Home/ Blog / 6 Major Elements to Focus on for Building an Excellent Compliance Management Framework

The 2024 landscape of financial regulation and compliance management presents complicated and ever-evolving challenges for financial institutions. With fast-paced technological advancements and dynamic regulatory environments, the need for a robust and dynamic compliance management framework has never been more critical.

The year 2024 marks a significant shift in how businesses approach compliance. Gone are the days when compliance was viewed merely as a regulatory obligation. It is a strategic imperative that can drive business success and sustainability today.

Financial institutions face the dual challenge of embracing technological advancements while navigating an increasingly complex regulatory landscape. The rapid adoption of technologies like AI, blockchain, and big data analytics has transformed financial services and brought new dimensions to compliance management.

This blog is designed to guide you through the essential elements of building a practical compliance management framework in 2024. We will explore compliance management challenges in this new era, outline the six key elements of a successful framework, and discuss the integration of advanced compliance management software to help you fortify your compliance strategy.

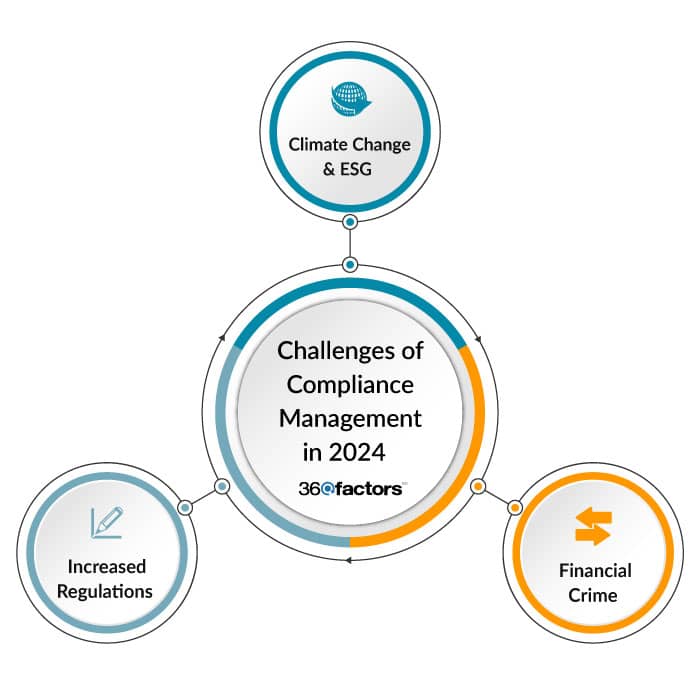

Challenges of Compliance Management in 2024

Climate Change & ESG

The escalating impact of climate change and the increasing focus on Environmental, Social, and Governance (ESG) criteria pose significant challenges. Financial institutions must assess the costs of climate change and its impact on supply chains and integrate comprehensive ESG disclosures into their reporting. Adapting to these changes requires a proactive compliance management framework to mitigate risks and align with sustainability goals.

Financial Crime

The fight against financial crime, including money laundering, remains a top priority in 2024. With over $800 billion laundered annually, institutions must invest in technologies like AI and machine learning for effective detection and prevention. Training teams to recognize red flags and conducting thorough due diligence are crucial to combating financial crime.

Increased Regulations

With new regulations emerging, such as the fair lending regulations requirements, financial institutions face the challenge of staying compliant with an ever-expanding regulatory landscape. This requires regular updates to policies and practices and ensuring that employees understand their regulatory obligations.

6 Elements for a Compliance Management Framework

1. People and Culture

The foundation of a robust compliance management system in financial institutions lies in cultivating a culture where compliance is integral to every operation. This culture should be deeply embedded in the organization’s ethos, influencing employee behavior and decision-making processes. It’s about creating an environment where compliance is not seen as a burden but as a critical component of success.

A comprehensive training program is an essential element of a robust compliance management framework for ensuring that all employees know the compliance requirements and their role in maintaining them. This involves regular training sessions on compliance, including ethical behavior, regulatory requirements, and the organization’s policies and procedures.

Training programs should be implemented to enhance employees’ understanding of compliance issues, emphasizing the importance of ethical behavior. Regular communication about the value of an effective compliance management framework and its impact on the organization’s reputation and success is crucial. This cultural shift ensures that every employee, from entry-level to executive, understands their role in maintaining compliance and feels empowered to act when necessary.

2. Governance and Policy

Strong governance and clear policies are the backbone of an effective compliance management system. This involves establishing a clear governance structure with defined roles and responsibilities for compliance management. Policies should be clear, concise, and easily accessible to all employees. They should also be regularly reviewed and updated to reflect changes in the regulatory environment.

Effective governance within your organization’s compliance management framework ensures accountability and a clear understanding of compliance obligations throughout the organization. It also involves setting up committees with defined mandates for advising and decision-making, ensuring compliance is intertwined into the organization’s governance component.

3. Regulatory Change

Staying updated with regulatory changes is critical for a dynamic compliance management solution. This involves regularly reviewing and updating the risk assessment processes to identify new risks and compliance requirements. Staying ahead of regulatory changes helps in adapting the compliance strategies proactively.

This involves training employees on new regulations and how they impact their roles and responsibilities. By integrating regulatory change management within the compliance management framework, financial institutions can ensure they remain compliant and are prepared for future regulatory shifts by proactively understanding and adapting to regulatory changes.

4. Monitoring and Testing

Regular monitoring and testing are essential to ensure the effectiveness of the compliance management framework. This involves setting up tools and processes for continuous monitoring of compliance controls and conducting regular audits to test their effectiveness.

Monitoring should include automated systems and manual checks to cover all compliance aspects. Regular testing helps identify any weaknesses in the compliance processes and allows for timely corrective actions. This ongoing process ensures that the compliance management framework is practical at any given moment and continues to be effective over time.

5. Data Management

Effective data management is a critical component of a compliance management system in today’s digital age. This involves establishing systems for consistently capturing, measuring, and reporting compliance-related data.

Data should be accurate, timely, and relevant to provide a clear compliance status. Effective data management helps make informed decisions and provides evidence of compliance for regulatory purposes. It also ensures that data is stored securely and managed in compliance with data protection regulations.

6. Issue Management

Effective issue management is crucial for a resilient compliance management framework. This involves establishing processes for the timely identification, escalation, and resolution of compliance issues. It’s essential to have a transparent process for employees to report compliance concerns and for these concerns to be investigated thoroughly.

Effective issue management also involves learning from past issues and making necessary changes to prevent future occurrences. This proactive approach to issue management helps maintain the integrity of the compliance program and ensures that problems are resolved promptly and effectively.

Incorporate an Integrated Compliance Platform to Advance Your Compliance Operations

Integrating a sophisticated platform like Predict360 Compliance Management Software becomes indispensable in the ever-evolving compliance management environment. Predict360 CMS is a next-generation compliance management platform that significantly enhances compliance monitoring, insights, predictions, and the overall organization’s compliance management framework.

Streamlining Compliance Management

Predict360 CMS stands out as an integrated and intuitive solution for compliance management. It offers a centralized platform for all compliance-related information, data, discussions, and documents, streamlining compliance workflow processes across different activities and users. This approach simplifies compliance management and ensures consistency and accessibility of compliance information throughout the organization.

Real-Time Compliance Intelligence

One of the critical features of the Predict360 CMS is its executive dashboards that provide real-time compliance intelligence and data. This feature facilitates building a proactive compliance management framework by giving executives a comprehensive view of the compliance status across the organization. The dashboards offer insights that help make informed decisions and take timely actions to address compliance issues.

Cost-Effective Compliance Solution

Predict360 CMS addresses one of the significant challenges in compliance management, the high cost associated with achieving optimum compliance levels. The software is designed to increase compliance levels while decreasing costs. This is achieved by automating compliance monitoring, reducing workload, and increasing the efficiency of catching violations. This cost-effective approach is particularly beneficial for businesses seeking to maintain high compliance standards within their compliance management framework without escalating operational costs.

Conclusion

The future of compliance management goes beyond traditional views of regulatory adherence. It’s about recognizing compliance as a strategic asset offering competitive advantages. Financial institutions that proactively integrate compliance into their business models can unlock new opportunities, enhance customer trust, and create a more sustainable business environment.

The role of technology, particularly AI, in reshaping compliance will be significant. Financial institutions should leverage AI tools such as Predict360 Compliance Management System Software for efficiency and gain deeper insights into compliance risks and customer behaviors. The future lies in harnessing technology within a compliance management framework to predict and preempt compliance issues before they arise.

The Predict360 is a comprehensive software solution integrating various compliance management aspects. Its applications include compliance monitoring and testing, issues and complaints management, regulatory change management, regulatory examination and findings management, policy and procedure document management, and third-party and fintech partner compliance and training management. Together, these applications ensure that every facet of compliance management is covered, from tracking and managing compliance tasks to handling regulatory changes and training requirements.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.