Home/ Blog / How to Stay Ahead with an AI-Powered Regulatory Change Management Process

Regulatory change management has become a constant operational challenge, given the frequent changes in rules and regulations. As agencies across jurisdictions release updates with increasing speed and complexity, compliance teams face mounting pressure to stay ahead. These updates often arrive with inconsistent timing, unclear applicability, and varying levels of detail, making it difficult to interpret and act on the right information.

A recent KPMG study found that 43% of Chief Compliance Officers view new regulatory requirements as their greatest challenge. In response, many organizations are prioritizing automation and industry-specific mapping to improve their regulatory change management processes. The trend is clear: traditional tools, such as spreadsheets, static alerts, and manual tracking systems, are no longer sufficient.

We must note that expectations are also rising. Regulatory bodies and auditors now expect organizations to show awareness of changes, clear, timely responses, and internal accountability. Without a scalable process in place, even well-staffed compliance teams can struggle to keep up.

Banking and financial institutions must use smarter regulatory change management solutions that can filter, interpret, and connect regulatory updates to business operations in real-time. This blog explores the growing challenges of regulatory change, practical strategies to manage them, and how AI-powered solutions can help compliance teams stay proactive and audit-ready.

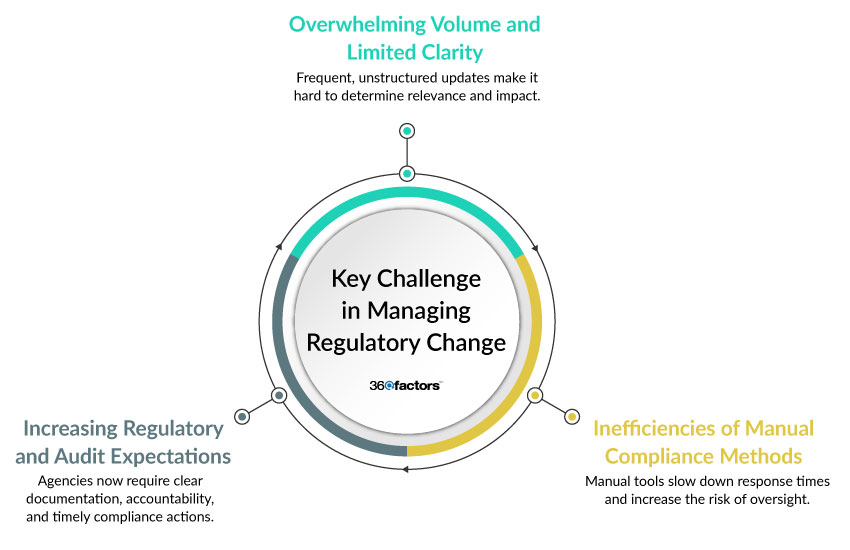

The Growing Challenges of Regulatory Change Management

Too Many Updates, Too Little Clarity

One of the biggest challenges is identifying which regulatory changes apply to your organization. With updates released frequently and without a standardized structure, compliance teams must go through large volumes of information to determine relevance. This task is further complicated by vague language, inconsistent terminology, and lack of context, which makes it difficult to assess what action is required or how quickly it needs to be taken.

Manual Processes Are Time-Consuming and Error-Prone

Despite the fast-paced nature of regulatory change, many organizations still depend on manual tools such as spreadsheets, email alerts, and PDF reports. These fragmented methods require constant oversight, yet still leave room for human error and missed updates. Cross-functional communication also suffers when there’s no central source of truth, leading to delays and gaps in regulatory change management.

Compliance Expectations Are Rising

Regulators now expect organizations to have a structured, documented process for monitoring, interpreting, and responding to regulatory changes. It is no longer sufficient to react. Compliance teams must be able to demonstrate a clear chain of accountability and provide evidence of timely action, particularly during audits or examinations. Without a systematic approach, proving compliance becomes challenging, and the consequences of failure can include penalties, reputational damage, and heightened scrutiny.

To meet today’s regulatory demands, organizations need more than effort; they need smarter systems that can keep pace with change and simplify the entire compliance process.

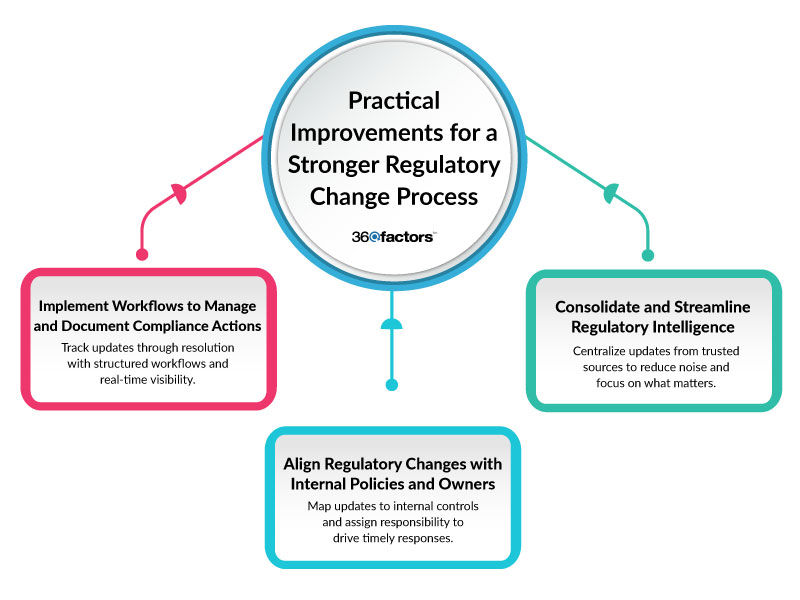

Smarter Ways to Improve Regulatory Change Management Process

Centralized Regulatory Intelligence

The first step toward a more effective process is consolidating regulatory updates into a single, centralized system. By collecting updates from trusted sources such as government agencies, industry groups, and legal advisors, organizations can avoid duplicative or irrelevant notifications. More importantly, filtering updates by geography, industry, or risk category ensures that only applicable regulations reach the compliance team. This targeted approach reduces information overload, making it easier to act on the right data at the right time.

Map Changes to Internal Controls and Responsibilities

Once relevant changes are identified, they must be linked to the corresponding internal structures. Linking new regulations to specific policies, procedures, and business units clarifies how each change impacts operations. Assigning ownership to the right individuals or departments ensures accountability and speeds up response times. This mapping process also helps organizations maintain alignment between regulatory requirements and internal controls, reducing the likelihood of oversight in regulatory change management.

Use Workflows to Track and Document Responses

Implementing workflows allows organizations to track regulatory changes through resolution. With assigned tasks, clear deadlines, and cross-departmental collaboration, teams can take timely and coordinated action. Dashboards and audit trails provide ongoing visibility into progress and outcomes, supporting better decision-making and easier audit preparation. By adopting structured workflows, compliance becomes a repeatable and transparent process, rather than a reactive scramble.

AI-Powered RCM as the New Standard

AI Speeds Up What Humans Struggle to Scale

Generative AI in banking can process and analyze massive volumes of regulatory data significantly faster than human teams. It scans thousands of sources in real-time, identifies relevant updates, and assesses their potential impact based on keywords, risk categories, and historical patterns. This eliminates the need for compliance professionals to manually read through lengthy documents, ensuring that significant changes are flagged promptly. As the volume of updates continues to grow, this kind of speed and scale becomes essential.

Automation Brings Structure and Efficiency

Automation helps turn a traditionally reactive process into a structured and consistent regulatory change management process. When a regulatory update is identified, automated systems can trigger predefined actions such as notifying process owners, updating impact assessments, or flagging related policies for review. This structured approach reduces the chances of oversight and ensures that compliance tasks are completed in a timely and traceable manner. By automating routine tasks, compliance teams can focus on higher-value analysis and strategic decision-making.

Audit-Readiness Becomes Built-In

With AI and automation, every regulatory update and organizational response is logged, time-stamped, and documented. This creates a reliable audit trail without requiring extra administrative effort. Dashboards provide real-time visibility into compliance activities, while reports can be generated quickly to demonstrate adherence. The result is a system where audit readiness is not an afterthought; it is an integrated part of daily operations.

Enhance Regulatory Change Management with Predict360 RCM Software

To keep pace with the speed and complexity of regulatory change, organizations need more than manual tracking and fragmented systems. Predict360 Regulatory Change Management Software is a unified, AI-powered platform that streamlines and enhances the entire compliance process.

The software consolidates regulatory intelligence from multiple trusted sources into a single, searchable feed. Intelligent parsing highlights the key elements of each update and determines its relevance to your business. Once a change is identified, the platform maps it to affected policies, procedures, and business units, automatically notifying the right stakeholders. Built-in workflows allow teams to assign tasks, set deadlines, and monitor progress through real-time dashboards and audit trails.

Kaia – Predict360’s AI Companion for Regulatory Intelligence

Kaia, Predict360’s integrated AI assistant, adds a new level of speed and insight to regulatory intelligence. Trained in regulatory documents, Kaia can answer compliance-related questions and provide instant, context-aware insights. Kaia offers advanced generative AI in banking to support impact analysis by identifying which internal policies are affected by specific changes.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.