Home/ Blog / Three Major Stages to Successfully Perform Risk Assessments for Financial Organizations

In the intricate financial environment, the ability to perform risk assessment effectively is not just necessary; it’s imperative for the survival and prosperity of any financial institution. The financial landscape is loaded with various levels of risk, each capable of impacting the institution’s operational integrity and compliance posture. Understanding and managing these risks is paramount to maintaining a healthy financial environment and safeguarding against potential threats.

An institution’s risk assessment process is at the heart of a robust financial framework. This critical evaluation considers all risk factors, combining them into an overarching assessment that reflects the potential threats to the financial institution. When we perform risk assessment, we delve into a detailed analysis of the customers, entities, transactions, geographic locations, products, and services, alongside the pivotal aspect of employee training for the organization. These elements play a significant role in risk management, influencing the organization’s regulatory compliance and risk mitigation efforts.

In this blog, we discuss the pre-essentials of risk assessment, the 3 key steps to performing risk assessment effectively, and how financial organizations can enhance the risk management process through AI-based risk assessment software.

Pre-Essentials of Performing Risk Assessment

Financial institutions must lay the groundwork before diving headfirst into the complexity of the risk assessment process. This preliminary stage sets a solid foundation for a comprehensive, insightful, and actionable risk assessment program.

Here are some essential tips and tricks to ensure your financial institution is well-prepared to perform risk assessment.

1. Customize Your Approach

Every financial institution is unique, with its own set of challenges, customer base, and risk exposure. Therefore, it’s imperative to tailor your risk assessment to your institution’s specific needs and circumstances. Avoid generic templates that do not reflect your institution’s reality. Instead, analyze the opportunities and weaknesses faced by your organization to create a customized risk assessment that addresses your unique environment.

2. Utilize Existing Resources

You don’t have to start the risk assessment process from scratch. Leverage existing resources such as previous risk assessments, industry reports, and regulatory guidelines. Additionally, consider consulting with peers, hiring consultants, or participating in online forums dedicated to bank risk assessment reports and risk management for financial organizations. These resources can provide valuable insights and benchmarks to conduct informed risk assessment.

3. Embrace Continuous Improvement

Performing risk assessment is not a one-time activity but a continuous process. The financial landscape and associated risks are constantly evolving. As such, your risk assessment should be a living document, regularly updated to reflect new threats, changes in the business environment, or shifts in regulatory requirements. Continuous monitoring and reassessment ensure that your institution remains proactive rather than reactive in its risk management approach.

4. Justify Your Decisions

Regulators and examiners are increasingly interested in the thought process for the way you perform risk assessment. It needs to be more than just identifying risks; you must also justify your analysis and decisions. This means clearly explaining why certain areas are considered higher risk and detailing the control measures you have put in place to mitigate these risks. An effective risk control self-assessment software, supported by logical reasoning and evidence, will stand up to scrutiny and demonstrate your institution’s commitment to effective risk management.

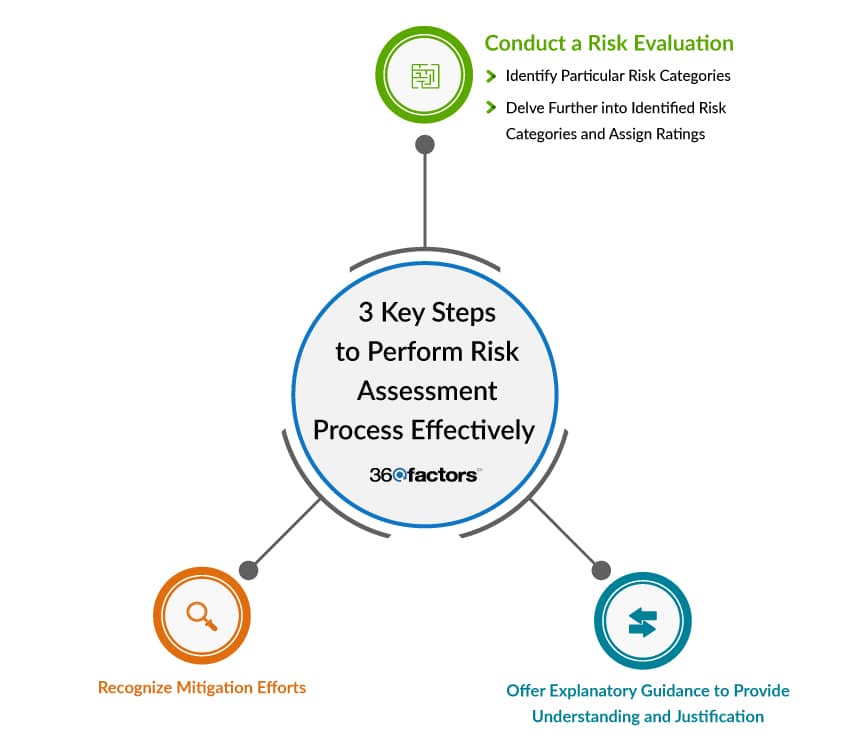

3 Key Steps to Perform Risk Assessment Effectively

A structured and detailed approach is essential to ensure financial institutions effectively navigate the complex landscape of risks. Let’s delve deeper into the three pivotal steps that form the backbone of a successful risk assessment process.

Conduct A Risk Evaluation Based on Risk Factors

A. Identify Particular Risk Categories

The first step in a meticulous risk assessment involves identifying specific risk categories intrinsic to a financial institution’s operations. These categories encompass products and services, customers and entities, and geographic locations. Each category harbors unique risks that could influence how you perform risk assessment; for instance, certain products may inherently carry a higher risk of money laundering or terrorist financing. By identifying these categories, institutions can effectively enhance their risk assessment efforts to address each area’s nuances.

B. Delve Further into Identified Risk Categories and Assign Ratings

After pinpointing the risk categories, it’s crucial to dissect them further through risk control self-assessment software. This involves examining the inherent risk factors such as transaction volume, and the complexity of products and services. Financial institutions should ask critical questions: Does a service enable rapid, high-volume transactions? Does it provide anonymity? Is identification required? Institutions can rate each risk category as low, moderate, or high by evaluating these factors while performing a risk assessment.

2. Add Guidance for Understanding and Justification

Once risks are identified and rated, it’s imperative to articulate the reasoning behind these assessments. Organizations can utilize risk-assessment software to do this accurately. This step involves providing a detailed narrative that explains the institution’s understanding of its risk exposure.

For example, suppose a particular geographic location is deemed high-risk. In that case, the institution should document the factors contributing to this rating, such as its status regarding High-Intensity Drug Trafficking Areas (HIDTA) or its association with High-Intensity Financial Crime Areas (HIFCA). This explanatory guidance should extend to all risk categories while performing risk assessment, offering clear justifications for each appraisal, and demonstrating a logical, informed approach to risk evaluation.

3. Recognize Mitigation Efforts

The final cornerstone of practical risk assessment is the recognition and implementation of robust mitigation efforts. This encompasses establishing monitoring and tracking mechanisms to ensure continuous risk oversight. Financial institutions should delineate their acceptable levels of risk and detail the strategies employed to manage risk at these levels. This includes outlining the controls, processes, and procedures to mitigate identified risks, such as enhanced due diligence (EDD) for high-risk customers and entities.

Moreover, an institution’s commitment to managing compliance risk should be evident through its internal controls, such as adopting technology-driven solutions to perform risk assessment. By documenting and justifying these mitigation efforts, institutions demonstrate their proactive stance on risk management and provide a clear roadmap for maintaining a secure and compliant operational environment.

Conclusion

In financial risk management, the evolution from traditional methods to innovative solutions is not just a trend but a necessity. The Predict360 Risk Control Self-Assessment Software stands at the forefront of this transformation, offering a comprehensive solution that standardizes and automates risk assessment evaluation and reporting. This tool is not merely a software application; it’s a paradigm shift in how financial institutions perform risk assessment.

Predict360 RCSA transforms the risk assessment process into an effective, value-added, and innovative risk management solution. The software provides a centralized platform for risk and control reporting across business units, establishing a common taxonomy of risks and controls across the organization.

One of the standout features of the Predict360 RCSA tool is its real-time identification of risks operating outside tolerance levels. This capability ensures that risk managers, Chief Risk Officers, and the Board have access to up-to-date risk information, enabling them to make informed decisions swiftly. The software also makes it easy to set up schedules to perform risk assessments for periodic and recurring tasks, ensuring timely risk evaluations based on the current risk landscape.

Integration of Predict360 Risk Control Self-Assessment Software with OpenAI GPT-4, a leading generative AI model, has enhanced its capabilities. This integration enables customers to identify AI-recommended risks and controls based on user-submitted regulatory documents, making it easier to perform risk assessments and ensure no potential risk is overlooked. Incorporating AI-recommended risks and controls into your risk register with just a few clicks revolutionizes the process of identifying and defining risks and controls, making risk assessment much more efficient and effective.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.