Risk Control Self Assessment for Banks and Financial Institutions

Risk and Control Self-Assessment (RCSA) reporting is critical to ensuring that banking and financial services organizations are addressing, evaluating, and mitigating risks. The process has traditionally been managed manually using distributed spreadsheets, documents, and email.

However, in today’s fast-paced regulatory environment, Chief Risk Officers, Risk Managers, Business Unit Managers, and Boards of Directors require more than last term’s historical assessment data. They need real-time risk and control insights.

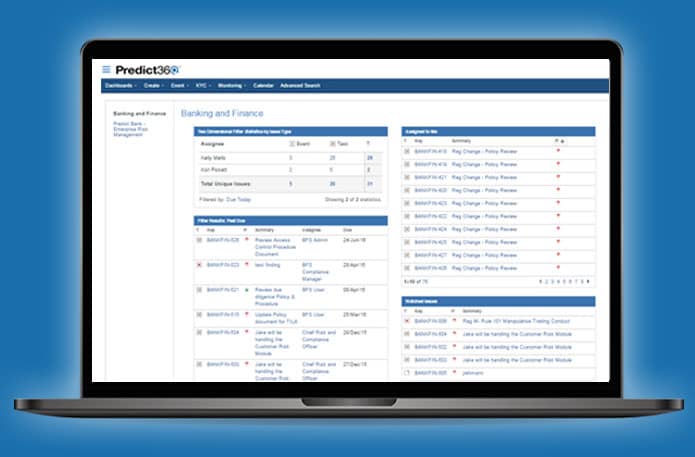

Predict360’s RCSA solution delivers risk stakeholders:

- Centralized risk and control reporting across business units

- A common taxonomy of risks and controls across the organization

- Risk assessment scheduling for periodic and/or reoccurring assessments

- Real-time identification of controls that are operating outside tolerance levels

- Action items for remediation or improvement plans that are linked to risks and/or assessments

RCSA Tools That Provide Uniformity, Expediency and Clarity

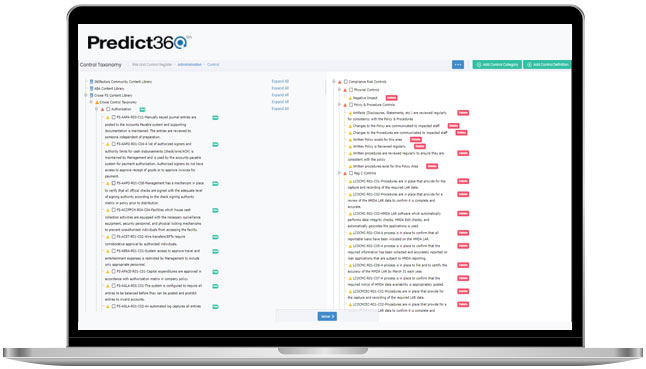

Predict360’s risk control self-assessment software enables organizations to manage risks using proven enterprise risk management techniques. It empowers organizations to capture inherent and residual risk ratings and controls, risk owners, risk types, management comments, monetary impact and more.

Individual risks can also be linked with their associated regulations and/or business obligations. The main features of Predict360 RCSA include:

- Real-time insight into RCSA progress and risk ratings

- Standardization of risk and control taxonomies make it easier to compare and evaluate risks

- Predict360 RCSA is integrated with OpenAI GPT4 – the premier LLM used by millions of people daily. Customers can generate AI-recommended risks and controls that are based on user-submitted regulatory documents, then move into their risk taxonomy and edit for refinement. The data submitted through the platform remains within Predict360 and is not used for training OpenAI’s LLM.

- Incorporate AI-recommended risks and controls into your risk register with just a few clicks and refine as required with editing.

- Enterprise level RCSA reports based on data from different business units

- Multiple RCSAs can be initiated concurrently within the same business unit, and the progress of all RCSAs will be independently tracked and updated according to their workflow.

- Executive visibility into risk items with the ability to drill down to greater detail

Replace Manual Risk Assessment Reports

Legacy risk assessment reports are time-consuming and inefficient. The effort required to gather and evaluate risks, controls, and inherent and residual risks is compounded by decentralized data and manual data entry and analysis.

Predict360 RCSA empowers risk managers to overcome:

- Inconsistent risk ratings across business units

- Non-standardized control taxonomies and definitions

- Difficulties in rolling up overall enterprise risk

- Duplication of efforts across departments

- Subjective versus objective assessments

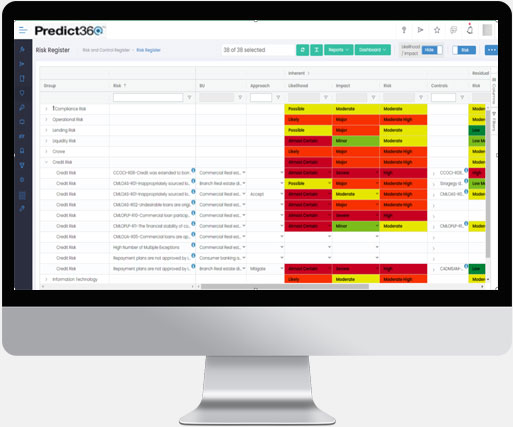

Assess Inherent, Residual and Current Operational Risks

Inherent and residual risk ratings can be captured as user-specified impact and likelihood values, or the system can prompt the end-user to determine these values through a company-defined set of questions/criteria. This ensures that a consistent risk rating methodology is used across the organization. This results in more accurate risk self-assessments.

- Control Information can be captured in a summary control text field or as individual control items with attributes including efficacy, implementation percentage, and weightage to calculate the effectiveness that a control has on managing a particular risk.

- Functionality linking multiple controls to a single risk and/or a single control linked to multiple risks is supported.

- Controls are implemented with a percentage and weightage to assess residual risks. A current risk rating is calculated and updated in real-time to identify risks operating outside tolerance levels. These values can be updated whenever an incident occurs, or control tests fail to instantly flag emerging risks to the enterprise

Control Testing

The Predict360 Control Testing application delivers additional functionality to the Risk Management and Control Self-Assessment application, including:

- Control activity management: tasks and activities can be created from and/or linked to controls, such as control tests, tasks and action plans to review or improve controls, and issues related to a process or control test failure.

- Control testing workflows, including both Design Assessment Procedures (DAP) and Operating Effective Procedures (OEP) types

- Optional control tests (industry-recommended assessments/questionnaires) that can be linked to specific controls pre-loaded into Predict360

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist