Home/ Blog / Key Features to Ensure in Regulatory Change Management

A Regulatory management system refers to the process of detecting, evaluating, and managing the changes in regulatory requirements. As regulatory updates are occurring at an augmented pace worldwide, Regulatory change management is becoming a legitimate challenge for compliance experts due to the rate of change, especially in insurance, banking, and other financial industries.

Large US-based financial enterprises can typically monitor standards and regulatory bodies’ directions due to the large product offerings across their industries and the latest systems. Regulatory management software, the process of regulatory monitoring gets simplified when it comes to medium and small financial enterprises, they still need to work on making their regulatory change management streamlined.

In this blog post, we will walk through the importance of effective regulatory management software along with its key features, and the long-term benefits of streamlined RCM:

Significance of Effective Regulatory Change Management

It is critical to have effective regulatory management software for businesses to stay compliant with the constant regulatory updates and execute critical to comply with the new changes.

Businesses not complying with regulatory requirements can face financial and legal penalties such as sanctions, fines, and reputational damage. Here, regulatory management software facilitates avoiding these penalties by assuring compliance with the advanced regulations. Also, an effective regulatory change management system assists companies in getting ready for updates and implementing necessary changes to ensure all their operations are running efficiently.

Most organizations take advantage of regulatory management systems for enhanced risk management by making well-informed decisions after identifying risks and executing the necessary measures. As it essentially provides timely and accurate information regarding regulatory changes, regulatory management software allows companies to make wise decisions regarding how to comply with updated regulations.

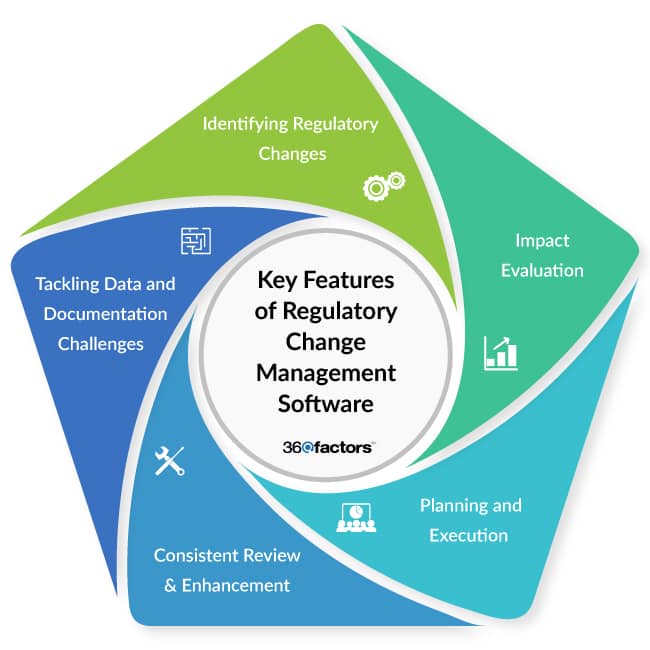

Key Features of RCM & How to Ensure Them with RCM Software

The process of handling regulatory changes within a company is called regulatory change management. It is an essential procedure that assists businesses in maintaining compliance with applicable laws, rules, policies, and standards and staying ahead of regulatory needs with the help of regulatory management software. Regarding an organization’s internal operations, it uses various processes that include critical assessment, planning, execution, and supervising procedures to ensure the organization is streamlined with all the relevant regulatory needs. It also involves the recognition of stakeholders in the company, an evaluation of the consequences of regulatory change, the establishment of plans to counter changes, and the efficient monitoring of places for persistent effectiveness.

The noticeable demand for continuous regulatory changes, render manual strategies to become time-consuming and expensive. In this regard, Regulatory management software is an effective solution. It is associated with the method of aligning the company to the regulatory atmosphere in which the operations of your business take place. Such as States, industry, and regulatory bodies- supervising regulatory development transversely issuing bodies, and adjusting the standards, policies, and controls to applicable regulations to make sure the consistent compliance. Employing good regulatory change management solutions is one of the best solutions to ensure that the prime features of RCM are streamlined and follow the entire RCM process. The following are some essential elements of RCM and how successful RCM software can facilitate to ensure the alignment of these critical features:

Identifying Regulatory Changes

The first stage in regulatory change management is finding the regulatory changes that might influence the organization. Regulatory management software tracks regulatory policy and modifies the organization-relevant laws, rules, regulations, policies, and standards. A real-time executive view of regulatory intelligence, updates, and news is required to ensure to stay aware of all the modifications taking place in the market.

By keeping track of regulatory updates and alerting pertinent stakeholders, regulatory management software may automate the process of regulatory monitoring. This ensures the business is informed of regulatory changes and their potential effects. Monitoring and keeping up with changes in regulatory standards that can influence the company is a crucial component of regulatory change management. This entails keeping up with regulatory information, notifications, and announcements and studying pertinent regulatory material.

Impact Evaluation

After identifying the regulatory changes, the organization must determine how they will affect its regulatory management system. Analyzing the modifications can help to comprehend how the adjustments will impact the company’s efficiency, procedures, policies, and methods. In short, Intelligent parsing of regulatory updates to highlight changes and the applicability of said changes in an appropriate manner is mandatory for RCM.

Regulatory management software offers capabilities to evaluate the effects of legislative reforms on various company functions, goods, and services, which can help with evaluations. This supports businesses in determining and prioritizing the developments that demand action. Assessing the impact of regulatory changes on the firm comes next after they have been recognized. This entails examining the specifications to determine how they will impact the systems, services, products, and company operations.

Planning and Execution

The organization must prepare and implement the required changes to comply with the new requirements after assessing the effect of regulatory changes. This could entail developing new processes, training staff members, and changing policies and procedures; such tactics can be done in regulatory management software. Project plans are required to track and manage multiple simultaneous tasks.

Well, regulatory change management software provides project management capabilities to facilitate adopting regulatory changes. This includes creating action plans, delegating duties, establishing deadlines, and keeping track of development.

Consistent Review & Enhancement

Lastly, regulatory change management is a constant process. Therefore, to make sure the company is fulfilling its regulatory commitments, automatic notifications of all related audits, policies, rules, and documents affected by changes are needed, that can be done manually but it’s much more time consuming.

Although, regulatory management software gives tools for constant review and monitoring of regulatory changes, such as displays and reporting tools that offer real-time progress reports, risk monitoring, and legal compliance. Ultimately, efficient RCM software can offer the functionality and tools required to guarantee the application of the significant RCM principles, from regulatory monitoring through ongoing monitoring and review. This aids businesses in maintaining regulatory compliance and improving risk management.

Tackling Data and Documentation Challenges

Growth and modification have been observed in terms of demands for financial data. Organizations must generate much bigger and grainier datasets that extract data from various sources, requiring it to be verified, well-organized, and standardized. With updating regulatory demands, the compliance experts must manage with regulatory management software any problems that may appear for data availability, quality, accumulation, and management to ensure that the organization makes accurate, detailed, and opportune reports at the time of responding promptly to regulators. It’s also essential for management to deal with all the steps taken at the time of regulatory management method, offering transparent rationales for decision making. A comprehensive audit trail in the regulatory management system will inform the improved and enhanced audit process and address any queries regulators may raise.

Long-Term Advantages of Effective Regulatory Change Management

Regulatory change management is a holistic system that needs to be managed with the selected attributes that makes it effective. Ignoring such features can negatively affect the overall RCM system:

Mitigating Risks

Regulatory management software is considered an obvious solution to mitigate the risks of business disruption and loss if the law makes business structures or activities illegal. One more key objective is to reduce the risk of ignoring a regulation or rule because of insufficient controls and human error. Additionally, the financial aspects of such a risk can damage the organization’s reputation and hurt customer trust. If a violation occurs and is investigated, the financial institution will also have to deal with more regulatory scrutiny moving ahead as corrective actions are implemented. These incidents could all lower the organization’s economic value and can be avoided by employing regulatory management software.

Decreasing Costs

The pressure for faster, more innovative, and more cost-efficient regulatory management systems is increasing for financial institutions, with every newcomer coming from diverse directions. A streamlined and well-planned regulatory change management approach can assist organizations in attaining these objectives with reduced costs.

Guarding Customers’ and Market Integrity

Professionals in the compliance department must pay attention to their customers while safeguarding their organization regarding regulatory updates. The prime objective of successful regulatory management software is increasing concentration on financial conduct and culture while making specific fair results for clients and safeguarding market integrity. The prime impetus in this discussion is for financial institutions to consider their customers’ best interests at the heart of their business and regulatory management system’s structures.

Banks and other financial organizations are now advised by regulatory bodies to monitor their frameworks. The goal is to ensure that regulated institutions constantly evaluate and enhance their internal operations to fulfill their accountabilities to financial consumers. Since everyone’s behavior within the company eventually affects conduct and culture, some organizations may need to manage this evolving risk category more holistically with regulatory management software in an environment where conduct and culture are the focus of regulatory, media, and public scrutiny.

How Predict360 RCM Software Streamlines Regulatory Updates, Activities & Reporting

It is the core accountability of the compliance department to comprehensively understand every regulatory development that impacts the business with any method they find beneficial. The recommended one is regulatory management software. Regulatory bodies continuously update standards, publish new policies, reveal information, provide guidance notes, take disciplinary actions, and more. It is necessary to follow the news changes and updates to learn the additional details that assist organizations in following the law.

Reading and extracting meaningful insights from this knowledge is immensely time-consuming when done manually. Also, it is susceptible to human mistakes, putting your company at risk of non-compliance. You can find yourself working with an insufficient or outdated understanding of the laws, regulations, and regulations that apply to your organization. These problems can be solved with regulatory management software.

Most financial institutions are searching for more innovative regulatory management systems to manage these difficulties by incorporating technologies that can ease regulatory procedures, such as modern data management systems, and the capabilities to enhance essential control methods via automation. This enables an enormous decrease in manual workloads and related risks.

Predict360 RCM is one of the most effective regulatory management software solutions, providing up-to-date regulatory updates, intelligence, news, and changes related to regulatory updates and change management on a single holistic platform.

Keeping up with regulatory changes while optimizing compliance can be challenging without modern solutions such as Predict360 regulatory management software. It provides benefits such as improving and strengthening your overall compliance process, insights, monitoring, audits, performance, and decision-making. These features are ideal for your organization to streamline its general regulatory management system requirements as each of Predict360’s modules deals with versatile challenges that impact the improvement of overall compliance operations.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.