In recent years, the financial services sector has witnessed a seismic shift towards integrating generative AI in finance technologies. This transformative journey is about adopting new tools and fundamentally reimagining how banking and financial operations can be enhanced, personalized, and made more efficient. Generative AI, with its ability to analyze vast datasets, generate predictive insights, and automate complex processes, is at the forefront of this revolution.

The allure of generative AI in finance stems from its potential to unlock new levels of productivity and innovation. Financial institutions leverage these technologies to create personalized customer experiences, streamline operations, and develop new products and services. For instance, it can generate AI-recommended risks and controls which can enhance and speed up the risk assessment process, making it an indispensable tool in the financial risk management toolkit.

As we stand on the brink of a new era in financial services powered by generative AI, the journey ahead promises to be exciting and challenging. Financial institutions’ ability to navigate this transition successfully will depend mainly on their commitment to adopting a robust risk and compliance framework, ensuring that the benefits of generative AI in finance can be realized fully. In this blog, we will delve deeper into the role of AI in risk and compliance, how to accelerate the adoption of generative AI in financial services and outline the top 10 principles of a trusted AI framework.

The Role of Risk and Compliance in Accelerating Generative AI Adoption

As the financial services sector embarks on its journey toward integrating generative AI technologies, the role of risk and compliance functions has become critical. Risk and compliance management teams are uniquely positioned to identify and mitigate potential risks associated with the application of generative AI in finance and accelerate its adoption by ensuring these technologies are used responsibly and according to regulatory mandates. This dual role of risk and compliance functions as both gatekeepers and enablers and is essential for fostering innovation while maintaining trust and integrity within the financial ecosystem.

Deploying generative AI in financial services generative AI in financial services brings a complex array of risks, including ethical dilemmas, data privacy concerns, security vulnerabilities, and the potential for regulatory non-compliance. Risk and compliance professionals must navigate this landscape by developing comprehensive AI risk management and assessment strategies that address these challenges head-on.

One of the critical challenges in adopting generative AI in finance is the pace at which these technologies evolve compared to the more gradual evolution of regulatory frameworks. Risk and compliance functions act as a critical bridge between the innovative potential of AI and the need to adhere to existing and emerging regulations. By maintaining an ongoing dialogue with regulators and participating in industry forums, these professionals can help shape the development of AI governance frameworks that are both effective and flexible enough to accommodate future innovations.

Ultimately, the successful adoption of generative AI in finance depends on fostering a culture of ethical AI use throughout financial organizations. Risk and compliance functions can do a lot to promote awareness and understanding of the moral implications of AI technologies among employees, management, and stakeholders.

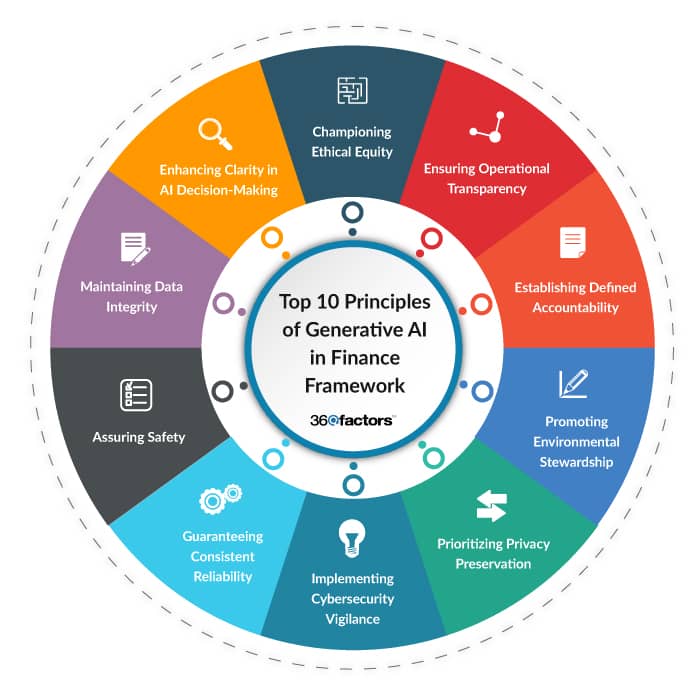

Top 10 Principles of Generative AI in Finance Framework

Integrating generative AI into the financial sector is a paradigm shift in how financial services operate, innovate, and interact with their customers. As financial institutions harness the power of generative AI, embedding core principles into their operational DNA is crucial. These principles guide ethical and responsible use of AI in finance and ensure its integration, strengthening the foundation of trust and security that the financial sector is built upon.

1. Championing Ethical Equity

The principle of ethical equity is paramount, ensuring that generative artificial intelligence for risk and compliance management systems serves all users reasonably, without bias or discrimination. This requires a vigilant approach from risk and compliance teams to continuously monitor, audit, and refine AI algorithms and datasets. The goal is to identify and correct biases, ensuring that AI-driven decisions are equitable across all demographics.

2. Ensuring Operational Transparency

Transparency is the cornerstone of trust when it comes to integrating Ai in Finance. Financial institutions must demystify AI operations, making the inner calculations of AI models accessible and understandable to stakeholders. This involves clear documentation and communication strategies that explain AI decision-making processes in layperson’s terms. For risk and compliance professionals, this means crafting and enforcing protocols that ensure AI’s decisions are transparent, traceable, and justifiable, fostering a culture of openness and accountability.

3. Establishing Defined Accountability

With great power comes great responsibility. As AI takes on more decision-making roles, defining clear lines of accountability becomes essential. This involves setting up governance structures that attribute responsibility for AI’s decisions, including mechanisms for redressal and correcting any errors. Risk and compliance play a critical role in establishing these frameworks, ensuring there is always a human element accountable for any decisions that are taken based on the recommendation of generative AI in finance. This safeguards organizations against misuse and ensures ethical compliance.

4. Promoting Environmental Stewardship

The environmental impact of generative AI is an increasingly important consideration. Financial institutions must ensure their risk and compliance AI strategies are sustainable, minimizing carbon footprints and promoting green technologies. Risk and compliance departments are at the forefront of this effort, integrating environmental considerations into AI project assessments and aligning AI adoption initiatives with broader ESG commitments. This helps protect the planet and aligns financial institutions with the values of environmentally conscious consumers and investors.

5. Prioritizing Privacy Preservation

In the data-driven world of finance, protecting personal and sensitive information is paramount. With its vast data processing capabilities, the application of generative AI in finance poses unique privacy challenges. Risk and compliance teams must ensure these systems adhere to stringent data protection laws and ethical standards. This involves conducting regular privacy impact assessments, implementing robust data protection measures, and fostering a privacy-first culture in AI development and deployment.

6. Implementing Cybersecurity Vigilance

The cybersecurity implications of generative AI are profound. As AI systems become more integrated into financial operations, they will become attractive targets for cyber threats. Establishing comprehensive cybersecurity frameworks, conducting regular security assessments, and ensuring AI systems are resilient to attacks are becoming critical functions of risk and compliance. This vigilance protects the financial institution’s assets and safeguards customer information and trust.

7. Guaranteeing Consistent Reliability

Reliability is non-negotiable for the adoption of AI in finance systems. Financial decisions and transactions rely on AI systems’ consistent and predictable performance. Risk and compliance artificial intelligence departments must ensure these systems are rigorously tested for reliability across various conditions and have contingency plans for system failures. This commitment to reliability ensures that AI systems enhance, rather than disrupt, financial operations and customer experiences.

8. Assuring Safety

The deployment of AI in financial services must prioritize the safety of both humans and property. This involves a thorough assessment of AI applications for potential risks and the development of strategies to mitigate these risks. Risk and compliance teams play a crucial role in this process, ensuring that technologies used for the adoption of AI in finance are deployed to protect users and align with regulatory safety standards.

9. Maintaining Data Integrity

The integrity of the data used by AI systems is foundational to their effectiveness and trustworthiness. Risk and compliance management must oversee data management practices to ensure accuracy, completeness, and quality. This oversight is crucial for maintaining the integrity of AI-driven decisions and operations, ensuring they are based on reliable and valid data.

10. Enhancing Clarity in AI Decision-Making

In the complex financial services landscape, AI systems’ decisions must be understandable to those who rely on them. Organizations must develop models for adopting AI in finance that provide clear, comprehensible explanations for their output. Risk and compliance teams should champion these efforts, ensuring AI in risk and compliance systems is accurate, transparent and understandable. This enhances trust and confidence among customers, regulators, and the wider public.

Conclusion: Building a Responsible AI-Powered Future

The journey towards integrating AI into the financial sector offers immense opportunities for innovation, efficiency, and customer service enhancement. However, it also presents challenges that require diligent oversight, ethical consideration, and strategic management to ensure that the benefits of Ai in Finance are realized responsibly and sustainably.

In this context, the role of advanced risk and compliance management solutions becomes invaluable. Predict360 Risk and Compliance platform exemplifies the kind of innovative software that financial institutions need to navigate the complexities of AI integration while adhering to the highest risk and compliance management standards. Predict360 Risk and Compliance software is not just a tool; it’s a strategic partner in the journey towards a responsible AI-powered future.

Predict360 Risk and Compliance Platform stands out for its enhanced AI risk and compliance management capabilities, offering a comprehensive suite of risk and compliance management applications tailored to the financial sector’s unique needs. This intuitive platform integrates AI in finance seamlessly with existing systems, providing real-time risk insights, predictive analytics, and automated workflows that streamline risk and compliance processes. It enhances efficiency and ensures financial institutions can stay ahead of regulatory changes, manage risks proactively, and embed ethical considerations into every aspect of their risk management and compliance programs.

Moreover, Predict360 Risk and Compliance Management software’s AI-driven analytics and reporting tools empower financial institutions to make data-driven decisions, enhancing transparency and accountability across operations. Predict360 enables financial institutions to foster a culture of continuous improvement and innovation by facilitating a holistic view of risk and compliance.