Home/ Blog / Key Risk Trends Transforming Risk Management in Insurance Companies

Insurance risk management has become a critical pillar of strength and stability. As the insurance industry faces increasingly complex risks, including rising cyberattacks, shifting regulations, economic pressures, and operational disruptions, insurers must respond with greater precision, speed, and confidence.

The traditional, reactive approach to managing risk is no longer effective. Today’s risk landscape demands continuous monitoring, predictive insights, and cross-functional coordination. Effective risk management is not confined to a single department; it is embedded within underwriting, compliance, finance, and operations, driving better decisions at every level.

This blog examines the most significant risk themes reshaping how insurance organizations operate and protect their businesses. It also highlights the role of modern insurance risk management software in helping insurers navigate uncertainty, streamline compliance, and strengthen organizational resilience. With the right tools and strategies, insurers can transform risk into a source of clarity, control, and long-term performance.

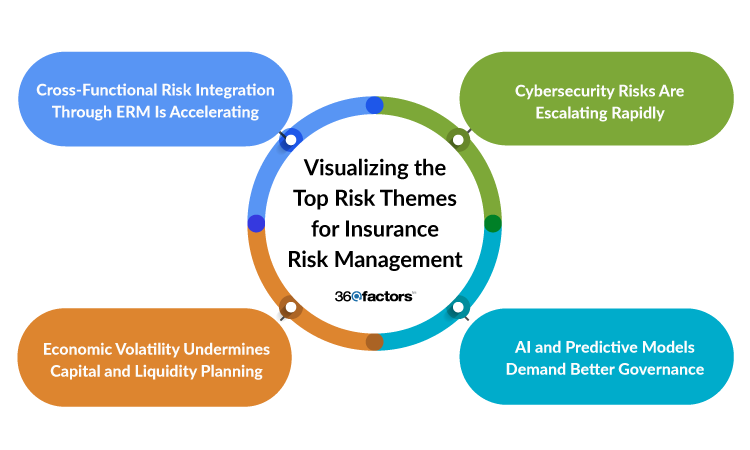

Top Risk Themes for Risk Management in Insurance Companies

The risk management environment for insurance companies continues to evolve, bringing new pressures that require faster response, greater transparency, and more agile tools. From cyber risks to financial instability, the challenges are no longer isolated, or occasional, they are persistent and interconnected. Below are four key themes shaping how insurers approach risk today.

Cybersecurity Risks Are Escalating Rapidly

In insurance risk management, cybersecurity remains a top concern for insurers, who are frequent targets due to the sensitive data they manage and the growing value of digital operations. Recent data shows that 60 percent of insurers have experienced at least one cyberattack in the past year, with the average cost per breach now reaching $4.9 million. These incidents go beyond financial loss; they disrupt operations, erode trust, and attract regulatory attention.

Despite the high stakes, many insurers still lack robust internal safeguards. Only 39 percent consistently apply advanced encryption and multi-factor authentication across their systems, leaving critical assets vulnerable to exposure. As risks become more sophisticated, insurers are increasingly adopting cyber risk quantification models to better measure their exposure. These tools help translate technical vulnerabilities into actionable financial insights, leading to smarter investments in cybersecurity programs.

AI and Predictive Models Demand Better Governance

Artificial intelligence is becoming deeply embedded in insurance risk management operations, particularly in underwriting, risk scoring, and claims management. In 2023, 48 percent of insurers adopted AI-powered predictive models, and 72 percent deployed automated tools for risk assessment, which boosted accuracy but also introduced governance challenges. Unlike traditional algorithms, AI systems learn and evolve, which makes their decision-making less transparent and harder to audit.

The shift to predictive analytics has outpaced governance in many organizations. As a result, there is increasing pressure to implement formal controls to monitor AI performance, validate outputs, and ensure models are free from bias. Regulators are also taking notice, particularly when generative AI in insurance is used to make decisions that affect pricing, eligibility, or customer outcomes. Clear governance frameworks, supported by technology that enables model validation and monitoring, are now essential to ensuring accountability, compliance, and confidence in AI-driven risk processes.

Economic Volatility Undermines Capital and Liquidity Planning

Fluctuating economic conditions are placing pressure on insurers’ capital positions and liquidity planning efforts within insurance risk management. Changes in interest rates, market instability, and inflation can affect investment returns, reserve adequacy, and long-term financial planning. In response, insurers are placing greater emphasis on stress testing, scenario analysis, and more dynamic capital management strategies.

Within modern insurance and risk management, insurers are placing greater emphasis on stress testing, scenario analysis, and dynamic capital management strategies. Traditional forecasting tools often fall short in capturing the complexity of today’s environment. Risk management platforms that integrate capital planning with broader risk assessments help insurers build resilience and respond quicker to financial shocks. They also support better alignment with solvency regulations and internal risk appetite. The ability to access real-time financial risk data is becoming a strategic necessity, not a luxury.

Cross-Functional Risk Integration Through ERM Is Accelerating

Risks in insurance are no longer isolated by function. Cyber incidents can lead to regulatory violations, financial missteps can affect compliance, and operational failures can expose insurers to reputational harm. This interconnectedness has driven a growing shift toward enterprise-wide risk management frameworks.

More insurers are adopting ERM systems that combine financial, operational, cyber, and regulatory data into unified dashboards. This approach enhances visibility, accelerates risk response, and enables leadership to understand the impact of emerging issues fully. Enterprise systems also reduce duplication of effort across departments and enable better resource allocation.

To support this shift in insurance risk management, many organizations are adopting flexible, modular risk platforms delivered as a service. These systems enable companies to scale oversight and maintain control without significantly increasing staffing, making them especially valuable in resource-constrained environments.

How AI-Powered Insurance Risk Management Software Helps Companies

Today’s insurance risk management demands more than traditional tools to address growing uncertainties. As cyber risks, market disruptions, and regulatory demands evolve, insurers are adopting intelligent platforms that improve visibility, accelerate decision-making, and unify risk efforts across the business. Cloud-based, AI-enabled solutions provide continuous monitoring of exposures, automated model validation, and seamless workflow integration, empowering teams to maintain proactive control and strategic alignment without overhauling existing systems.

Meeting Modern Risk Demands with Intelligence

As insurance companies face increasingly interconnected risks ranging from cyber risks to regulatory pressure, manual processes and siloed systems can no longer keep pace. AI-powered insurance risk management software offers a more advanced and responsive approach to managing risk. These platforms enable continuous monitoring, automate critical workflows, and support faster, evidence-based decisions across the enterprise.

From Reactive to Predictive Risk Management

AI-based insurance risk management tools help insurers to shift from reacting to problems after they occur to anticipating risks before they escalate. By analyzing large volumes of internal and external data, these systems uncover patterns, flag anomalies, and forecast potential disruptions. Whether it’s emerging compliance issues or changes in capital exposure, predictive insights enable earlier and more strategic interventions.

Streamlined Collaboration and Reporting

AI in the insurance industry plays an important role in implementing modern software platforms that unify risk data into centralized dashboards, breaking down silos between departments. This supports cross-functional coordination, enhances reporting accuracy, and enables executives to maintain a 360-degree view of the organization’s risk landscape.

Stay Ahead by Implementing Predict360 Insurance Risk Management Software

The risk themes explored in this blog – cybersecurity risks, AI governance, economic pressures, and the need for integrated oversight – reveal a clear reality: insurers require more innovative and adaptive tools to manage today’s challenges. Predict360 Insurance Risk Management Software is purpose-built to meet this need.

It ensures continuous visibility and faster response times, while its modular design allows insurers to scale and configure the system according to their unique risk profiles. For organizations ready to modernize their risk management approach and enhance operational resilience, Predict360 provides the tools and insights to stay ahead, regardless of how rapidly the landscape evolves.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.