Home/ Blog / 6 Crucial Attributes to Enhance the Efficiency of Your Regulatory Change Management Process

As a chief compliance officer, you must have encountered compliance failures because of an ineffective regulatory change management process. The root cause could be the frequent regulations throughout the financial industry, including too many legislative updates, the latest regulations that needed to be included, the execution of new products and services, and a need for follow-up on the importance of the implemented reforms.

Well, change is persistent. Regulations change swiftly that impose the latest needs and compliance risks for companies worldwide, whether the organization is aware of these updates or not. The objective of RCM is to stay on top of evolving regulations so you can execute them successfully, making your regulatory change management process effective across the company. The more you stay ready to manage regulatory changes, the easier it will be.

The need for successful RCM strategies has never been more critical in the dynamic business world, where regulatory landscapes continuously evolve. This process is essential in ensuring organizations navigate regulatory changes seamlessly, maintaining compliance and preserving their reputation. It is not just a regulatory necessity but a strategic requirement that substantially influences an organization’s ability to operate effectively in complicated regulatory change circumstances.

Understanding the regulatory change management process is the first step toward developing a robust and compliant organization. It involves an organized approach to recognizing, evaluating, and executing regulatory changes within the business. This procedure ensures that all aspects of the organization are aligned with the current regulatory constraints, safeguarding the company from possible legal hazards and reputational harm.

With the appropriate regulatory change management process, companies can turn regulatory compliance into a strategic reward, ensuring they are always ahead. Let’s explore the six crucial attributes that can enhance the efficiency of your RCM Process, paving the way for a compliant and robust business environment.

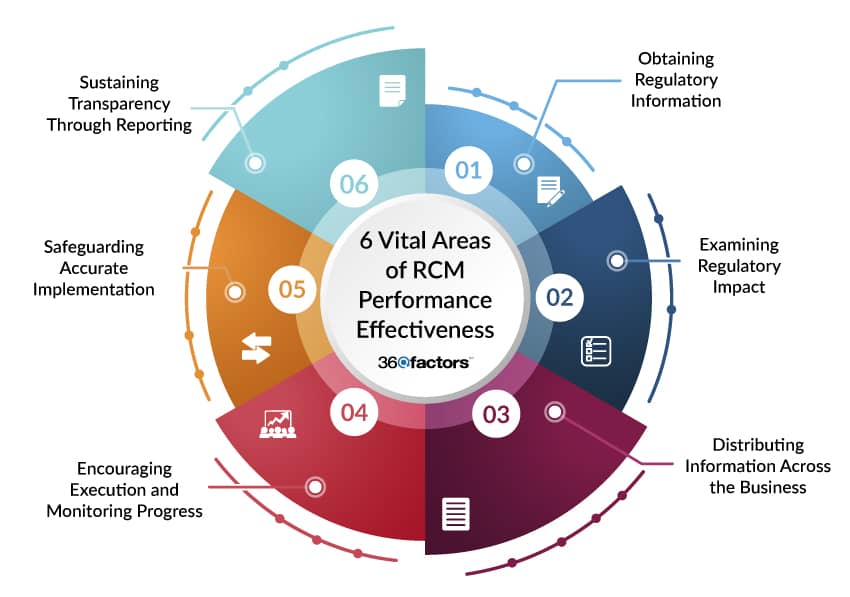

6 Vital Areas of Regulatory Change Management Performance Effectiveness

Managing the challenges of regulatory changes needs robust and successful RCM approaches. Effective strategies are paramount for lessening compliance risks and guaranteeing that an organization functions within the legal framework. Six key areas need precise attention and strategic management to optimize the successful regulatory change management process’s efficiency.

1- Obtaining Regulatory Information

Directing the copious amounts of regulatory information requires a precise and strategic approach. Organizations must establish trustworthy channels to gather legislative and regulatory improvements relevant to their operations. This involves selecting various sources, from industry groups to commercial regulatory providers, incorporating bank compliance software and online resources. The key is to ensure the accuracy and trustworthiness of the information while rationalizing the process to prevent issues and improve efficiency.

2- Examining Regulatory Impact

Once the regulatory content is obtained, the following fundamental step is to interpret its impact on the organization. This needs a profound realization of a successful regulatory change management process, the regulatory environment, and the ability to translate complex legislative documents into actionable insights. Compliance professionals are vital in this stage, providing detailed instructions on how regulatory changes impact different business units. Relevance and precision in analysis are paramount to prevent late execution and ensure the organization stays compliant.

3- Distributing Information Across the Organization

It is crucial to guarantee that the right people within the company know the regulatory changes and their implications. Employing tools like email distribution lists, internal webportals, and collaboration platforms can facilitate swift and broad communication. However, maintaining updated distribution lists and ensuring recipients understand their responsibilities is critical to the success of this stage.

4- Encouraging Execution and Monitoring Progress

The regulatory change management process does not limit the distribution of information. Continuous monitoring and dynamic support are necessary to execute regulatory changes successfully across the organization. The compliance department must actively support business units, provide guidance, and ensure responsibility throughout the implementation procedure.

5- Safeguarding Accurate Implementation

Authentication is vital to verify that regulatory changes have been executed correctly and are sustainable over time. This involves systematic audits and checks to confirm that the changes are established in the organization’s procedures and yield the regulatory changes desired results. Verification helps identify gaps in execution and provides an opportunity for timely adjustment, ensuring long-term compliance.

6- Sustaining Transparency Through Reporting

Transparent and comprehensive reporting is necessary to measure the efficacy of the regulatory change management process. Organizations must establish key metrics and performance indicators to monitor their compliance status and recognize areas for improvement. Regular reporting provides significant insights into the organization’s compliance health, allowing informed decision-making and constant improvement.

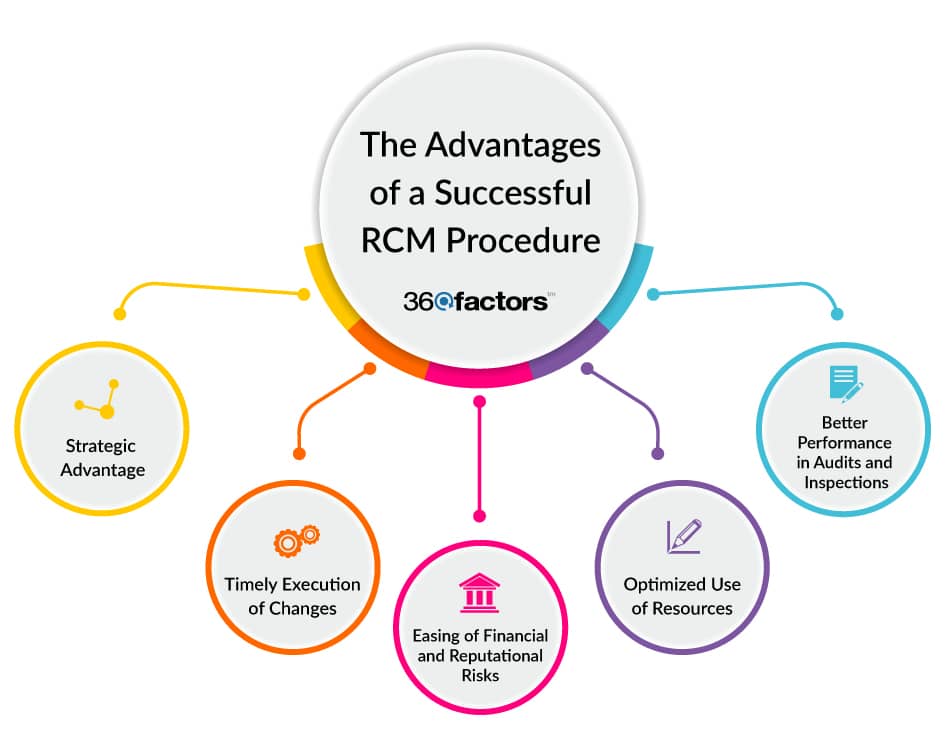

The Advantages of a Successful RCM Procedure

A well-structured and capably executed regulatory change management process is fundamental to the compliance function of any financial institution . It safeguards compliance with legal standards and positions the organization for success in the face of regulatory scrutiny. Here are the key advantages of a successful RCM procedure:

1- Improved Performance in Audits and Examinations

A robust regulatory change management process improves an organization’s performance in internal compliance audits and regulatory examinations. Safeguarding that all regulatory changes are detected, analyzed, and executed promptly demonstrates its devotion to compliance, lowering the risk of penalties and reputational damage.

2- Optimized Use of Resources

An effective RCM procedure inhibits the over-burdening of compliance staff with ineffective tools and rework. By restructuring the regulatory change management process, the organization guarantees its compliance professionals can focus on their core obligations, improving overall efficiency and effectiveness.

3- Mitigation of Financial and Reputational Risks

Non-compliance can result in severe financial penalties and long-lasting damage to an institution’s reputation. An effective RCM process alleviates these risks by ensuring all regulatory requirements are met, maintaining the organization’s financial stability and reputation in the market.

4- Timely Execution of Changes

Employing regulatory changes late in the regulatory cycle can improve costs and operational challenges. An effective regulatory change management process ensures that regulatory changes are implemented well before the deadline, reducing the financial burden on the organization, and providing a smooth transition to the new regulatory environment.

5- Strategic Advantage

Ahead of compliance, a successful RCM process provides a strategic advantage to the organization. It guarantees that the institution is always ahead of the curve concerning regulatory compliance, positioning it as a leader in the industry and enhancing its competitive edge.

Conclusion

Concluding our comprehensive discussion on the RCM, it is evident that a well-structured and efficient regulatory change management process is required for financial institutions planning to stay compliant and mitigate risks. However, the complexity of regulatory requirements and their ever-evolving nature demand a more innovative and proactive approach. This is where Predict360 Regulatory Change Management Platform steps in, presenting a transformative solution that enhances the overall performance of companies in managing regulatory changes.

- Streamlining Regulatory Updates and Activities

- Regulatory Intelligence and Impact Assessment

- Comprehensive Change Activity Management

Incorporating Predict360 Regulatory Change Management Software into your RCM process prepares your organization with the tools to direct the complex regulatory landscape. It enhances the regulatory change management process’s efficacy, ensures appropriate implementation of changes, and provides a strategic advantage in compliance management.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.