The Challenge

Dispersed data creates blind spots and inefficient capital use

Collateral data often resides in separate loan systems—commercial, mortgage, and consumer—making it difficult to assess how assets are pledged and whether they provide appropriate loan coverage.

This lack of visibility can lead to:

- Duplicate pledging of assets like real estate, vehicles, or equipment across multiple loans

- Over-collateralization resulting from outdated asset valuations or unclear guidelines

- Under-collateralization that increases the risk of regulatory non-compliance or financial loss

- Ineffective capital allocation due to uncertainty about asset use and availability

The Solution

A unified dashboard that delivers accurate collateral intelligence

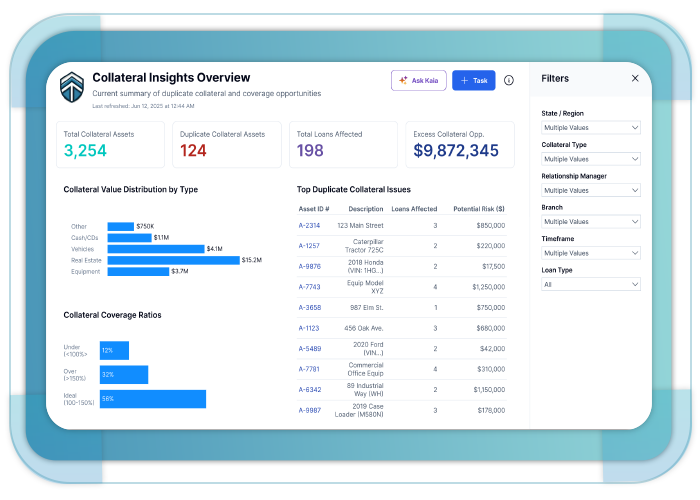

The Collateral Insights Dashboard, built in Power BI, aggregates data across systems to provide a clear and interactive view of your institution’s collateral profile. Tailored for credit, risk, and relationship management, the dashboard enables your team to:

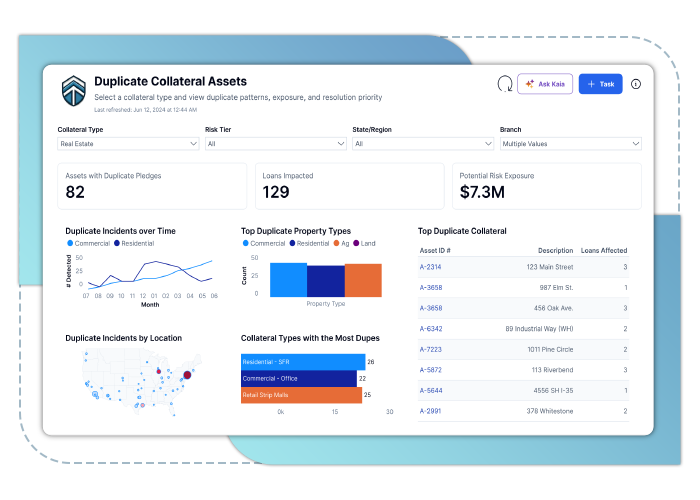

- Identify duplicate collateral across loan portfolios

- Highlight collateral surpluses that may be released

- Track coverage ratios to ensure regulatory and internal thresholds are met

- Drill down by region, asset type, borrower segment, and other key filters

It also integrates with AI tools and task managers so your team can take immediate, informed action.

How It Works

Transform unstructured data into actionable decisions

1. Integrate your loan systems

Pull data from various loan origination systems into a centralized data warehouse.

2. Run duplication checks

Machine learning algorithms automatically identify assets pledged to multiple loans.

3. Display actionable metrics

Visual dashboards reveal patterns of overuse, underuse, and potential release value.

4. Initiate next steps directly

Use built-in options like “Create Task” or “Ask AI” to trigger follow-ups without leaving the platform.

5. Maintain real-time accuracy

As updates are made, the dashboard refreshes KPIs and visualizations automatically, keeping everyone aligned.

Connect with an ExpertWhy Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist