Implementation within 30 Days

Customer Satisfaction

Faster Risk Resolution

Key Differentiators

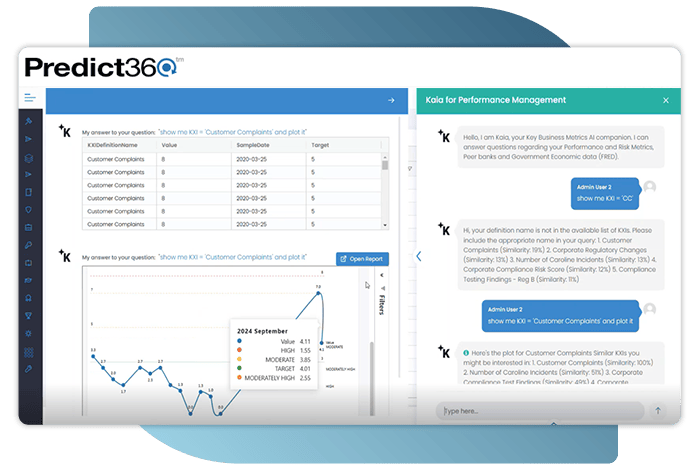

- AI-Driven Intelligence: Leverage Ask Kaia, Predict360’s generative AI companion, to instantly interpret new regulations, draft policies, and identify emerging risks.

- Unified GRC Platform: Manage all governance, risk, and compliance activities within a single system—eliminating silos and redundant tools.

- Fast, Scalable, and Cost-Effective: Multi-tenant SaaS architecture enables quick deployment and minimal IT requirements.

- Built-In Analytics: Embedded Power BI dashboards deliver real-time visibility into risks, controls, and compliance performance.

- Ease of Use: Intuitive design and expert implementation support ensure smooth onboarding and rapid adoption.

Typical Challenges Predict360 Solves

Risk Management Simplified

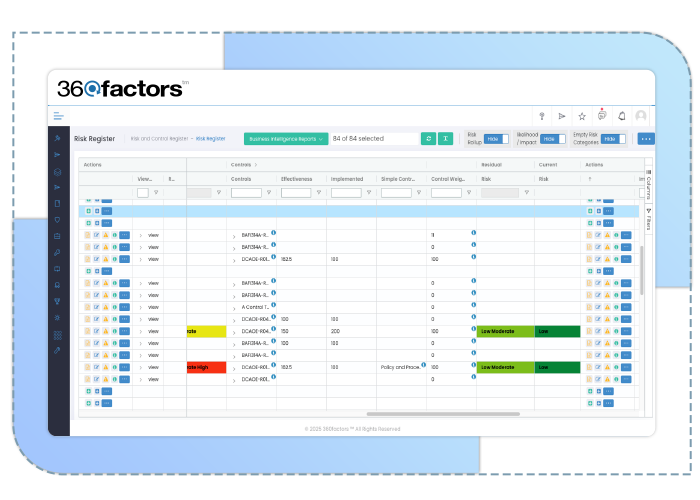

Predict360 centralizes every aspect of enterprise and operational risk management:

- Identify and track inherent and residual risks

- Evaluate controls and measure effectiveness

- Define and monitor risk appetite and tolerance metrics

- Conduct RCSAs and risk reviews

- Monitor risks in real time with automated alerts

- Apply AI-powered predictive analytics to identify emerging threats early

Result: Eliminate redundant systems, strengthen oversight, and make faster, data-driven decisions.

Compliance Management Made Easy

Replace manual processes and spreadsheets with one integrated compliance platform. Predict360 automates:

- Compliance testing, monitoring, and QA/QC

- Regulatory change management and risk assessments

- Examination management, remediation, and corrective actions

- Complaint and hotline tracking

- Task scheduling and progress tracking via the built-in compliance calendar

Result: Simplify audits, reduce compliance workload, and ensure continuous regulatory readiness.

Business Impact

Predict360 helps financial institutions streamline operations, stay audit-ready, and make smarter, faster decisions with AI-powered predictive insights. By transforming risk and compliance from reactive processes into proactive intelligence, Predict360 enables your organization to work smarter, respond faster, and grow stronger.

- Value Generation – Transforms risk and compliance from cost centers into value-generating parts

- Accelerated Profitability – Empowers organizations to accelerate profitability and innovation

- Enhanced Decision-Making – Improved decision-making through predictive analyticshowdy

Learn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

I have loved using Predict360 for the last few years. We implemented the following models: Complaint Management, Compliance monitoring and testing, Issue Management, and RCSA.

Jennifer G. Director of Compliance Testing

360factors as an organization as it comes to helping with questions, providing professional services support, listening to feedback on the Predict360 software, and implementing changes or enhancements. The Predict360 is a pretty easy software to understand and interact with from an end user perspective.

Conrad S. ERM Director

Cloud-based SaaS platform, offering multiple modules for risk and compliance in one platform, AI-powered, affordable, easy to use, endorsed by American Bankers Association (ABA).

A Predict360 User Director Risk and Compliance

Predict360 is a beneficial GRC software, and it is helpful to mitigate risk and provide on-time regulatory updates. The software runs smoothly, and the customer support is fantastic. And most important is that it has been endorsed by American Bankers Association (ABA).

A Predict360 User Head of Risk and Compliance Management

The Predict360 team is responsive and knowledgeable. They are easy to work with and value suggestions and feedback.The availability of ABA and community-based risk and control libraries helps identify any missing risks or controls in our risk assessments. The ease of choosing which solutions work best for our institution and customizing those to fit our needs…

Heather D. Enterprise Risk Manager