Empowering Insurers with Smarter Governance and Data-Driven Decisions

Insurance organizations operate in a highly regulated environment, balancing compliance with growth, profitability, and customer trust. The industry faces evolving state and federal mandates, rising operational complexity, and data silos across underwriting, claims, and distribution. There is a need for intelligent, connected solutions that improve workflows.

360factors’ intelligent platforms, Predict360 and Lumify360, enable insurers to modernize governance, streamline compliance workflows, and gain deeper insight into risk and performance.

With 360factors solutions, insurance leaders can move from reactive compliance management to proactive performance optimization:

- Maintain Continuous Compliance: Automate regulatory monitoring, manage testing and reporting, and stay ahead of NAIC, state DOI, and federal expectations through Predict360.

- Unify Data and Performance Insight: Connect financial, operational, and risk data across business lines with Lumify360’s dynamic dashboards.

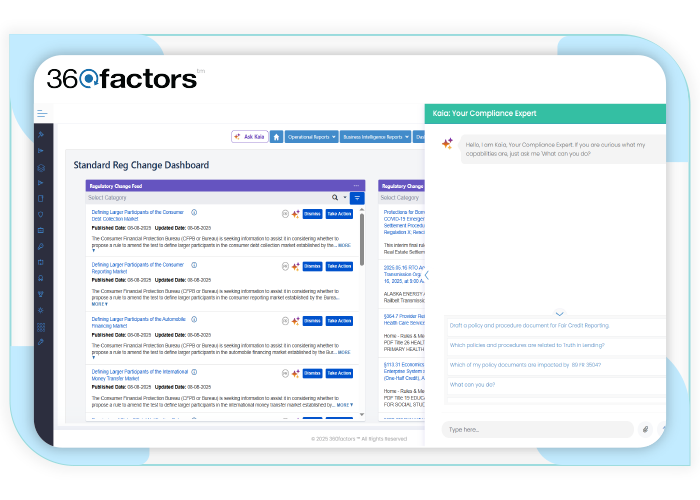

Empower Compliance and Risk Teams with AI Intelligence: Predict360’s AI Companion Kaia enhances risk and control identification and saves hours of regulation review time by leveraging regulatory expertise, AI-driven insights, and best practices for Insurance organizations.

Request a Custom Demo

Industry Challenges for Insurers

The insurance industry faces growing scrutiny from regulators, policyholders, and investors, all while managing increasing risks from global healthcare and environmental events, cyber threats, and third-party dependencies. Manual oversight and fragmented data make it difficult to ensure compliance and make timely, data-backed decisions.

Common challenges include:

- Frequent updates from state Departments of Insurance and the NAIC requiring continuous monitoring and interpretation.

- Disconnected systems for underwriting, claims, risk, and compliance that limit enterprise visibility.

- The need for consistent documentation, evidence, and reporting to meet regulator and auditor expectations.

- Expanding use of AI and third-party models that increase governance and transparency requirements.

- Pressure to manage emerging risks, including cybersecurity, climate, and conduct risk, with limited compliance resources.

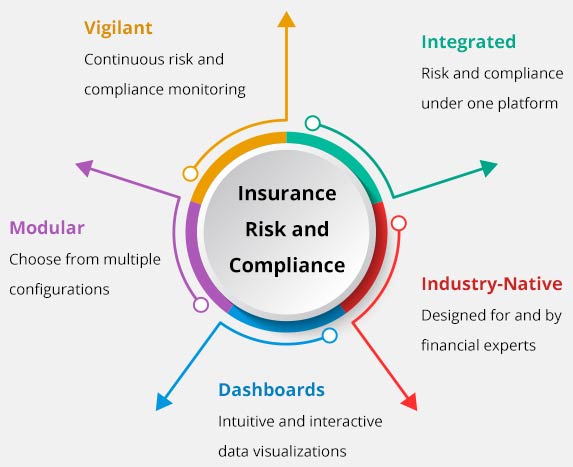

Intelligent Risk and Compliance Management for Insurers with Predict360

Predict360 helps insurance organizations achieve compliance confidence, operational efficiency, and regulatory readiness through intelligent automation, centralized oversight, and AI-assisted decision-making. With the embedded AI Kaia, Predict360 allows compliance and risk professionals to access contextual regulatory insight, guidance summaries, and workflow support all within the platform.

With Predict360, insurers can:

- Automate regulatory monitoring, compliance testing, and reporting. Kaia can summarize NAIC laws, DOI bulletins, and emerging regulations to improve compliance workflows.

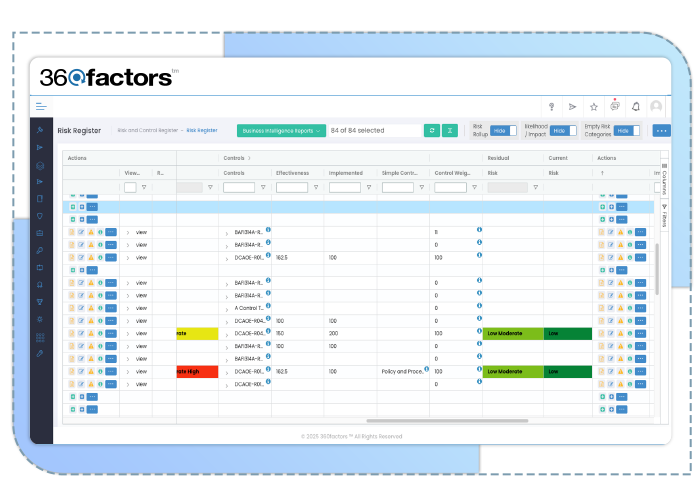

- Centralize risk assessments, control testing, and findings management to streamline insurance operations.

- Stay aligned with evolving state and federal insurance regulations, as Kaia provides plain-language explanations of how regulatory changes may affect compliance obligations.

- Manage policies, audits, and corrective actions in one platform for faster, more consistent documentation.

- Generate regulator-ready reports and dashboards, with Kaia assisting in validating evidence and summarizing compliance status.

Lumify360 Data Insights and Performance Management for Insurers

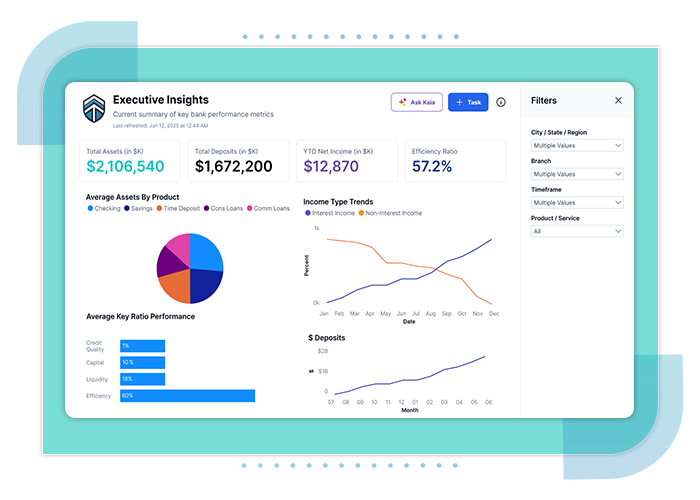

In insurance, data drives every aspect of operations, from underwriting to claims and customer retention. Lumify360 transforms fragmented data into unified, actionable insights that help insurers monitor performance, manage risk exposure, and enhance profitability.

What insurers gain with Lumify360:

- Consolidate KPIs and KRIs from underwriting, claims, and compliance into unified dashboards.

- Gain real-time visibility into loss ratios, claims turnaround times, and control performance.

- Use AI-powered forecasting to predict operational and financial outcomes, including risk exposure.

- Empower decision-makers with easy-to-understand visualizations — no data scientist required.

- Integrate seamlessly with Predict360, Power BI, and existing systems to create a single source of performance truth.

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist