Simplify Risk Management with Predict360 Essentials

Predict360 Essentials delivers standardized, preconfigured tools for managing risk assessments, issues tracking, and compliance—all tailored to the unique needs of community banks and credit unions.

Predict360 Essentials provides the tools you need to manage risk without adding complexity:

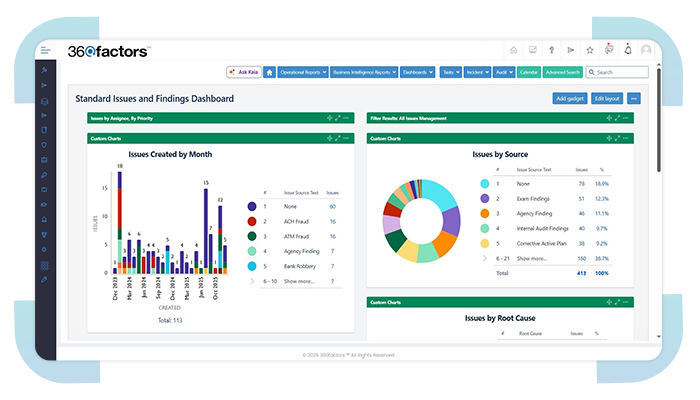

- Preloaded Dashboards and Reports: Gain immediate insights with standard risk assessment reports, heat maps, and dashboards for risks and controls.

- Replace Outsourced Compliance Testing: Reduce dependence on external firms and eliminate typical annual costs of ~$30K by bringing standardized testing in-house.

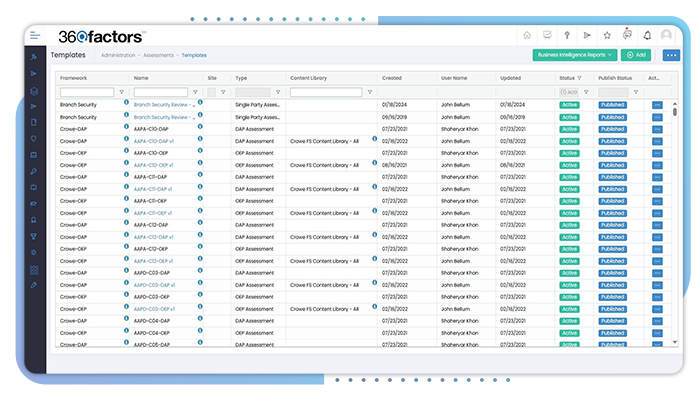

- Pre-Built Workbooks: Use ready-made, examiner-aligned workbooks that remove the need for custom scripts or manual configuration.

- Scalable as You Grow: A flexible system designed for institutions from under $1B in assets to over $100B+, ensuring you never outgrow your risk and compliance platform.

- Implementation in under 30 Days: Be up and running quickly with onboarding included.

Predict360 Essentials Features

Key Predict360 Essentials features include:

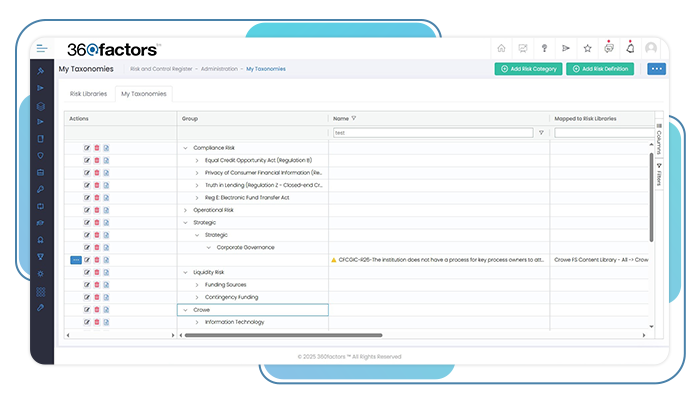

- Comprehensive Risk Libraries

Access to our preloaded community banking library and the Crowe Risk Library.

- Preconfigured Standard Risk Assessments

Risk assessments include a robust set of preloaded evaluations, such as:

- BSA/AML/OFAC/CIP Risk Assessment

- Information Security Risk Assessment, covering:

- Vendor/Partner InfoSec Ratings (NPPI or proprietary information exposure)

- Vendor Mission Criticality Ratings

- Information System Ratings and Risk/Control Assessments

- Cyber Security Risk Assessment

- UDAAP Risk Assessment (Unfair, Deceptive, and Abusive Practices)

- Fair Lending Risk Assessment

- FACTA Risk Assessment

- ACH Risk Assessment

- Remote Deposit Capture Risk Assessment

- SOX/FDICIA Risk Assessments (SOX for public banks, FDICIA for banks over $1B in assets)

- Real-Time Issues Management

Move beyond spreadsheets and emails with a centralized, real-time view of issues and action plans across your organization.

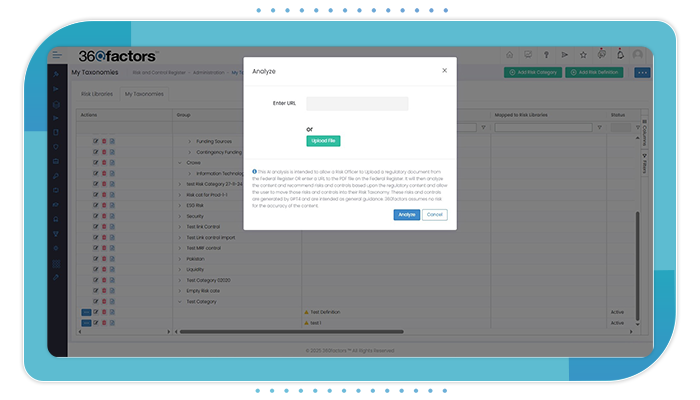

- Kaia AI Assistance

Use Kaia to explore additional controls, streamline workflows, and enhance risk management efficiency.

Why Predict360 Essentials?

Community banks often face challenges such as:

- Ensuring comprehensive risk coverage

- Managing siloed data without a standard methodology

- Preparing for regulatory exams without additional headcount

Predict360 Essentials eliminates guesswork and helps you gain peace of mind.

Ready to Streamline Risk and Issues Management?

Take control of your risk and issues workflows today. Schedule a demo to see how Predict360 Essentials can help your community bank meet regulatory obligations with confidence, without adding complexity.

Connect with an Expert

Predict360 Essentials Benefits

Predict360 Essentials equips community banks and credit unions with a streamlined, examiner-aligned foundation for risk and issues management. Institutions can improve consistency, reduce effort, and strengthen risk management posture from day one.

- Standardized Tools: Ensure consistent risk methodologies and reporting.

- Future-Proof: Easily upgrade to additional apps within the Predict360 platform when your organization is ready.

- Trusted Partner: Built by the experts at 360factors, trusted by community banks nationwide.

- Standardize Risk Reporting: Align processes across all departments and business units.

- Gain Confidence: Meet regulatory obligations with built-in compliance testing worksheets.

- Reduce Costs: Reduce reliance on costly third-party outsourcing services.

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

From simple risk assessments to a complete risk register and compliance testing frameworkAI-Powered Solution

Leverage AI to identify, analyze, and predict risksSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist