Empowering Financial Services with Intelligence and Insight

The financial services industry operates at the intersection of innovation, risk, and regulation. Whether managing client assets, underwriting loans, or offering advisory services, firms must comply with complex regulatory expectations while ensuring operational excellence and data transparency.

360factors’ intelligent platforms — Predict360 and Lumify360 — empower financial organizations to modernize compliance, manage risk more effectively, and make data-driven decisions with confidence.

With our suite of solutions, financial services can transform from reactive compliance management to proactive governance and performance optimization:

- Ensure Regulatory Compliance: Automate monitoring, testing, and reporting through Predict360’s AI-powered compliance engine.

- Gain Unified Business Insight: Integrate and visualize financial, risk, and operational metrics in Lumify360’s data-rich dashboards.

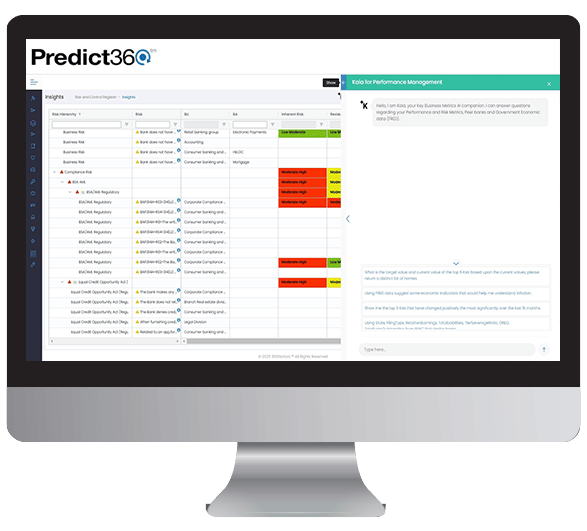

- Empower Compliance and Risk Teams with AI Intelligence: Predict360’s AI Companion Kaia enhances risk and control identification and saves hours of regulation review time by leveraging regulatory expertise, AI-driven insights, and best practices for Financial Services.

- Integrate Seamlessly: Each solution works independently or as part of an interconnected ecosystem to enhance governance, reduce risk, and improve performance.

Industry Challenges for Financial Services

From increased regulatory scrutiny to evolving client expectations, financial service providers face mounting challenges in maintaining compliance, mitigating risks, and optimizing performance. Manual reporting and disconnected systems make it difficult to deliver the oversight and agility that regulators and investors expect.

Common challenges faced by financial services organizations include:

- Frequent regulatory updates from the SEC, FINRA, CFPB, and state regulators require constant tracking and interpretation.

- Fragmented risk, compliance, and performance data across departments and legacy systems.

- Pressure to demonstrate effective governance, transparency, and control testing to stakeholders and auditors.

- Growing cybersecurity, data privacy, and third-party risk exposure.

- Limited resources for risk and compliance teams to manage complex reporting and oversight demands efficiently.

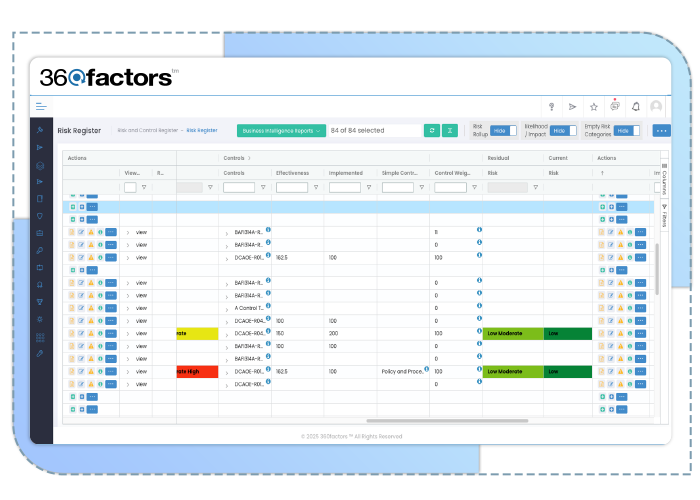

Intelligent Risk and Compliance Management for Financial Services with Predict360

Predict360 helps financial services simplify compliance oversight and enhance governance with AI-powered automation, centralized workflows, and regulatory intelligence.

With Predict360, financial services can:

- Automate compliance monitoring, testing, and regulatory reporting across lines of business with Kaia summarizing and explaining rules.

- Centralize risk management, control assessments, and findings through AI to identify and address vulnerabilities early.

- Stay aligned with evolving guidance from the SEC, FINRA, CFPB, and federal banking agencies with AI recommendations.

- Track policies, audits, and corrective actions in a unified platform for full accountability.

- Generate regulator-ready evidence and dashboards to support examinations and due diligence reviews.

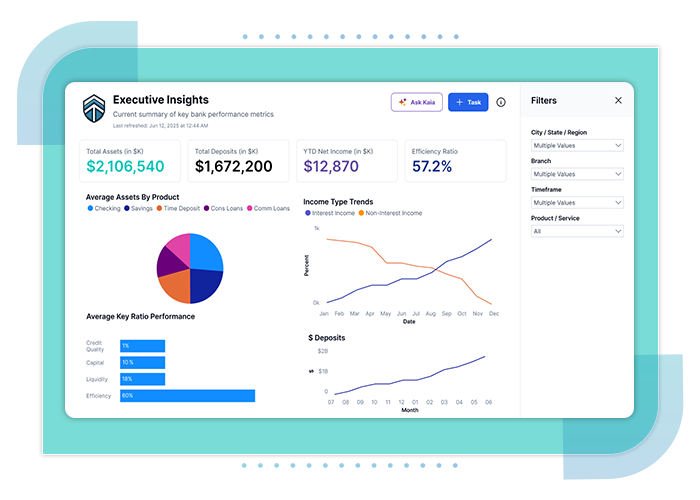

Lumify360 Data Insights and Performance Management for Financial Services

In financial services, data drives every decision — but fragmented systems often hide valuable insights. Lumify360 unifies your financial, operational, and compliance data, providing leaders with a comprehensive and actionable view of organizational performance.

What financial services organizations gain with Lumify360:

- Consolidate financial metrics from multiple systems into one unified dashboard.

- Enable real-time monitoring of profitability, customer trends, and risk exposure.

- Use predictive analytics to forecast financial outcomes and identify potential issues early.

- Empower non-technical users to explore and visualize insights independently.

- Integrate seamlessly with Predict360, Power BI, and other business tools to connect compliance and performance intelligence.

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist