Home/ Blog / Mastering Regulatory Change in 2025: Navigating Divergence, Resilience, and Fairness with AI-Powered RCM

In 2025, the regulatory landscape for financial institutions is more complex and fast-paced than ever. Regulatory bodies worldwide are intensifying their focus on key areas, including artificial intelligence, data governance, environmental sustainability, operational resilience, and consumer protection. However, the challenge extends beyond the increasing volume of regulations. The fragmented, multi-jurisdictional nature of new rules is creating significant operational strain. Federal, state-level, and even international mandates are evolving at different speeds and directions, forcing institutions to adapt their compliance strategies continuously.

Organizations need intelligent, automated solutions that provide real-time visibility, streamline regulatory mapping, and proactively manage compliance risks. AI-powered RCM platforms, such as Predict360, offer a critical advantage, enabling banks and financial institutions to stay ahead of evolving regulatory expectations.

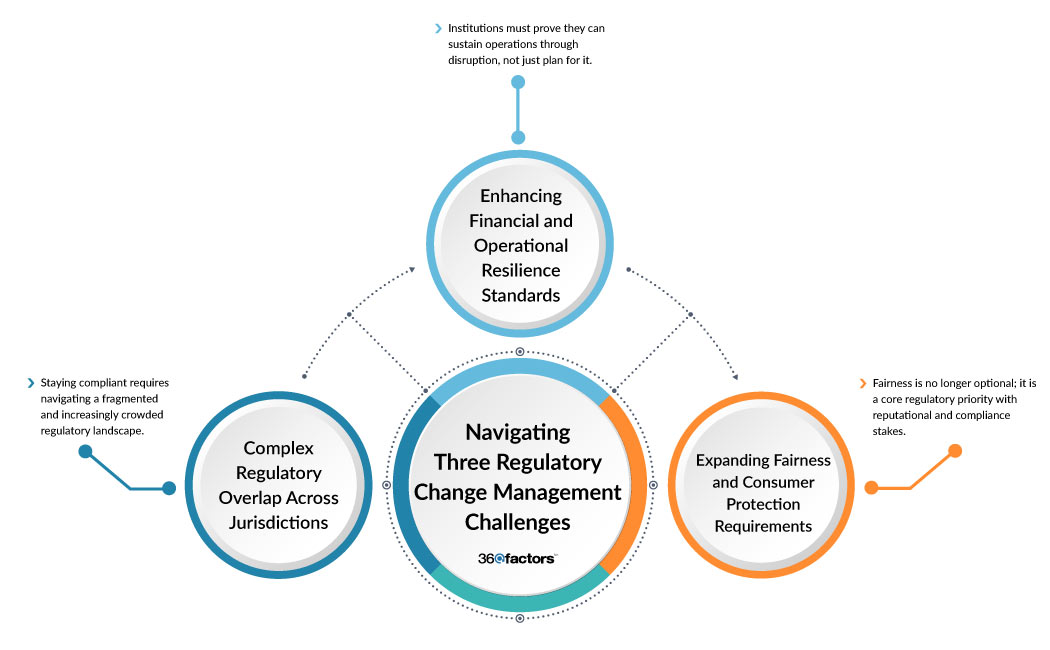

Tackling 2025’s Triple Regulatory Change Management Challenge

Regulatory Intensity and Jurisdictional Divergence

One of the most significant challenges in 2025 is the widening divergence in regulatory approaches across jurisdictions. While election outcomes are shaping the federal pace, state-level regulators are pressing forward decisively, particularly on complex issues such as AI, climate disclosures, and fair access. Progressive states, like California and Colorado, are leading the charge, driving robust standards that exceed federal requirements.

Adding to the complexity, states increasingly utilize Requests for Information (RFIs) and Requests for Comments (RFCs) to incorporate consumer perspectives into their regulatory processes. This growing public engagement underscores consumer voices’ expanding role in shaping the rules that govern financial services.

The resulting patchwork of regulations poses a substantial burden for professionals. The need to track, interpret, and implement jurisdiction-specific mandates in real time has outpaced the capabilities of manual tracking systems and siloed processes. Institutions risk inconsistent adoption, compliance failures, and reputational exposure without cohesive strategies.

Successfully navigating this fragmented landscape requires centralized visibility and coordinated action, facilitated by AI-powered RCM. Institutions must ensure they aren’t just reacting to changes but anticipating them, aligning internal policies and procedures swiftly with evolving state and federal expectations.

Heightened Financial and Operational Resilience Mandates

Resilience is central to regulatory focus in 2025 for banks and financial institutions. Organizations must demonstrate their ability to withstand both immediate shocks and long-term disruptions. These include interest rate volatility, climate-related risks, supply chain breakdowns, and cyber incidents.

Looking ahead, the Republican administration is set to prioritize financial stability and operational resilience. Supervision and enforcement efforts are expected to align with this agenda, balancing growth ambitions with effective oversight. Despite ongoing legal challenges that may constrain the pace of new rulemaking, supervisory expectations are projected to rise, reinforcing higher compliance and risk management standards across the financial sector.

Regulators increasingly focus on companies’ ability to manage third-party risks and maintain robust incident response processes. This isn’t just about documenting preparedness; it’s about embedding resilience into the organization’s operational DNA.

What’s evident is that resilience is no longer optional or theoretical. It has become a daily operational imperative. Firms that proactively strengthen their resilience frameworks will meet supervisory expectations and position themselves for greater stability and trust in volatile markets.

Expanding Fairness and Consumer Protection Obligations

Consumer protection continues to stand as a central regulatory theme in 2025, driven by evolving state-level initiatives and rising consumer expectations, with a heightened focus on fairness and transparency throughout the customer journey. From product development and marketing to sales, service, complaints handling, and pricing practices, scrutiny is intensifying.

At the federal level, many initiatives have faced delays due to legal challenges over regulatory authority. However, states are stepping in assertively. States are advancing consumer protection mandates that demand greater transparency and accountability from banks and financial institutions. Moreover, regulators are actively seeking direct input from consumers through RFIs and RFCs, embedding public feedback into rulemaking.

Meeting these growing obligations requires real-time awareness of state-specific mandates and the ability to implement changes promptly across operations with AI-powered RCM software. Proactively managing fairness and consumer protection is crucial for maintaining compliance and trust.

Why Traditional RCM Approaches Are No Longer Effective

Traditional RCM methods, built around manual tracking and fragmented workflows, are no longer sufficient in today’s fast-paced environment. The reliance on spreadsheets, emails, and siloed teams leads to delays, missed updates, and an increased risk of non-compliance. Outdated systems struggle to keep up with the sheer volume and velocity of regulatory changes, especially across multiple jurisdictions. AI-powered RCM platforms provide real-time insights and automated regulatory tracking, enabling seamless collaboration. By enhancing efficiency, accuracy, and responsiveness, modern solutions like Predict360 RCM software enable organizations to confidently meet regulatory demands.

Advancing RCM to Meet the Complex Demands of 2025 with Predict360

Banks and financial institutions need more than just awareness to navigate the rising tide of regulatory complexity in 2025. They need actionable intelligence and integrated automation. Predict360 RCM Software delivers exactly that by unifying regulatory intelligence, change tracking, impact assessments, and activity management within a single, AI-powered platform. Instead of scattered tools and fragmented workflows, compliance teams gain real-time visibility into regulatory updates and their organizational impact.

The Predict360 AI-powered RCM platform continuously monitors regulatory developments, provides timely updates, and assesses the relevance of changes to your institution’s specific activities.

Kaia – Your AI-Powered RCM Companion

Kaia, Predict360’s AI assistant, offers an interactive experience in regulatory change management. Kaia analyzes newly released regulatory documents, answers real-time questions about applicability and penalties, and even reviews your internal policies to flag impacted procedures. This ensures proactive compliance and minimizes risk exposure of generative AI in financial services.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.