Home/ Blog / Elevate Your Bank’s Compliance Management Process with 6 Strategic Moves in 2024

The year 2024 will be pivotal for banks and financial institutions, where the compliance management process is expected to become more than just a regulatory formality—and evolve into a strategic imperative. Compliance management guarantees that banks act responsibly within the legal and regulatory frameworks. Financial institutions come across new regulatory changes or updates every day, so having an efficient and effective compliance process is vital for banks to stay on the right side of the law.

As we delve into this critical topic, our focus is on empowering banks with actionable strategies to elevate their compliance management program. This is not just about meeting the baseline requirements; it’s about setting a new standard in compliance excellence. In this blog, we will explore the significance of refining the compliance management process and introduce six strategic moves that are essential for banks in 2024.

Significance of Improving Compliance Management Processes for Financial Institutions

The banking compliance landscape is evolving rapidly, driven by technological advancements, changing regulatory demands, and the increasing expectations of consumers and stakeholders. Banks that stay ahead in their compliance management practices will not only navigate these challenges more effectively but will also unlock new opportunities for growth and innovation.

In this dynamic financial environment, the role of a robust compliance management solution is more crucial than ever. For banks, the compliance management process is a foundational pillar that encourages integrity, stability, and an esteemed reputation in the financial sector.

Mitigating Legal and Financial Risks

For banks, effective compliance-related strategies are central to mitigating legal and financial risks. In a landscape marked by ever-changing regulatory frameworks, the commitment to compliance goes beyond mere legal adherence. Banks must proactively identify and address areas of potential non-compliance. This foresight prevents legal complications and financial penalties, safeguarding each institution’s financial health and standing.

Cultivating Trust and Reputation

In today’s digital era, a bank’s reputation is a priceless asset. Having a well-structured compliance management process is critical to nurturing this reputation. By demonstrating unwavering commitment to regulatory compliance, banks earn and maintain the trust of their customers, investors, and the wider community. This trust is fundamental to fostering long-term relationships and attracting new clientele in a competitive marketplace.

Boosting Operational Efficiency

Banks recognize that an efficient process is a catalyst for operational excellence. By integrating state-of-the-art compliance management systems and tools, they can automate and streamline compliance-related tasks. This not only minimizes human error but also reallocates valuable resources to strategic areas, enhancing operational efficiency and service delivery.

Fostering a Culture of Compliance

Beyond the tangible benefits, a robust compliance management process cultivates a deep-rooted culture of compliance within banks. By integrating compliance into core values and everyday operations, it becomes a collective responsibility of all employees. This cultural shift not only guarantees adherence to regulations but also reinforces ethical behavior and decision-making across the organization.

6 Critical Tactics for Improving the Bank’s Compliance Management Process

1. Expanding Resource Utilization for Identifying Regulatory Risks

Banks should broaden their resource pool committed to improving their compliance management systems. This involves not only relying on internal assessments and reviews but also incorporating external benchmarks and industry best practices into their compliance management processes.

By comparing internal compliance statuses with those of peers and market standards, banks can gain a comprehensive understanding of their regulatory risk landscape. This approach helps in identifying potential areas of non-compliance and emerging risks, ensuring a more robust and proactive compliance strategy.

2. Leveraging Technological Advancements for Regulatory Change Adaptation

In the fast-paced regulatory environment, banks must utilize compliance management system technology to stay abreast of changes. There are several automated systems that provide real-time updates and action-oriented workflows, which can make a difference. These systems filter through the plethora of regulatory updates, highlighting those that are most pertinent and relevant.

Technological solutions enable banks to improve their compliance management process by quickly adapting to new regulations, efficiently managing changes, and ensuring continuous compliance, thereby reducing the risk of non-compliance and associated penalties. Banks should be cautious of common pitfalls such as scope creep and ensure they partner with vendors who have deep industry expertise to maximize the benefits of these technological investments.

3. Strategic Risk Mapping to Key Compliance Elements

Effective compliance management requires a strategic alignment of identified risks with critical operational elements. This involves mapping out how each compliance risk correlates with specific products, procedures, controls, and training programs.

Such a strategic mapping ensures that any change in the regulatory landscape can be quickly reflected in the operational processes. This minimizes disruptions and enhances the bank’s compliance management process, as well as its ability to respond to regulatory changes effectively.

4. Standardizing Risk Quantification and Control Assessment

Banks need to establish standardized methods for quantifying risks and assessing the effectiveness of control measures. This standardization involves developing consistent questionnaires and formulas for risk managers to evaluate the inherent strength and residual impact of various risks.

By having a uniform approach, banks can prioritize risks more effectively, allocate resources efficiently, and make informed decisions to strengthen their compliance posture.

5. Customizing Compliance Reporting for Diverse Stakeholders

Tailoring compliance management reports to meet the informational needs of different stakeholders within the organization is crucial. This requires customization of the compliance management process to ensure that each level of the organization, from front-line staff to executive management, receives relevant and actionable information.

By providing tailored reports, banks can facilitate better understanding and engagement with compliance processes across all levels of the organization.

6. Integrating Assessments for Enhanced Monitoring and Testing

Integrating assessments into the compliance monitoring and testing processes is critical to achieving a comprehensive view of the bank’s compliance status. This integration involves linking testing activities directly to regulatory requirements and using systematic questionnaires for thorough reviews.

Such an approach streamlines the monitoring process and ensures that all aspects of the compliance management process are thoroughly evaluated and documented, enhancing the overall effectiveness of the compliance program.

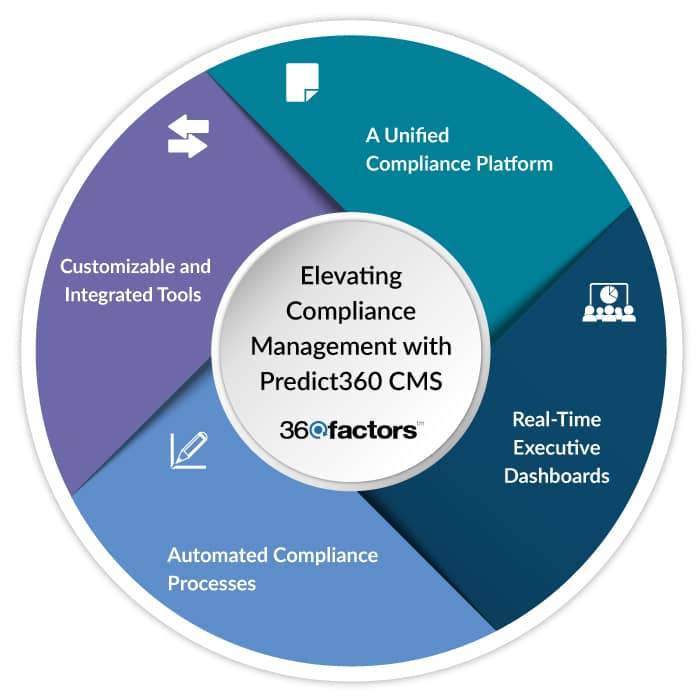

Conclusion: Elevating Compliance Management with Predict360 CMS

To wrap up our exploration of how to enhance your bank’s compliance management process in 2024, it’s clear that the integration of advanced technology solutions is not just beneficial but essential. This is where Predict360 Compliance Management Solution, a next-generation compliance management system software, comes into play, offering a transformative solution for financial institutions.

Predict360 CMS stands out as an AI-powered solution that significantly improves compliance monitoring, insights, and predictions. The platform offers a comprehensive suite of features, including:

A Unified Compliance Platform

Predict360 CMS consolidates all compliance-related information, data, discussions, and documents into a single, intuitive platform. This centralization streamlines the compliance workflow, making it easier for banks to manage and track all the activities in their compliance management process.

Real-Time Executive Dashboards

The Predict360 compliance management software provides executive dashboards that display real-time compliance intelligence and data. This feature enables proactive management of compliance, allowing banks to stay ahead of potential issues and regulatory changes.

Automated Compliance Processes

Predict360 compliance management tool automates many aspects of compliance management, from monitoring upcoming regulations to document management. This automation reduces the workload on staff, increases efficiency, and decreases the costs associated with maintaining compliance.

Customizable and Integrated Tools

The Predict360 compliance management software includes a range of tools that can be used independently or as part of the integrated compliance management suite. These tools cover various aspects of the compliance management process, including regulatory change management, policy and procedure document management, third-party compliance management, and training management.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.