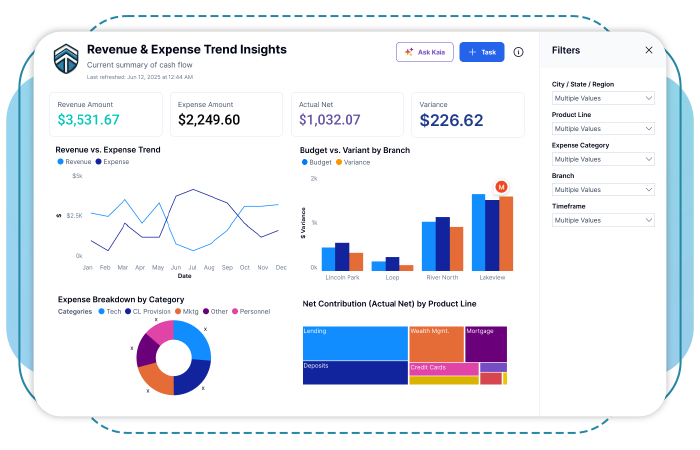

A Unified View of Revenue and Expense Trends

Finance executives and branch managers need accurate visibility into revenue and expenses to keep performance on track. Yet traditional reporting often comes from multiple sources, making it difficult to align budgets, monitor costs, and understand profitability by product line.

Revenue & Expense Trend Insights consolidates this data into a single, easy-to-read dashboard—delivering clarity across branches, categories, and product lines.

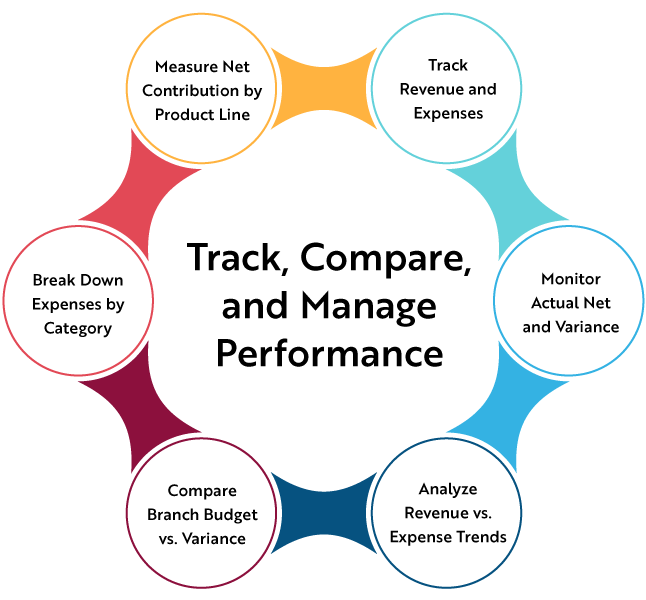

Track, Compare, and Manage Performance

With Revenue & Expense Trend Insights, you can:

- Track Revenue and Expenses – monitor amounts in real time for greater financial control

- Monitor Actual Net and Variance – measure profitability and identify gaps against budget

- Analyze Revenue vs. Expense Trends – spot patterns across months and forecast with confidence

- Compare Branch Budget vs. Variance – evaluate performance across locations with clear visualizations

- Break Down Expenses by Category – see where dollars are going across technology, marketing, personnel, and more

- Measure Net Contribution by Product Line – understand profitability across lending, deposits, wealth management, credit cards, and mortgages

Clarity for Budget Management and Performance Tracking

Unlike static reports or spreadsheets, Revenue & Expense Trend Insights provides:

- Consolidated reporting across branches, categories, and product lines

- Clear visuals that simplify branch-level and enterprise-wide comparisons

- Actionable insights to control budgets, reduce waste, and align performance with goals

With this visibility, finance leaders and branch managers can work together to optimize performance and improve profitability. Empower your finance and branch teams with the visibility they need to control costs, track performance, and improve outcomes.

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

![]()

Complete GRC

All the GRC tools you need integrated in one solution

![]()

Basic to Enterprise

From simple risk assessment to complete risk register and control testing

![]()

Speed & Execution

Insights into your risk program & control effectiveness

![]()

Fast Implementation

The cloud-based solution can be integrated within days

![]()

Flexible and Modular

Pick the modules you need for your business

![]()

Easy to Use

Automation and an intuitive interface ensure ease of use

Learn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist