Home/ Blog / Regulatory Harmony in 2024: Shaping the Future of Insurance Sector Compliance

The insurance industry saw transformative shifts in 2023, laying the ground work for a future where resilience and adaptability are imperative. This trend will continue in 2024 as insurance businesses prepare to safeguard individuals and businesses from unforeseen risks. While the sector embraces innovation and grapples with unprecedented challenges, maintaining regulatory harmony is also critical for sustaining the trust of policyholders and stakeholders alike.

InsurTech and environmental, social, and governance (ESG) considerations had a major impact on insurance. These factors, coupled with the evolving regulatory landscape, underscore the need for insurers to be not just reactive but anticipatory in their approach to compliance. Insurance businesses must strike a delicate balance between innovation and regulation. The multifaceted demands on insurers are not just restricted to traditional risk management and financial stability but also encompass ethical considerations, data privacy, and responsible technology deployment.

In this blog, we explore the key regulatory challenges and opportunities that lie ahead for the insurance sector in 2024 and examine how insurers can shape their compliance strategies to not only meet but exceed regulatory expectations in an era of unprecedented change.

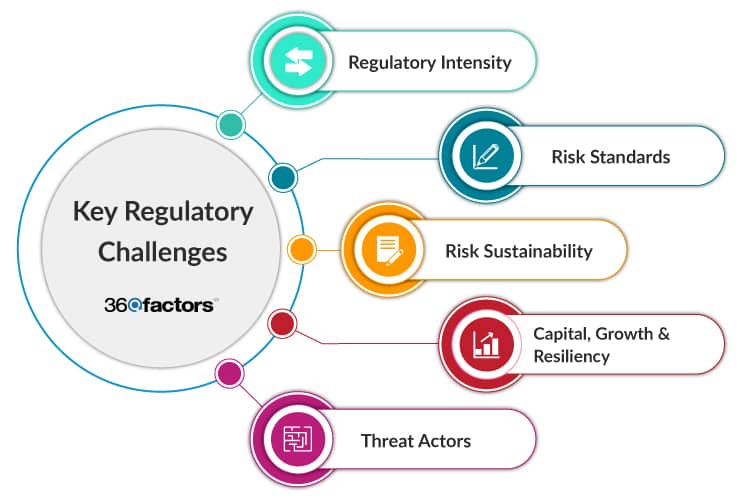

Key Regulatory Challenges Expected for Insurers in 2024

According to industry experts, the year 2024 presents a number of regulatory challenges that demand the attention and strategic foresight of industry stakeholders. Understanding and navigating this landscape is essential for insurers seeking to not only comply with evolving standards but also to proactively shape their operations in alignment with broader industry objectives.

Let’s delve deeper into the key regulatory challenges anticipated in the insurance sector for the year ahead.

Regulatory Intensity

This intensified regulatory focus demands insurance providers to meticulously assess or reassess their current and targeted operations, risk management policies, governance structures, and the robustness of their data and systems infrastructure.

Regulators will be poised to initiate more stringent evaluations, potentially leading to ratings downgrades or supervisory and enforcement actions. Immediate action is crucial, necessitating rapid assessments, allocation of resources, and sustained processes, with a clear emphasis on executive accountability to address potential weaknesses promptly.

Regulators will demand that risk management and governance processes are adequately resourced. Deficiencies in risk management and compliance may be viewed as indicators of insufficient investment and resourcing, elevating both operational and intangible risks.

Risk Standards

In 2024, supervisory and enforcement levels will shift up, requiring insurance firms, regardless of size, to demonstrate and sustain heightened standards across various aspects of their operations. These include the following.

- Governance

- Risk Management

- Internal Controls

- Compliance

- Treasury

- Liquidity

- Interest Rate Risks

- Risk Assessments

- Model Risk Management

- Enterprise Data Management

- Digitalization

- Cybersecurity

The focus extends across all three lines of defense, mirroring the OCC Heightened Standards and FRB Enhanced Prudential Standards. Supervisory intensity and enforcement actions will center on firms’ responsiveness to and mitigation of risk and compliance shocks, as well as risk accountability and governance.

Insurers should demonstrate and sustain heightened risk standards by strengthening risk assessment methodologies, reviewing control testing coverage, clarifying the board’s role in compliance, and appropriately positioning, scaling, and rewarding risk management and compliance.

Risk Sustainability

To sustain risk management, insurers must establish a credible firm culture and values. Regulators will increasingly scrutinize whether insurers reward compliant behaviors and accountability while deterring misconduct within their workforce. Insurers must demonstrate a sound approach to assessing and monitoring risk culture, ensuring it aligns with regulatory expectations.

Insurers will need to provide evidence of sustainable processes and effective risk coverage. This includes developing metric-driven capacity models to determine resources needed during periods of cost containment, growth, or changes in business.

Regulators will expect insurers to conduct adequate and robust analyses of complaints, disputes, and claims information for systemic issues. Insurers must demonstrate actions taken based on risk assessments, modifying products/services, enhancing process controls, and clarifying product terms or disclosures.

Capital, Growth & Resiliency

Regulatory actions for 2024 are expected to involve anticipating and adapting to changes in long-term debt requirements, acquisition and merger reviews, and heightened expectations for the resilience of third-party critical activities. A notable development involves an interagency proposal by the Federal Reserve (FRB), Federal Deposit Insurance Corporation (FDIC), and the Office of the Comptroller of the Currency (OCC) to impose long-term debt requirements on certain financial institutions with assets exceeding $100 billion.

Regulators are evolving expectations for third parties providing critical activities to financial services firms, such as cloud services and IT support. There is a growing emphasis on resilient risk standards and testing tools, including cyber resilience. Insurance companies must proactively assess the resilience of their critical third-party relationships and implement robust risk management measures to fortify their operational and technological foundations.

Threat Actors

Regulators, acknowledging the gravity of cyber and criminal threats, are intensifying their scrutiny of insurance firms’ defenses against a spectrum of financial crimes, including terrorist financing, money laundering, cybercrime, fraud, and compliance violations. Regulators will demand robust capabilities to trace and report on data at both the customer and transaction levels. This includes demonstrating traceability across business processes, systems of record, and systems of origin, ensuring transparency and accountability in data handling.

Similarly, regulators are focusing on evaluating fraud management and controls related to existing and new products, services, customers, and geographic operations. This encompasses protecting consumers and insurers from fraud, identity theft, and other scams.

How Can Insurers Shape Compliance Strategy

Insurers can do a lot to implement industry best practices and meet regulatory compliance while embracing technology for better, more innovative products and services. Some of these strategies include the following:

Embracing Technological Advancements

Insurers should embrace advanced technologies such as AI and ML for enhanced risk monitoring, fraud detection, and compliance automation. They should also invest in Insurtech solutions to streamline compliance processes, ensuring efficient data management and reporting.

Fostering a Compliance Culture

Regulatory compliance can be achieved by incorporating a culture of compliance throughout the organization, emphasizing ethical behavior, regulatory adherence, and individual responsibility among employees. Insurers should provide ongoing training and run awareness programs to keep employees abreast of evolving regulations, fostering a proactive compliance mindset.

Strengthening Data Governance

Robust data governance practices ensure the accuracy, integrity, and security of data, aligning with privacy and confidentiality regulations. Insurers must adopt advanced analytics and data analytics tools for in-depth insights into compliance-related data, facilitating better decision-making.

Emphasizing Product Compliance

Insurance products must be regularly assessed and updated to meet changing regulatory requirements. Integrating compliance checks into the product development process ensures that new offerings adhere to prevailing regulations.

Engaging with Regulators

Active engagement with regulators keeps insurance firms informed about upcoming changes. They may also contribute to the policy-making process by influencing regulatory discussions and shaping the regulations that correspond to industry needs.

Continuous Monitoring

Insurers must establish a robust internal audit function to run regular compliance assessments. They may utilize data analytics tools for continuous monitoring of compliance metrics, promptly identifying and addressing any deviations from established compliance standards.

Leveraging Regulatory Technology

Regulatory Technology (RegTech) solutions are highly effective in catering to the insurance industry’s compliance needs. Insurers may integrate RegTech tools to automate compliance workflows, ensuring accuracy, efficiency, and real-time monitoring.

Conclusion

The era of reacting to regulatory changes or sticking to old, legacy compliance systems is gone. The foundation of a modern, robust compliance management framework lies in proactively monitoring regulations, embracing technological innovations, and fostering a culture of customer-centric approach.

Secure data governance and compliance with privacy regulations, while focusing on safeguarding customer information, stand as pillars of responsibility. Advanced risk management strategies, including real-time risk analysis and integrated frameworks for gathering regulatory data, empower insurers to anticipate challenges and fortify their resilience against unforeseen disruptions.

Predict360 Risk and Compliance Management Software can be a valuable resource in achieving these goals. Through its innovative features, the Predict360 Platform offers real-time regulatory intelligence, enabling insurers to stay ahead of evolving compliance requirements.

The platform’s robust risk management capabilities assist insurers in identifying, assessing, and mitigating risks effectively. Predict360’s integrated solutions for data governance, risk and control assessment, regulatory change management, and regulatory reporting contribute to the seamless execution of compliance obligations. Furthermore, the platform facilitates the implementation of best practices in employee training, document management, and issues and complaints tracking, promoting a compliance-centric mindset across the organization.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.