Home/ Blog / How to streamline Regulatory Change Management?

The Compendium of Evidence on the Effectiveness of Innovation Policy Intervention Project in the stewardship of Manchester Institute of Innovation Research (MIoIR), University of Manchester has revealed some interesting facts about Regulatory Change Management. There have always been mixed opinions about the importance of regulations in the industries and people are unable to come to a consensus. In order to get some clarity and ascertain the impact of regulations on organizations, an endogenous growth approach, developed by Carlin and Soskice in 2006 was employed. This approach allows for the comparison of the negative effect of compliance costs with the dynamic effect of regulations generating additional incentives for innovative activities.

Regulations and Innovation

The crux of the new approach lies in the empirical methodology that it employs. Empirical analyses, which were already known, were surveyed by employing a variety of methodological approaches, databases, and results. Through the analysis, the short term and long term impact of regulations have been revealed. The investigation has divulged that short term impacts of regulations are often negative for innovation. However, rules and regulations more than make up for their initial failings by serving as great assets in the long run. There is an added incentive of spillover benefits, which help in enhancing an organization’s structure and also drive the uptake of innovation.

Most quantitative studies done by using the empirical methodology haven’t been able to distinguish between the influences of changes in the creation of rules, their implication, and the resultant compliance of the companies. However, it has been found that the innovative culture when inculcated in the operations of regulatory bodies promotes the positive innovative impact of regulations.

Through the studies, the following proposals for more innovation-friendly and innovative targeting regulatory policy can be deduced:

- Optimize the frequency and timing of reviewing existing regulations.

- Strengthen the focus on innovation while creating regulatory policy.

- Enhance the quality of the regulatory framework that is directed at innovation.

Regulations and Economics

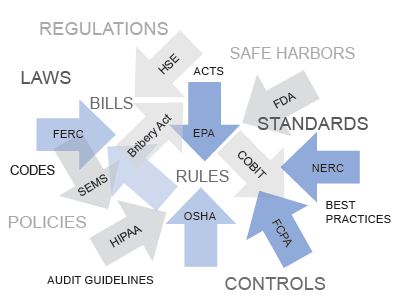

The definition of regulations by OECD in 1997 states that regulation is the implementation of rules by public authorities and governmental bodies in order to influence market activity and the behavior of private actors in the economy.

In order to structure the argument for economic regulations, we distinguish between the different subcategories:

Regulation of Competition

The policies that are devised with the purpose of enhancing competition increase the incentives for companies to invest in innovative activities. When the competition is within a certain limit, it can have a positive effect; however, when it becomes uncontained, and imitation becomes a better option than innovation due to its lower costs, it can have a negative effect.

Market Entry Regulations

The regulations created for keeping a check on the entry of new businesses are very important to prevent the integrity of the industry. It is best to thwart the efforts of the inefficient entrepreneur who can do more harm to the industry than any good to its reputation. These regulations also work in favor of the already established businesses that prefer a lower level of competition and want to restrict the entry of new businessmen. However, this approach lowers the competition and diminishes the innovative performance in the market. Through an analysis, it was discovered that incumbents’ growth and patenting is positively linked with the lagged foreign firm entry. But this is only valid in technologically advanced industries. It is still required for backward industries to promote the growth of new entrants to leverage innovation via competition.

Use of Artificial Intelligence (AI) for Handling Regulatory Change Management

From the aforementioned analysis, we can clearly see that it is hard to figure out a standard approach for regulatory management that is beneficial to all. Using rudimentary tools and methods for governance, risk and compliance (GRC) do not hold any value in today’s dynamic industrial landscape. It is best to utilize an AI-powered solution that can learn trends and predicts patterns and ultimately helps you in making critical decisions that are innovative and economically viable at the same time.

In order to streamline Regulatory Change Management System, you can procure Predict360’s Regulatory Change Management Software. It is licensable as a standalone web-based application and can also be procured as part of an integrated regulatory change management and learning management solution.

For more information about Regulatory Change Management Software and how it can be further enhanced as part of an integrated risk and compliance management suite, visit //www.360factors.com/regulatory-change-management-software/.

About the company

360factors, Inc. (Austin, TX) helps companies improve business performance by reducing risk and ensuring compliance. Predict360, its flagship software product, vertically integrates regulations and requirements, policies and procedures management, risks and controls, audit management and inspections, and on-line training and qualifications, in a single cloud-based platform based on artificial intelligence.

Remain up-to-date on industry news/updates through our Twitter & Linkedin profiles.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.