Bank Risk and Compliance Under One Platform

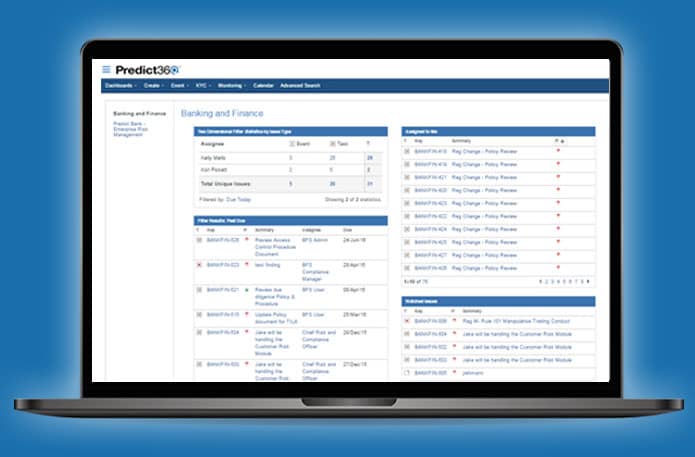

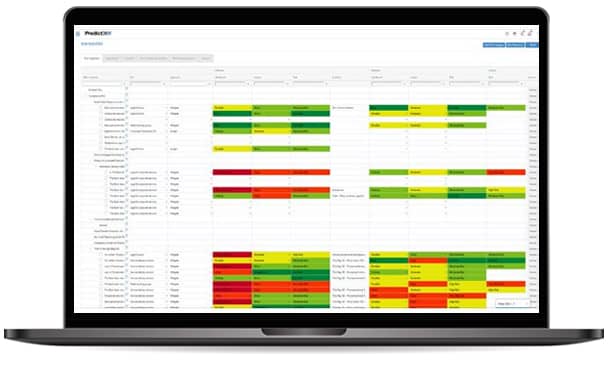

The Predict360 Risk and Compliance Intelligence platform brings all risk and compliance management activities under one platform, allowing banks to synchronize and streamline risk and compliance processes while eliminating redundancies. The integrated approach enables banks to predict risks, monitor compliance levels, and develop a responsive risk and compliance framework that delivers true business value for banks.

Request a Custom Demo

Industry Native Applications

Predict360 has been designed for the banking industry which enables it to deliver immediate benefits for banks. Experts from the banking and regulatory domains helped design the workflows and reporting features to ensure that bankers will be able to easily find all the tools and features they need to deliver enhanced risk and compliance performance. Our key relationships with American Bankers Association and other industry players allows us to deliver integrated services that help banks jumpstart their risk and compliance frameworks.

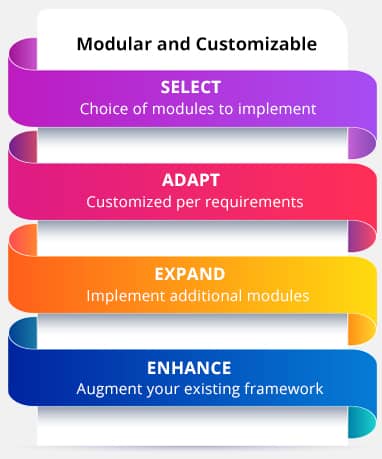

Predict360 Bank Risk And Compliance Management Software is Modular And Customizable

The modular nature of Predict360 is one of its most important features for banks. Banks can choose the solutions they need to achieve their strategic objectives. It is possible to implement selected modules of Predict360 and then add other modules later on, ensuring that banks can expand the solution as needed instead of locking themselves into a limited solution that cannot support their growth plans. Predict360’s risk and compliance solutions can be implemented by themselves or they can be implemented as an integrated solution to enable enhanced predictions and monitoring.

Connect with an Expert

Banking Services and Content

360factors has developed strategic partnerships with banking industry firms and service providers to deliver more value for our banking customers. Predict360 is the American Bankers Association endorsed solution for risk and compliance management. Customers can integrate risk libraries from ABA to enhance their risk management framework. Predict360 users can also integrate risk and compliance libraries from the banking community, risk and control libraries from Crowe, templates and advisory services from Temenos, and much more.

Reserve Your DemoWhy Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist