Home/ Blog / Top 10 Considerations to Boost Compliance Management Framework in 2023

In an age where the regulatory environment transforms with steady complexity and frequency, the anchor of any forward-looking enterprise is its capability to adapt and remain compliant. A holistic compliance management framework is necessary here, no longer just a luxury. It’s an essential component that enhances a company’s reputation, resilience, and operational victory.

The importance of a robust compliance management framework cannot be overstated in the existing challenging circumstances. This framework serves as the backbone for organizations, ensuring that they operate within the confines of regulatory requirements while maintaining a strong ethical stance. As we delve into the complexities of the compliance management framework, it’s essential to understand its foundational elements.

A compliance framework incorporates well-defined guidelines, controls, and methodologies that help organizations support their operations and processes with regulatory constraints, industry norms, and central business objectives. This framework facilitates in:

- Identifying vulnerabilities in security measures, reducing potential breaches, safeguarding uninterrupted business operations, and upholding adherence to significant compliance management standards.

- Examining the integration of new technologies, modifying the existing system, and addressing issues while maintaining comprehensive documentation.

- Successfully allocating both human and financial resources to reinforce efficiency.

- Augmenting operational performance through an ample approach integrating procedures, personnel, and technology.

The leading objective of any compliance management framework is to ensure that an organization stays compliant with all external regulations while adhering to internal policies and ethical standards. This twin focus guarantees businesses avoid legal implications and build trust with their stakeholders, including customers, employees, and investors.

In the following sections, we will delve deeper into the top 10 considerations that can improve the effectiveness of your compliance management framework in 2023. These considerations are critical in safeguarding that your framework is forceful and aligned with the emerging challenges and opportunities of the modern business world.

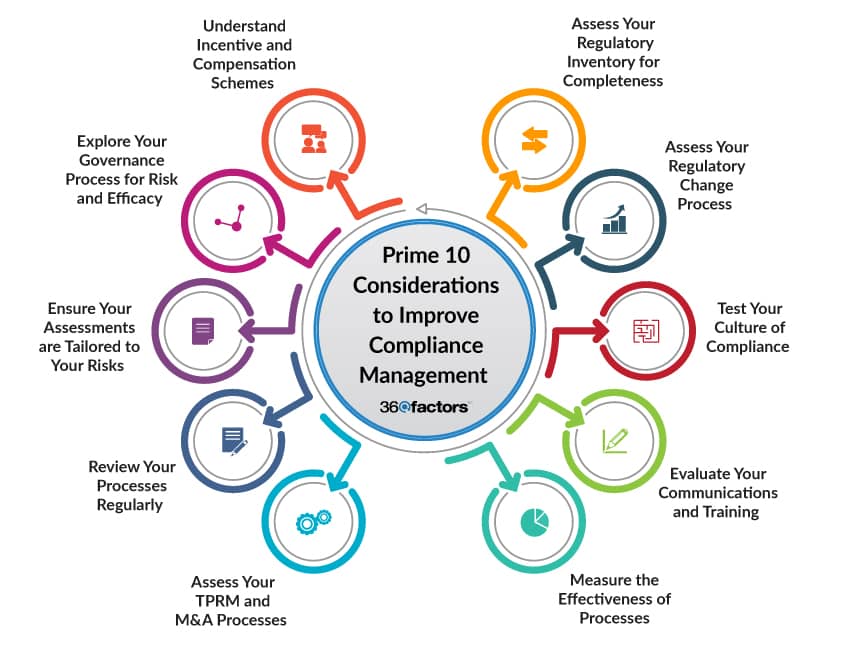

10 Prime Considerations to Improve Compliance Management

A holistic compliance management framework is the foundation for enterprise success and integrity in the sophisticated environment faced by business organizations. Adapting and refining this framework to fulfill the evolving expectations has been a major challenge in 2023.

The goal of the 10 following considerations is to offer a roadmap for financial organizations, guiding them towards a more proactive, resilient, and successful compliance management system that complies with regulations and promotes trust and transparency.

1. Evaluate Your Regulatory Inventory for Completeness

A comprehensive regulatory inventory acts as the foundation of any compliance management framework. This inventory includes the laws, rules, and regulations (LRRs) that apply to the business. Regularly updating this inventory ensures you know all pertinent regulations, allowing for proactive rather than reactive compliance strategies.

2. Assess Your Regulatory Change Process

The regulatory landscape is ever-evolving. Your process for adapting to these changes should be agile, ensuring timely updates to policies and procedures. Regular assessments can highlight areas for improvement, ensuring efficiency in your compliance management framework.

3. Test Your Culture of Compliance

Outside mere policy development, a genuine culture of compliance is critical. This includes assessment of employee understanding and adherence to compliance policies. Regular evaluations, through surveys or feedback sessions, can provide insights into areas needing reinforcement in your compliance management framework.

4. Evaluate Your Communications and Training

Clear communication is crucial for effective compliance. Training modules should convey regulations and engage employees, making them stakeholders in compliance. Organizations can foster a deeper understanding of compliance requirements by ensuring these modules are tailored and updated.

5. Measure the Effectiveness of Monitoring, Auditing, and Reporting

Monitoring, auditing, and reporting processes are the eyes and ears of the compliance framework. They should offer clear insights into the organization’s compliance health, highlighting areas of concern. Regular reviews, especially with the assistance of compliance software, ensure these processes remain sharp, offering timely and actionable insights.

6. Assess Gaps in Your Third-party Management and M&A Processes

Collaborations through third-party partnerships or mergers & acquisitions may introduce gaps and risks to your compliance management framework. Assessing these relationships from a compliance perspective ensures that external entities align with the organization’s standards, minimizing potential risks.

7. Review Your Processes Regularly

Ensure regular review of compliance processes for prevention, detection, discipline, and reporting violations. A holistic approach to violations ensures detection and appropriate remediation. Regular reviews can refine these processes, providing swift and effective responses to any breaches in the compliance management framework.

8. Ensure Your Assessments are Tailored to Your Risks

Different organizations face risks that are unique to their environment and operations. Generic assessments overlook specific challenges. The compliance management framework offers a more targeted and effective assessment that can be tailored to the organization’s unique profile.

9. Examine Your Governance Process for Risk and Efficacy

Governance processes provide the basis for compliance. They should be clearly defined, transparent, and effective. You should periodically re-evaluate them to ensure these processes align with the organization’s goals and the evolving regulatory landscape.

10. Follow the Money – Understand Incentive and Compensation Schemes

Financial incentives drive behavior. It’s crucial to ensure that these incentives promote regulatory compliant behaviors. Organizations can reinforce the right behaviors by reviewing and aligning compensation structures with compliance goals.

By carefully addressing these ten considerations, organizations can ensure that their compliance system is robust and controlled to navigate the complexities of the modern regulatory landscape.

Conclusion: Enhancing Compliance Through Technology

Integrating technology into the compliance management framework is essential in today’s fast-paced business environment. It’s important to note that the future of compliance management is more than just following regulations. It’s about building trust, raising transparency, and ensuring balanced growth.

Reflecting on the insights shared above in terms of consideration, three fundamental premises stand out:

Integrated Approach to Compliance

Effective compliance is achieved when people, processes, and technology work together. This ensures that policies are not only set but are also effectively executed within a structured risk framework.

Incorporating Compliance into Business Operations

Compliance should seamlessly integrate into essential business functions, such as account creation and management. This ensures that compliance supports, rather than delays, customer interactions and operational processes in your compliance management framework.

Implementing Technology for Modernized Compliance

Utilizing technology to automate compliance processes is crucial. Organizations can manage compliance more efficiently and effectively by employing the right tools and systems.

If your organization wants to stay ahead of the curve, tools like Predict360’s compliance management software offer an integrated solution, combining the best technology with industry expertise. By incorporating such tools, businesses can confidently navigate the complexities of 2023 and beyond, ensuring they remain compliant, agile, and ready for the challenges and opportunities.

Predict360’s Compliance Management Software has emerged as a game-changer, offering features and benefits that position organizations at the forefront of the compliance management framework. Here’s how:

Integrated Framework: Predict360 compliance management software offers an all-in-one solution, consolidating various compliance tasks and processes into a single platform. This holistic approach ensures that nothing slips through the cracks and that organizations have a 360-degree view of their compliance landscape.

Automation Capabilities: Manual processes are time-consuming and prone to errors. Predict360 introduces automation into the compliance workflow, ensuring tasks like regulatory change tracking, risk assessments, and reporting are streamlined and accurate.

Real-time Monitoring: Staying ahead means being informed on time, so integrating such tactics into your compliance management framework is critical. Predict360 offers real-time monitoring capabilities, alerting organizations to potential compliance issues as they arise and ensuring timely intervention and resolution.

Regulatory Updates: The regulatory landscape is evolving significantly. Predict360 keeps organizations updated with the latest regulatory changes, ensuring they are always compliant and prepared for any shifts in the regulatory environment.

Scalability: As organizations grow, their compliance needs evolve. Predict360 is designed to scale, ensuring it remains a valuable tool regardless of the organization’s size or complexity.

Cloud-Based Solution: Predict360 ensures organizations can access compliance data and tools anytime. This accessibility ensures continuity and consistency in the compliance management framework.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.