Banks, like many other sectors today, are on a digital transformation journey.

For Chief Risk Officers (CROs) seeking to realign their operations to meet strategic growth initiatives and/or readjust strategies to meet economic changes, digital transformation is now a must-have.

Boards of directors, shareholders and management are no longer satisfied with months-old risk and compliance information. They are seeking real-time data to make timely and accurate decisions – especially in today’s challenging economy.

How does today’s CRO meet these needs quickly, especially with remote teams now the norm? In a sea of complex legacy solutions and emerging point-solution vendors, the process of finding a technology partner, acquiring a solution, and working through implementation and training is daunting.

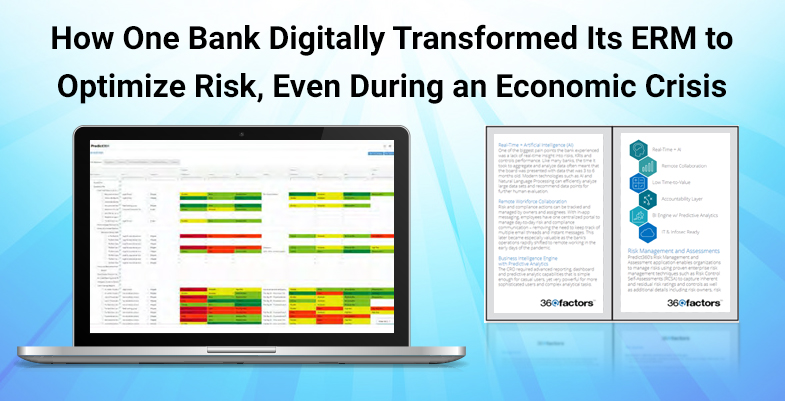

This case study examines how one bank CRO overcame these challenges by first aligning his team’s initiatives with the strategic growth objectives of the bank, then – during the early months of the Pandemic – use real-time data to respond to concerns of the bank’s customers, employees, board of directors, and shareholders.

Download Case Study

Fill out the form to access the case study

By clicking ‘SUBMIT’ you agree to our Privacy Policy.