Empowering Credit Unions to Operate with Integrity, Efficiency, and Insights

Credit Unions play a vital role in their communities, providing member-focused financial services while adhering to rigorous regulatory standards. However, evolving oversight from the NCUA, CFPB, and state regulators, combined with rising regulatory, operational, and third-party risks, continues to challenge compliance and risk teams.

360factors’ intelligent solutions, Predict360, Lumify360, and Ask Kaia, empower credit unions to modernize compliance oversight, enhance governance, and gain actionable insight into operational and financial performance.

With 360factors, credit unions can transform compliance into a strategic advantage:

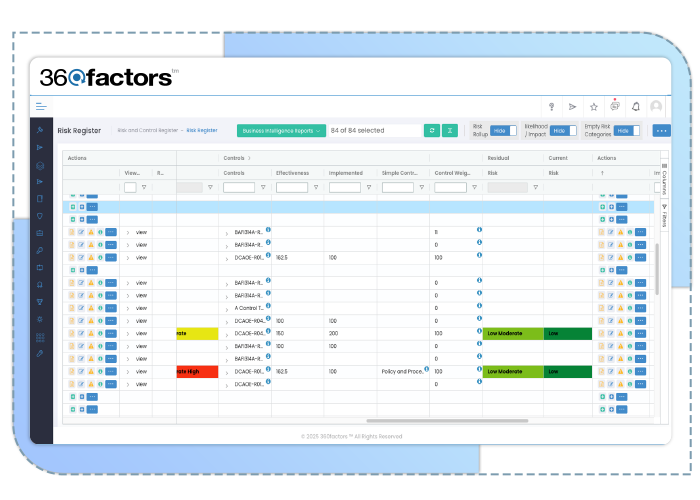

- Improve Risk and Compliance: Predict360 is designed to help credit unions manage and mitigate risks while streamlining regulatory compliance.

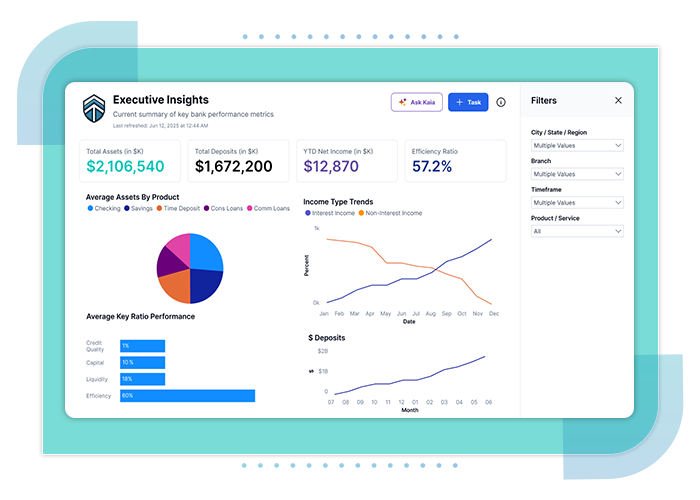

- Business Analytics & Performance Visibility: Transform siloed data into real-time, actionable insights for data-driven decision-making, particularly for small & mid-market organizations, with Lumify360.

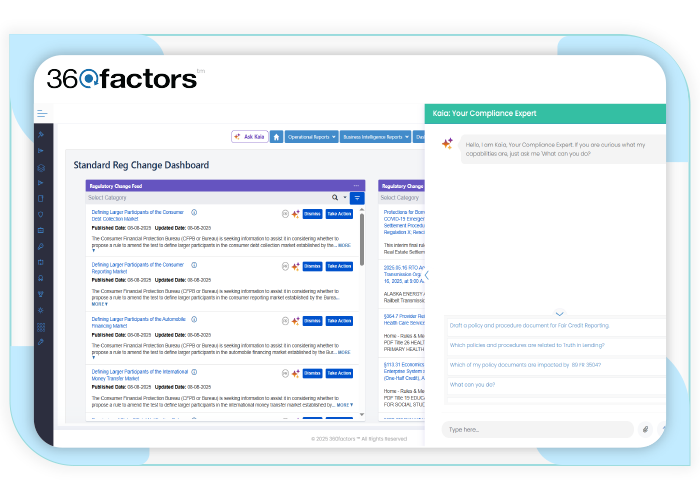

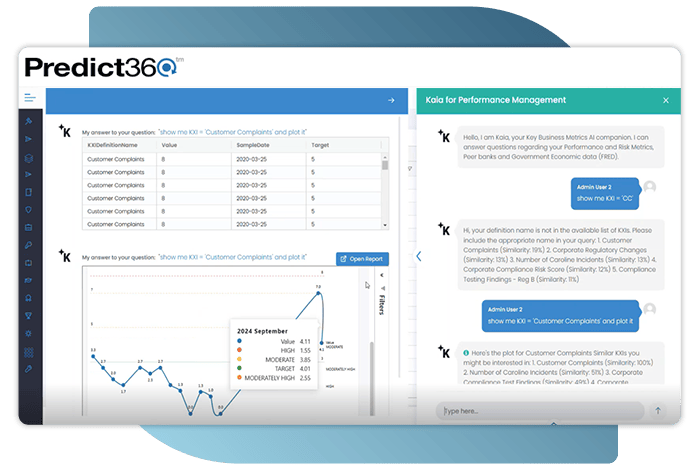

- Empower Compliance Teams with an AI-Powered Expert: Ask Kaia streamlines time-consuming compliance and risk management tasks via a natural language interface, enabling users to interact with regulations and data.

- Integrate Seamlessly: Each platform operates independently or as part of a unified ecosystem that connects compliance, risk, and performance.

Industry Challenges for Credit Unions

Credit unions must balance mission-driven member service with strict compliance obligations. Limited staff, manual processes, and fragmented data systems can make it difficult to demonstrate compliance, track risk exposure, or respond efficiently to regulatory changes.

Common challenges include:

- Evolving NCUA and CFPB regulations require ongoing monitoring and documentation.

- Siloed systems for risk, compliance, lending, and operations that reduce visibility.

- Resource constraints that limit the ability to manage testing, audits, and assessments efficiently.

- Increased examiner expectations for transparent, automated compliance and risk evidence.

Intelligent Risk and Compliance Management for Credit Unions with Predict360

Predict360 enables credit unions to simplify compliance oversight and enhance governance through AI-powered automation, centralized workflows, and integrated regulatory intelligence. With Kaia embedded within Predict360, teams gain instant access to contextual guidance and insights into NCUA and CFPB rules, directly within their compliance and risk workflows.

With Predict360, credit unions can:

- Enhance compliance monitoring, testing, and reporting through Kaia by getting instant references and summaries of relevant NCUA or CFPB requirements.

- Manage enterprise and operational risks in one platform, where AI helps identify control gaps and suggest mitigation strategies based on regulatory best practices.

- Stay aligned with regulatory changes, using AI-powered updates and impact assessments supported by Kaia’s explanations of how new guidance affects credit union operations.

- Unify policy management, audits, and corrective actions.

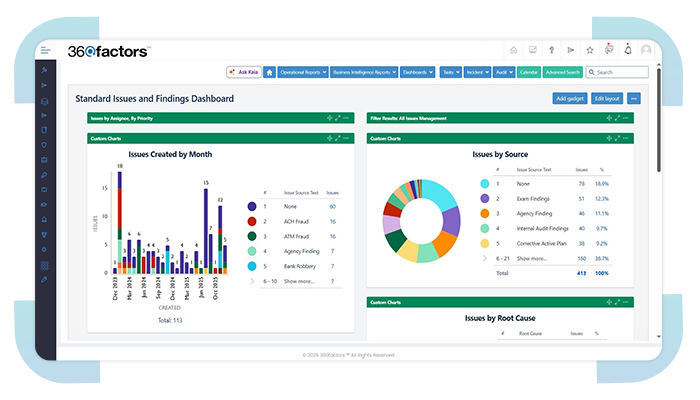

- Generate examiner-ready reports and dashboards, ensuring transparency and confidence in compliance.

Lumify360 Data and Performance Management for Credit Unions

Credit unions manage vast data sets across lending, deposits, member engagement, and operations. Lumify360 helps transform this data into clear, actionable insights that help leaders make faster, more confident decisions.

What credit unions gain with Lumify360:

- Integrate data from external sources like FRED and FFIEC, and internal core banking, compliance, and financial systems into a unified dashboard.

- Monitor KPIs and KRIs for lending, member growth, operations, and compliance performance.

- Identify trends early using AI-driven analytics and forecasting models.

- Empower leadership with intuitive visualizations that require no technical expertise.

Ask Kaia Regulatory Intelligence for Credit Unions

Ask Kaia delivers instant regulatory insight for credit union professionals, helping compliance, audit, and risk teams interpret and apply complex guidance efficiently. Trained on NCUA, CFPB, and federal credit union regulations, Ask Kaia acts as a 24/7, standalone regulatory assistant.

How credit unions benefit from Ask Kaia:

- Receive immediate, accurate responses to compliance and policy questions in plain language.

- Access verified citations and summaries from regulatory guidance.

- Save hours on research and document review by letting Kaia locate and summarize relevant rules.

- Draft and update policies, ensuring consistent understanding and documentation across teams and branches.

- Get instant marketing ad reviews, minimizing work cycles and approval times.

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist