Home/ Blog / Generative AI in Banking and Financial Services: Navigating the Opportunities, Challenges and Risks

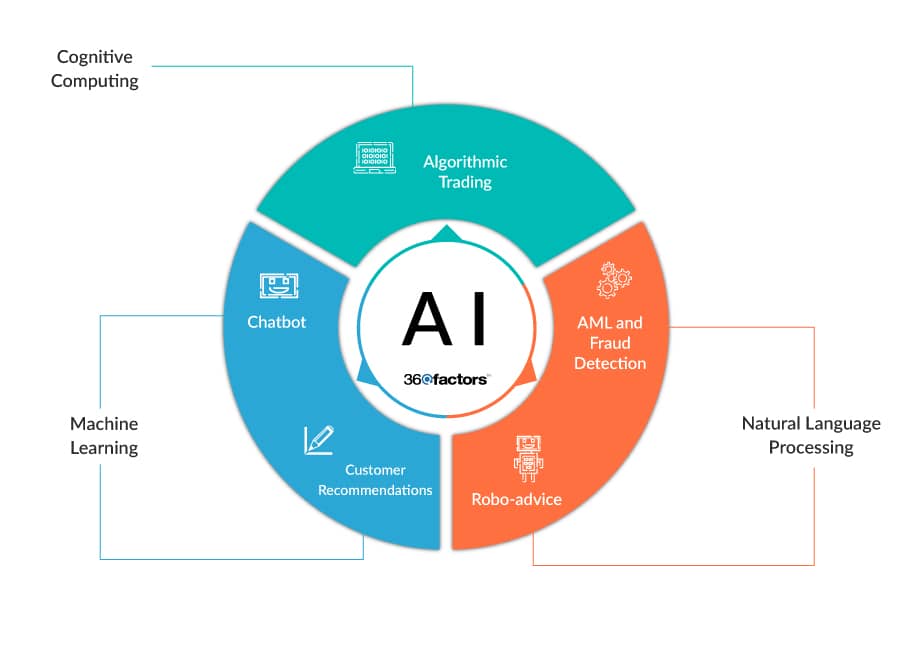

Generative Artificial Intelligence in banking has seen significant developments in recent years. The evolution of Generative AI in Financial Services is deeply rooted in advancements in deep learning, with neural networks taking center stage as the architectural backbone. The building blocks of this technology include large language models (LLM), natural language processing (NLP), and machine learning (ML).

With its ability to comprehend and generate human-like text and analyze enormous volumes of data, AI in the finance industry is a formidable force reshaping the financial sector. As the volume of data has grown beyond human processing capability in the banking and financial services industry, there is a need for advanced analytical tools that can be complemented through AI. The potential for such technology integration includes data analysis, product development, marketing, customer service, and reporting.

The year 2023 was a turning point as we witnessed a significant upswing in businesses adopting or investing in this technology. Notable examples include AI-driven chatbots providing personalized advice and support and integration of Generative AI with customer service, risk assessment, and compliance software. Industry giants like Morgan Stanley, Bloomberg, and Goldman Sachs, among others, are already looking into useful applications of Generative AI in their financial operations.

Generative AI in Financial Services offers an array of possibilities that could transform conventional practices. Opportunities range from improved decision-making and personalized services to innovative product development and marketing.

However, as with any technological leap, there are risks and challenges in adopting AI in banking, necessitating carefully exploring its application in the financial domain. Challenges include heightened competition, regulatory scrutiny, and cyber threats, which demand strategic navigation. Some of the risks encompass data privacy concerns, operational disruptions, potential exploitation, and the ever-looming threat of cyber-attacks.

What Are the Effects of the Growth of AI in Financial Services and Its Impact on Banks and Other Financial Institutions?

At its core, Generative AI refers to a class of algorithms that can generate new content, such as text, images, or other forms of data that closely resemble human-generated content.

Generative AI’s development resulted from progress in artificial intelligence and machine learning. Previous machine learning models were focused on simple tasks such as classification and regression, relying on extensive datasets to make predictions. However, Generative AI takes a leap beyond these capabilities, enabling systems to create novel, synthetic data points that share characteristics with the training data.

Recent developments of Generative AI in Banking have been influenced by advancements in deep learning, particularly due to neural networks. Techniques such as Generative Adversarial Networks (GANs), Variational Autoencoders (VAEs), and Transformers have been pivotal in achieving unprecedented levels of sophistication in content generation.

Major achievements of AI in the finance industry include fraud detection and prevention, automated document processing, customer service chatbots, risk assessment and control management, financial forecasting and prediction, regulatory change management and reporting, credit scoring, and predictive analytics.

Key Components and Techniques

At the heart of many Generative AI models lies the neural network architecture, a computational structure that is modeled on the human brain. Generative models leverage neural networks to learn complex patterns and relationships within the data, enabling them to generate novel outputs.

- GANs are a key component of AI in financial services. GANs engage in a continuous adversarial process by combining a generator and a discriminator. The generator creates synthetic data, and the discriminator evaluates its authenticity. This dynamic interplay happens millions of times within microseconds, refining and improving the generator’s ability to produce increasingly realistic outputs.

- VAEs focus on learning the probabilistic distribution of data. VAEs map input data into a latent space, allowing for the generation of new samples from this space. This technique facilitates the generation of diverse and high-quality outputs.

- Transformers were designed for natural language processing tasks but have gained prominence in Generative AI. Their attention mechanism allows models to focus on specific parts of the input data, enabling more coherent and context-aware content generation.

Impact of AI in Banking and Financial Services

Generative AI can be a powerful tool for helping financial institutions cope with increasing data volumes and the need for advanced analytics. It offers tremendous potential in product development, marketing, customer service, risk and compliance management, and reporting.

In essence, the relevance of Generative AI to banking and financial services lies in its ability to augment human capabilities, streamline operations, and foster a culture of innovation. However, this technological leap is not without its challenges, and there is still a long way to go before we utilize it to its full potential.

What is Causing the Rapid Adoption of Generative AI in Financial Services?

The development of AI in the finance industry has been discussed across boardrooms and financial markets, but 2023 was the year when it really took off, with banks and financial organizations becoming serious about investing in this technology.

Historical Context of Artificial Intelligence in Banking

In recent years, AI has been remarkably integrated into financial services. Historically, AI adoption in finance focused on rule-based systems for automating routine tasks, risk assessment, and fraud detection. However, the limitations of traditional rule-based approaches became evident as financial data grew in complexity and volume. This paved the way for machine learning, where algorithms could adapt and learn patterns from data, marking a significant shift in the industry’s approach.

Over the years, the financial sector witnessed the application of machine learning techniques such as regression models and neural networks, leading to advancements in predictive analytics and algorithmic trading. As Generative AI technologies matured, the financial industry saw a leap beyond predictive capabilities, venturing into the realm of content generation, creativity, and personalized customer interactions.

Current Landscape and Adoption Trend

The adoption of AI in banking is gaining momentum in the sector, driven by the need for more sophisticated solutions in a data-driven and dynamic environment. Financial institutions are integrating Generative AI into their operations to extract actionable insights from vast datasets, enabling more informed decision-making. The adoption trend extends across various facets of financial services, including wealth management, risk assessment, customer service, and compliance.

Notable applications include the development of AI-driven chatbots that engage customers in natural language, providing personalized recommendations and support. Additionally, Generative AI is playing a pivotal role in risk management, fraud prevention, and the creation of innovative financial products.

AI in Financial Services Use Cases

In the third quarter of 2023, Morgan Stanley launched a customer-facing virtual assistant to help clients quickly sift through thousands of documents. The chatbot was developed with support from OpenAI, the creators of ChatGPT. The bank is also working on enabling the virtual assistant to create a summary of the conversation with the visitor, draft and send a follow-up email to them, update the bank’s sales database, and schedule a follow-up appointment after getting the user’s permission.

Bloomberg was an early adopter and started developing its own Generative AI model, BloombergGPT, based on a large language model (LLM) and natural language processing (NLP) in early 2023. They created a large domain-specific dataset from the company’s existing financial data that had been collected and maintained over the span of forty years. Their model was trained on datasets with over 700 billion tokens, making it one of the most comprehensive open models of Generative AI in Banking that is focused on financial tasks.

CNBC reported in March 2023 that Goldman Sachs was experimenting with Generative AI to help its developers generate and test code in their operations. ChatGPT was their main AI tool, but the company also used Google’s Bard and Stable Diffusion for development.

In June 2023, Fortune magazine reported that hedge funds were using ChatGPT to do their mundane work – such as market research, basic code writing, and fund performance summaries – which was usually relegated to junior staffers.

What are the Opportunities, Challenges, and Risks of Generative AI in the Finance Industry?

Like all new technologies that can transform an industry, generative AI also comes with its set of the good, the bad, and the ugly. Some of the major implications for the financial sector include the following themes.

New Opportunities of Generative AI in Financial Services

Generative AI technology opens many new opportunities for the financial services industry, which could reshape conventional practices while introducing innovative solutions. For instance, AI in banking can help improve decision-making by providing insights from vast datasets. Financial analysts can use these AI-generated reports to understand trends, risks, and investment opportunities, empowering them to make profitable and risk-averse strategic decisions.

Generative AI can facilitate the development of personalized services to enhance customer experience. Chatbots and virtual assistants powered by Generative AI can engage and respond to customers in natural language, providing tailored financial advice and support. Financial institutions can also leverage Generative AI to enhance risk management practices. The technology aids in the identification of potential fraud patterns, offering a proactive approach to safeguarding financial assets.

AI in financial services opens the door to innovative financial product development and marketing. AI systems can propose and even design new financial instruments that align with evolving consumer needs by analyzing market trends and customer preferences. Generative AI tools can also quickly support marketing content crafting, from text-based content to visuals.

Major Challenges of Generative AI in Banking

The development of Generative AI also introduces new challenges for the financial sector, especially when it comes to increased competition and heightened regulatory scrutiny. As financial institutions adopt Generative AI technologies to gain a competitive edge, the entire financial industry is expected to undergo a shift in the competitive landscape. Institutions that successfully integrate and harness the power of Generative AI will outpace their competitors in innovation, customer service, and operational efficiency.

The growing reliance on Generative AI has not gone unnoticed. Regulators have started closer scrutiny on its deployment in financial services. Compliance with existing financial regulations is becoming critical, as institutions must ensure that AI applications adhere to legal standards. The biggest challenge facing financial institutions opting to use AI is their impact on Data Privacy and Information Security regulations, which have been a major point of concern for regulators. As AI technologies are evolving rapidly, financial institutions must proactively ensure regulatory compliance and avoid legal complications.

Risks of Implementing Generative AI in Financial Services

Generative AI is powerful, and like all great technology advancements, there are associated risks, particularly in the context of cybersecurity, which financial institutions must recognize and consider. Generative AI models are susceptible to adversarial attacks where malicious actors manipulate input data to deceive the AI system. This poses a significant risk in financial services, as attackers could exploit vulnerabilities to manipulate financial data or trick AI systems into making incorrect decisions.

The vast amounts of sensitive financial data processed by generative AI systems make them attractive targets for cybercriminals. Data breaches and unauthorized access pose serious threats to the security and privacy of customer information, requiring robust cybersecurity measures to safeguard against potential breaches. AI can remember and learn from sensitive information submitted by financial institutions, so it is vulnerable to sharing that information with unrelated parties.

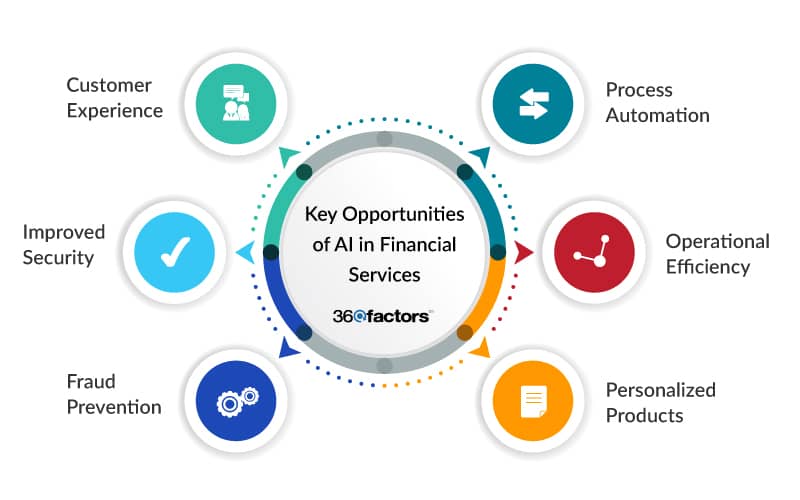

What are the Key Opportunities of Generative AI in Financial Services?

The integration of AI in banking offers several opportunities that go beyond traditional boundaries. The transformative impact is evident across various facets of financial operations, enhancing efficiency, customer experiences, and overall security measures.

Many organizations are looking to take advantage of these opportunities to employ AI in the finance industry. In 2023, KPMG conducted a survey of over 200 key executives and reported that 26% of organizations had already implemented at least one Generative AI solution in their operations or were looking to implement one within six months. A whopping 64% of financial service executives reported that their organization was prepared to allocate a budget to such projects.

Streamlining Processes through Automation

AI can significantly automate routine and mundane tasks while improving accuracy. Tedious and time-consuming processes, such as document review, data entry, and compliance checks, can be efficiently handled by AI systems, allowing financial institutions to redirect human resources toward more strategic and value-added activities.

Improving Operational Efficiency

Generative AI can optimize workflows, reduce processing times, enhance decision-making, and minimize errors, which saves costs and improves operational performance. Tasks like data analysis, report generation, and document processing are streamlined, contributing to an agile and responsive financial ecosystem.

Personalized Financial Products

Implementing AI in financial services enables businesses to offer personalized financial products and services tailored to individual customer needs. By analyzing customer data and preferences, AI systems can suggest tailored investment strategies, personalized savings plans, and customized loan options. This personalization not only enhances customer satisfaction but also fosters long-term loyalty.

Enhanced Interaction for Better Customer Experience

Integrating Generative AI in Banking can be crucial in reshaping customer interactions. Virtual assistants and chatbots powered by generative AI provide natural language interactions, assisting customers with inquiries, account information, and financial advice. This level of personalized engagement contributes to an improved overall customer experience.

Improving Security Measures

Generative AI can enhance security measures within financial institutions. AI systems can analyze vast datasets to identify unusual patterns and potential security breaches, improving threat detection.

According to the Cybersecurity and Infrastructure Security Agency (CISA), the technology facilitates the development of advanced cybersecurity measures, including better authentication and sensitive financial information safeguards, and CISA is already planning to integrate it into its cybersecurity models.

Identifying and Preventing Fraud

Generative AI can be a powerful tool in identifying and preventing fraudulent activities. AI systems can detect anomalies indicative of fraud attempts by analyzing transaction patterns, user behavior, and other relevant data.

What are the Challenges of Implementing Generative AI in Financial Services?

Financial institutions face multiple challenges as they implement Generative AI in their operations, and these challenges must be considered carefully to achieve sustained benefits in the long term. MIT outlined regulatory compliance, transparency of AI models, and data quality as some of the major challenges faced by the sector.

Compliance with Financial Regulations

Arguably, the biggest challenge for implementing Generative AI in banking lies in navigating the financial regulations. The financial sector operates under strict regulatory frameworks to safeguard consumer interests, prevent fraud, and maintain market integrity. Generative AI, as useful as it is, introduces new complexities related to data privacy, security, and adherence to regulatory standards. Financial institutions must align AI adoption with existing financial regulations to avoid legal complications and uphold industry compliance standards.

Integration with Financial Markets

The unpredictable nature of financial markets presents a formidable challenge for the integration of Generative AI. Financial institutions often deal with vast amounts of real-time market data, intricate trading algorithms, and diverse financial instruments. The challenge lies in developing Generative AI systems that can adapt to the complexity and volatility of financial markets, ensuring accurate predictions and effective decision-making in rapidly changing scenarios.

Issues of Bias and Fairness for AI in Banking

Generative AI is trained to produce results based on trends and hard facts, which could pose challenges related to bias and fairness. AI models, if not carefully designed and trained, can inherit biases present in historical data, leading to unfair treatment of marginalized groups and perpetuating existing disparities. Financial institutions must proactively address these issues to ensure that AI-driven decisions are fair, unbiased, and do not contribute to discriminatory practices.

Transparency in Decision-Making

The inherent complexity of Generative AI models often results in “black-box” decision-making, where the rationale behind specific output is not easily interpretable. Achieving transparency of outputs is crucial for the integration of AI in finance industry because financial institutions must explain their decisions based on AI process outputs to regulators, customers, or internal stakeholders. Striking a balance between the sophistication of AI models and the need for transparency is a key challenge to overcome in ensuring accountability and fostering trust.

Availability of Quality Data for AI in Financial Services

The effectiveness of Generative AI is dependent on the quality and availability of data. Financial institutions may encounter challenges related to data accuracy, completeness, and the availability of relevant datasets. Ensuring high-quality data inputs is essential to prevent AI-driven insights from being compromised by inaccuracies. Addressing data availability issues is crucial to avoid information gaps that could hinder the performance of Generative AI models.

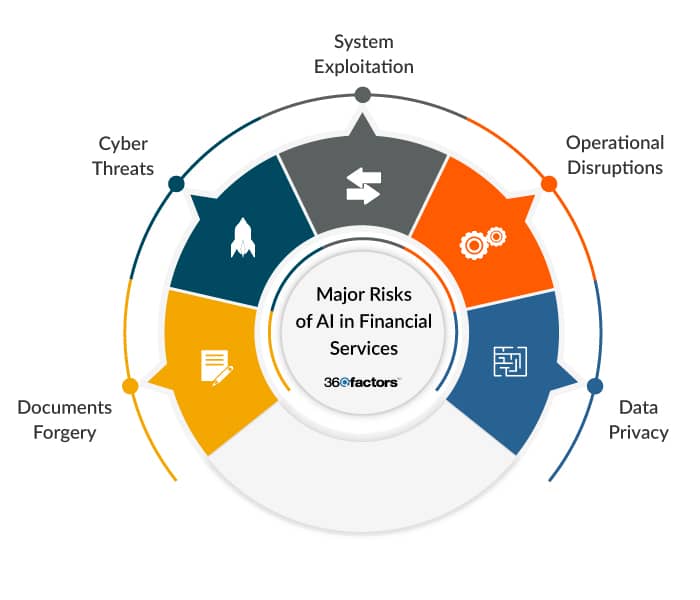

What are the Major Risks of Generative AI in Banking and Finance?

The implementation of AI offers benefits but also introduces new risks that demand careful consideration to safeguard the integrity and security of financial operations. In a recent publication, the IMF highlighted data privacy concerns, operational disruptions, and cyber threats as some of the chief risks posed by this new technology.

Data Privacy Concerns of Generative AI in Financial Services

Data privacy is the biggest concern when implementing Generative AI in the finance industry because it is dependent on collecting sensitive financial data to generate useful outputs. This dependency raises concerns about unauthorized access, data breaches, and the potential compromise of customer information. Financial institutions must employ robust encryption methods, access controls, and secure data handling practices to mitigate the risk of data breaches.

Operational Disruptions

Integrating Generative AI into critical operational processes introduces the risk of operational disruptions. System failures, technical glitches, or errors in AI algorithms and servers hosting AI models could disrupt regular banking activities, leading to financial or reputational losses and eroding customer trust. Ensuring the resilience and reliability of AI systems is crucial to mitigate the risk of operational disruptions.

Exploitation of AI Systems

The increasing sophistication of AI in Banking does not exempt it from exploitation by malicious actors. Adversarial attacks, where attackers manipulate input data to deceive AI systems, pose a significant risk. Financial institutions must implement robust security measures to detect and prevent potential exploitations, safeguarding the integrity of AI-driven processes.

Potential for Cyber Threats

The financial sector is a prime target for cyber threats, and integrating AI in financial services opens new doors of vulnerability. Cybercriminals may exploit AI systems to gain unauthorized access, manipulate financial data, or disrupt critical services. Financial institutions must stay vigilant, employing advanced cybersecurity measures to counter potential cyber threats and ensure the resilience of their AI infrastructure.

Document Forgery

Generative AI’s ability to generate realistic and sophisticated content extends to the risk of document forgery. Malicious actors can use AI to create counterfeit financial documents, leading to fraudulent activities and financial losses. Implementing robust document verification mechanisms and fraud detection systems is essential to mitigate the risk of document forgery.

How Do Generative AI Solutions Improve the Risk and Compliance Industry?

The implementation of Generative AI in Banking can revolutionize the risk and compliance landscape, offering a suite of transformative solutions that enhance efficiency, accuracy, and proactive risk management.

AI-Powered Query Assistance

The adoption of AI in Financial Services offers a remarkable shift in query assistance, especially regarding risk and compliance. By leveraging natural language processing capabilities, AI-powered systems enable users to pose complex queries and receive detailed, context-aware responses. This streamlines information retrieval and empowers professionals in risk and compliance to make informed decisions based on a nuanced understanding of the data at their disposal.

Dynamic Decision Support Systems

Generative AI’s dynamic decision-support systems empower risk and compliance professionals. These systems can continuously analyze vast datasets, providing real-time insights into emerging risks, regulatory changes, and market trends. This dynamic decision support enables agile and informed decision-making, allowing organizations to adapt swiftly to evolving risk landscapes.

Automated Compliance Monitoring & Reporting

AI integration in the finance industry can automate labor-intensive compliance monitoring and reporting processes. By continuously scanning regulatory changes and analyzing vast datasets for compliance violations, AI-powered systems ensure that financial institutions stay ahead of regulatory requirements. Automation in compliance reporting reduces manual errors and enhances the speed and accuracy of regulatory submissions.

Proactive IT Risk Detection

Generative AI can contribute to proactive IT risk detection by assisting IT risk officers in analyzing trends in network activity, identifying anomalies, and predicting potential security breaches. Through machine learning algorithms, AI-powered solutions can detect patterns indicative of cybersecurity threats, allowing organizations to address vulnerabilities before they become major risks.

Efficient Data Analysis and Insights Extraction

Another benefit of AI in banking and finance is accelerating data analysis for risk and compliance functions. AI systems can efficiently process large volumes of structured and unstructured data, such as,

- Identifying the impact of new regulatory changes

- Extracting valuable insights that aid in risk and control assessment

This efficiency enables organizations to sift through vast datasets rapidly, uncovering hidden patterns and potential risk factors.

Enhanced Risk and Control Selection

Generative AI in financial services empowers organizations to quickly analyze, select, and set effective risk controls within their risk management environments. Generative AI can quickly process massive risk and control libraries to find and highlight the ones relevant to a particular organization. This ensures a more effective risk management strategy that aligns with financial institutions’ specific needs and challenges.

Conclusion

The rapid evolution of Generative AI in banking promises continued advancements that will redefine how the industry approaches risk mitigation and regulatory compliance. Continued improvements in natural language processing, deeper contextual understanding, and enhanced decision-making capabilities will transform the sector.

Compliance will also evolve with regulators keeping a close eye on how businesses integrate Generative AI in Financial Services. Integrating AI in risk and compliance will see increased emphasis on transparency and ethical considerations. Staying on top of these trends will be crucial for organizations seeking to maintain a competitive edge in the dynamic financial landscape.

Financial institutions are at a crossroads. Many are ready to leverage the power of AI in the finance industry for more robust risk management and regulatory compliance. It will be important to embrace innovation and foster a culture of adaptability. Organizations must be open to exploring, experimenting, and collaborating with cutting-edge technologies because going down this path will ensure they are prepared for the challenges and opportunities.

The year 2023 has shown that the future is Generative AI. With a proactive approach, financial institutions can not only navigate uncertainties but also lead in shaping the next era of risk and compliance practices.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.