Empowering Money Services Businesses with Smarter Oversight and Performance Visibility

Money Services Businesses (MSBs), including payment providers, money transmitters, currency exchangers, and digital remittance companies, operate in one of the most closely monitored sectors of financial services. Navigating the complex requirements of AML, BSA, and state-level regulations demands precision, transparency, and automation.

Predict360 and Lumify360 help MSBs modernize compliance programs, strengthen risk management, and make informed business decisions backed by unified, real-time data.

With these solutions, MSBs can move beyond manual reporting and fragmented oversight to achieve proactive, automated governance:

- AML and BSA Compliance: Streamline compliance management and reporting workflows with AI-powered Predict360.

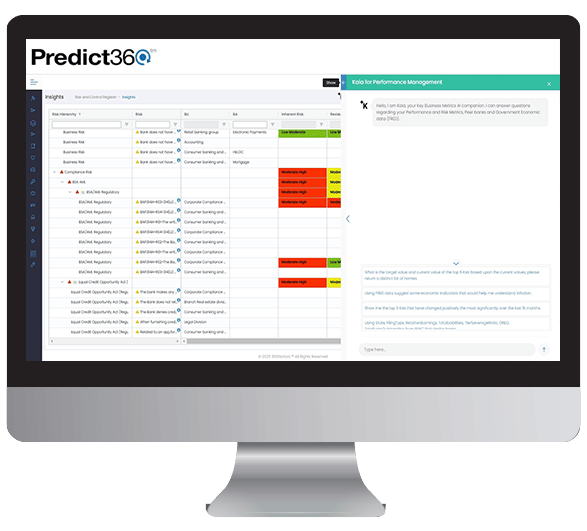

- Enhance Risk Management and Governance: Predict360’s AI Companion Kaia enhances risk & control identification, saving hours of document review time by leveraging regulatory expertise, AI-driven insights, and best practices for financial institutions.

- Unify Data and Performance Insights: Use Lumify360’s AI-driven dashboards to connect operational, compliance, and financial metrics.

Industry Challenges for Money Services Businesses

MSBs face stringent oversight from FinCEN, OCC, and state regulators, alongside growing expectations for customer due diligence, transaction transparency, and fraud prevention. Managing these requirements through manual processes can lead to inefficiencies, errors, and regulatory exposure.

Common challenges include:

- Complex and evolving AML/BSA regulations requiring continuous monitoring and documentation.

- Disconnected systems for customer verification, transaction monitoring, and compliance reporting.

- Manual risk assessments and audit tracking that hinder visibility and timeliness.

- Increasing exposure to financial crime, fraud, and cybersecurity threats.

- Resource constraints where small compliance teams have to manage large volumes of regulatory obligations.

Intelligent Risk and Compliance Management for Money Services Businesses with Predict360

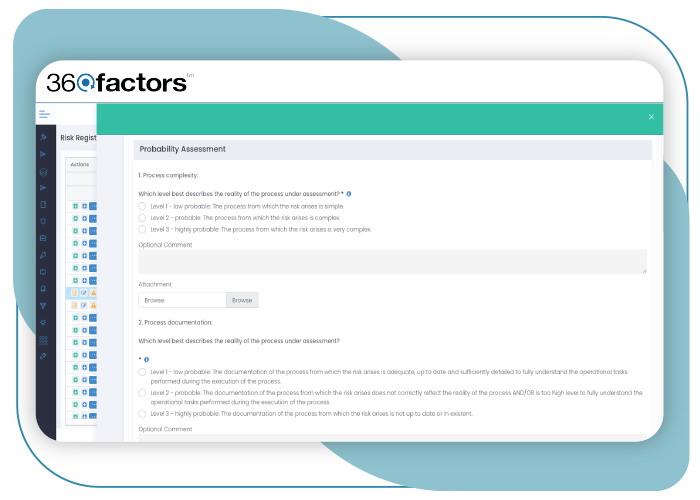

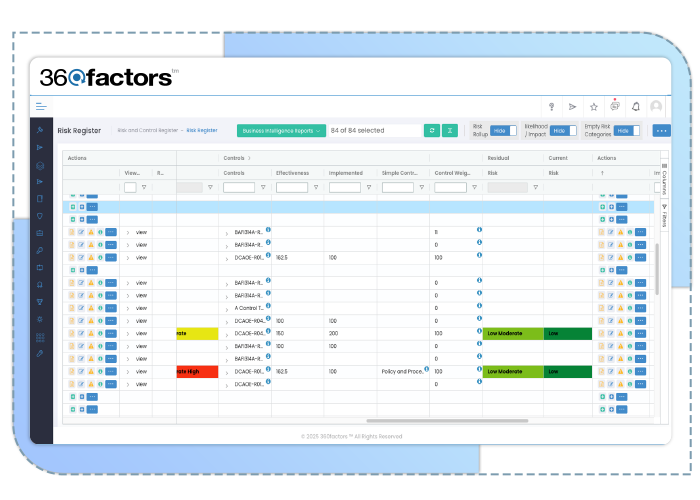

Predict360 enables MSBs to strengthen AML and compliance oversight with AI-powered automation, centralized risk management, and real-time regulatory monitoring. Designed to meet the unique operational and compliance challenges of money services, Predict360 unifies key governance workflows into one intuitive platform.

With Predict360, MSBs can:

- Manage enterprise risks, control frameworks, and findings in one place, identifying potential compliance gaps.

- Monitor and track regulatory changes across jurisdictions and impact assessments with Predict360’s AI Companion Kaia.

- Document policies, training, and audit evidence in centralized repositories to support examiner requests and due diligence reviews.

- Generate audit-ready reports and dashboards that deliver transparency across compliance performance, risk exposure, and control effectiveness.

Lumify360 Data Insights and Performance Management for Money Services Businesses

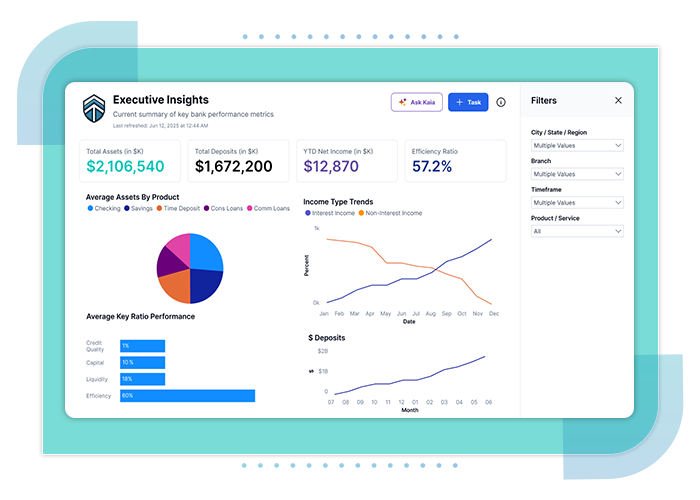

MSBs generate vast amounts of operational and transactional data, yet much of it remains siloed across systems. Lumify360 helps turn that data into clear, actionable insights that help MSBs monitor performance, detect emerging risks, and make data-driven strategic decisions.

What MSBs gain with Lumify360:

- Integrate data from compliance, finance, and transaction systems into a unified, real-time dashboard.

- Monitor key performance and risk indicators such as transaction volumes, suspicious activity alerts, and customer onboarding efficiency.

- Identify trends and forecast risk or performance issues through AI-powered analytics.

- Empower non-technical users to explore data independently and generate insights on demand.

- Connect seamlessly with Power BI and other business systems to align operational intelligence.

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist