- Reduced operational costs

- Time efficiency for compliance analysts

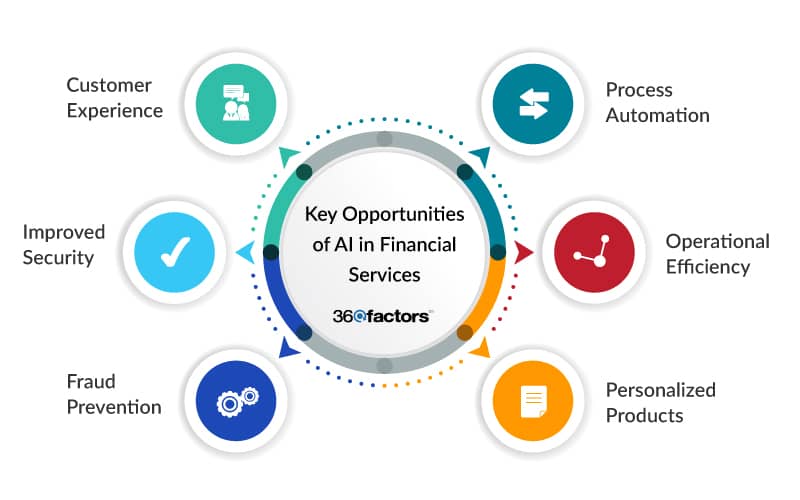

Opportunities for Generative AI in Finance

This technology opens new opportunities for the financial services industry, which could reshape conventional practices while introducing innovative solutions. For instance, AI in banking can help improve decision-making by providing insights from vast datasets.

Generative AI can facilitate the development of personalized services to enhance customer experience. Chatbots and virtual assistants powered by AI can engage and respond to customers, providing tailored support. AI can also be used to enhance risk management practices through identification of potential fraud patterns.

Key Takeaways for the Finance Industry

According to industry research, there are several benefits to opting to use AI.

- AI can serve as primary compliance system, as seen with HSBC

- Modern AI systems can provide the transparency regulators require

- AI can automate routine tasks while improving accuracy

- Generative AI can optimize workflows, reduce processing times, enhance decision-making, and minimize errors

According to the Cybersecurity and Infrastructure Security Agency (CISA), the technology also facilitates the development of advanced cybersecurity measures, including better authentication and sensitive financial information safeguards, and CISA is already planning to integrate it into its cybersecurity models.

Another benefit of AI in banking and finance is accelerating data analysis for risk and compliance functions. AI systems can efficiently process large volumes of structured and unstructured data, such as:

- Identifying the impact of new regulatory changes

- Extracting valuable insights that aid in risk and control assessment

This efficiency enables organizations to sift through vast datasets rapidly, uncovering hidden patterns and potential risk factors.

The rapid evolution of generative AI in banking promises continued advancements that will redefine how the industry approaches risk mitigation and regulatory compliance. Financial institutions are at a crossroads. Many are ready to use the power of AI in the finance industry for more robust risk management and regulatory compliance. 2025 has shown that the future will be driven by AI. Organizations must be open to exploring, experimenting, and collaborating with innovative technologies to lead the way in shaping the next era of risk and compliance practices.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.