Predict360: The Risk and Compliance Solution Exclusively Recommended by FIS

360factors and FIS have a strategic marketing partnership where 360factors and FIS market each other’s risk and compliance products and services, with FIS exclusively recommending 360factors’ Predict360 risk and compliance intelligence platform and 360factors marketing FIS’ Regulatory University to existing and future customers.

More information on these solutions and the value to banks and financial services institutions are described in the following sections.

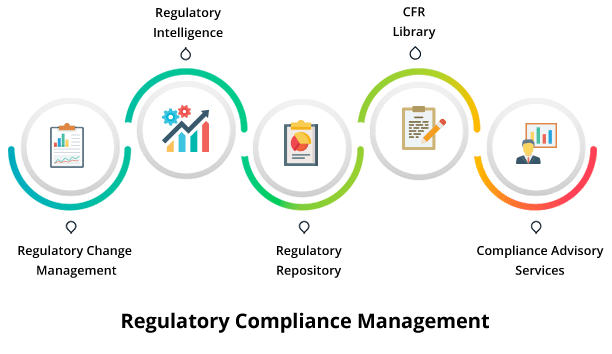

Predict360 Regulatory Compliance Management

Predict360’s Compliance Management applications enables organizations to collect, store, track and collaborate on all compliance-related activities and regulatory reporting requirements, including compliance monitoring & testing (QA/QC), compliance program reviews, regulatory examinations & findings, regulatory changes, remediation plans & corrective actions, internal & external complaints, hotline reporting, case management and investigations, training plans, document change requests, sanctions and many other types of compliance-related tasks. As such, the system provides a single system of record and a common calendar for all compliance-related activities.

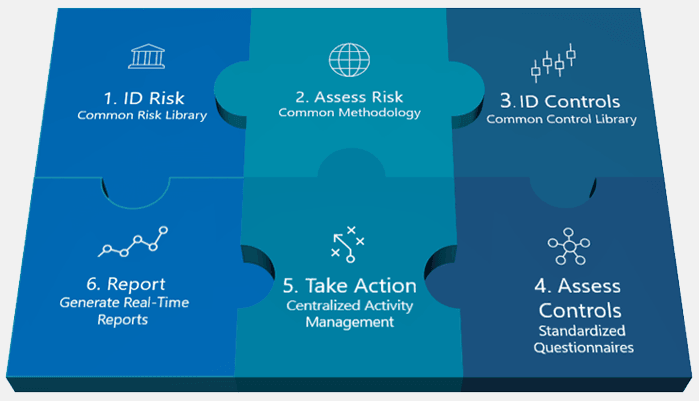

Predict360 Risk Management and Assessments (ERM/RCSA)

Predict360’s Risk Management and Assessment application enables organizations to manage risks using proven enterprise risk management techniques such as Risk Control Self-Assessments (RCSA) to capture inherent and residual risk ratings and controls as well as additional details including risk owners, risk type, management comments, monetary impact and more. Individual risks can also be linked with their associated regulations and/or business obligation as well.

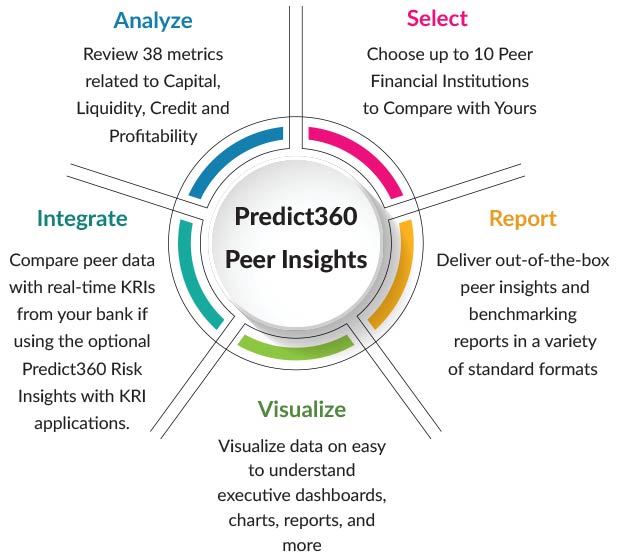

Predict360 Peer Insights

Predict360 Peer Insights integrates Reports of Condition and Income (Call Reports) and Uniform Bank Performance Reports (UBPRs) data from FFIEC’s central data repository with the integrated business intelligence report and dashboard engine of Predict360. Banks can now specify who their peer banks are within Predict360 and have full control over viewing their performance relative to their specified peers. Learn More

Predict360 Peer Insights provides your organization with a comparison of your performance against your actual peers, and when integrated with the KRI Engine of the Predict360 Risk Insights application, can provide a view of your current performance against your peers in real-time instead of a 3-month delay, enabling your executive team to make decisions based on actual data metrics while take action quicker and with more confidence.

FIS Regulatory University Training Classes

360factors recommends FIS Regulatory University – a learning management system (LMS) with over 300 courses of these courses can pre-loaded into the Predict360 Training Management application and delivered as part of the Predict360 Learning Management System (LMS).

FIS Regulatory University is the financial services industry’s most comprehensive, authoritative, cost-effective, Web-based regulatory training solution with a library of more than 300 courses covering safety and soundness, consumer protection laws and regulations, high and emerging risk issues, products and services, and other topics of relevance to banks and financial services institutions.

In addition to having the greatest variety of courses, Regulatory University also offers content that is continually refreshed with new compliance information, cases and exercises. Users also have the ability to customize their institution’s compliance training program by developing or editing their own content.

Learn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist