Home/ Blog / 2023 Global Survey Discovered 4 Dramatic Evolutions of Third-Party Risk Management Process

Third-Party relationships have become critical undeniably in the current era, where financial organizations’ ecosystems are progressively becoming intertwined. This interconnectivity comes with a complex web of risks that organizations must adeptly navigate.

The insights from Ernst & Young’s (EY) Global Third-Party Risk Management Survey show a vivid picture of the current landscape and the evolving challenges in managing third-party risks. This survey, portraying responses from diverse organizations across assorted sectors, offers a treasure trove of data and perspectives crucial for understanding the dynamics of the third-party risk management process.

We live in a world where 70% of businesses report an increased dependency on third parties. This astonishing statistic from the survey is not just a number; it reflects a rapidly changing business environment where external partnerships are integral to success. However, this increased reliance comes with its risks. More than half of the surveyed organizations (53%) reportedly faced significant incidents related to third-party engagements in the last three years, underscoring the hidden risks in such collaborations.

Despite these challenges, there’s a silver lining: awareness and action. A promising 59% of organizations plan to invest in the third-party risk management process, signaling a proactive stance toward mitigating potential risks. This shift is not just about financial investment; it’s a strategic realignment toward understanding and managing the complexities of third-party relationships more effectively. This blog will explore the dramatic shifts in 3rd party risk management processes and how businesses can navigate these challenges with technology and foresight.

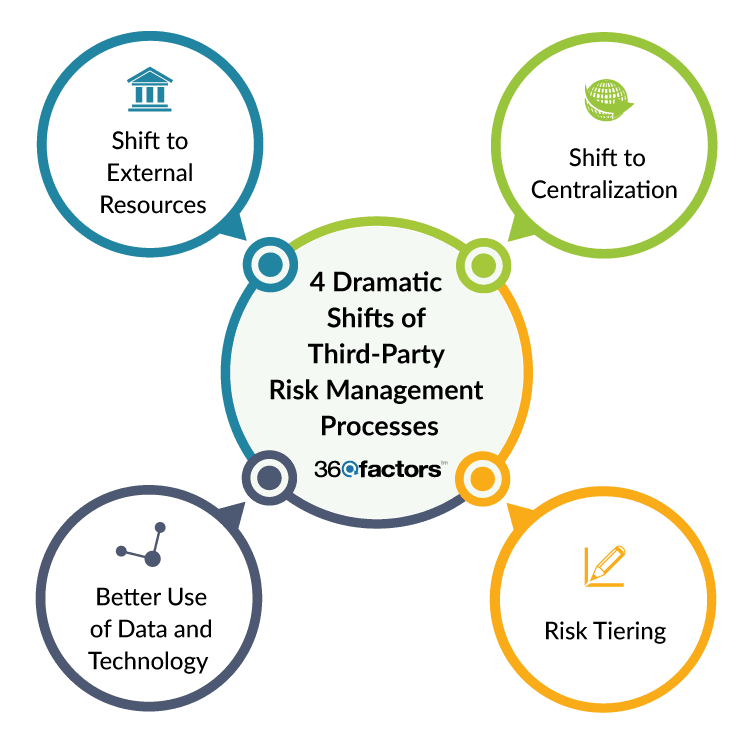

4 Dramatic Shifts of Third-Party Risk Management Processes

1. Shift to Centralization

The trend toward centralization in TPRM is a significant evolution. Organizations are moving from fragmented and siloed approaches to a more unified, organization-wide standard. This shift ensures a consistent application of risk management principles across all third-party risk management process engagements.

Mature organizations are particularly proactive in this area, integrating management of various third-party relationships into a single, comprehensive program. This approach allows for a more holistic view of third-party risks and enables better coordination and efficiency in managing these risks.

2. Shift to Using External Resources for TPRM Planning

The increasing reliance on co-sourcing and managed services is a strategic response to the growing complexity and scale of third-party risk management. These external resources offer specialized expertise, cost savings, and operational efficiencies for managing third-party risks.

External data sources have become vital in risk assessment and ongoing monitoring. This approach provides a broader perspective on potential risks through market and peer data, especially for critical third-party risk management processes, and fosters extended management relationships.

3. Risk Tiering

As the focus on critical third-party operations has intensified, organizations are implementing more stringent oversight and control mechanisms. A tiered approach to risk management allows organizations to allocate resources more effectively and focus on the most significant risks.

The criteria for determining a critical third party often revolve around financial impact and the services’ criticality. Data sensitivity and system access also play a crucial role in this assessment.

A notable challenge in this area is the difficulty in assessing the impact of unforeseen external events on third-party risk management processes and inventories, highlighting the need for dynamic and adaptable risk management strategies.

4. Increased Use of Data and Technology

Integrating technology and automation into TPRM processes represents a significant leap forward. These tools enhance the efficiency and effectiveness of risk assessments and monitoring. Many organizations report improving their understanding of their overall third-party risk posture due to these technological advancements.

The future of third-party risk management frameworks appears to be increasingly tech-driven, with many organizations planning to integrate more automation and external data sources into their risk assessment processes. This trend reflects a growing recognition of the value of technology in managing complex and evolving risk landscapes through third-party risk management processes.

Need for a Comprehensive Third-Party Risk and Compliance Management System

The need for a comprehensive Third-Party Risk and Compliance Management System has become more pronounced in the evolving global business landscape. As the EY Global TPRM Survey highlights, the dynamics of third-party interactions are changing rapidly, requiring a more robust and integrated approach to managing these relationships. Let’s understand the Imperative for a Comprehensive TPRM solution by highlighting a few factors:

1. Complexity of Modern Business Ecosystems

Today’s organizations are not isolated entities; they operate within intricate networks of suppliers, vendors, partners, and contractors. This complexity demands a third-party risk management process that can identify and assess risks across various third parties to manage and monitor these risks continuously.

2. Evolving Regulatory Landscape

With increasing regulatory scrutiny around data privacy, cybersecurity, and compliance, organizations must ensure that their third-party networks follow these evolving standards. A comprehensive TPRM system provides the framework to ensure compliance within the organization and its entire 3rd party risk management ecosystem.

3. Risk Exposure and Management

The interconnected nature of third-party relationships means that risks in one area can have flowing effects throughout the organization. A comprehensive third-party risk management process identifies these risks, assesses their potential impact, and develops strategies to mitigate them effectively.

Third-Party Risk and Compliance Management Solution Set Can Manage All Your Challenges

Organizations constantly pursue solutions to address their comprehensive risk and compliance management needs in TPRM’s complex and challenging landscape. The Predict360 Third-Party Risk Management solution offers an integrated, best-in-class solution to confidently manage an organization’s third-party risk and compliance.

Best Practices of Predict360 TPRM Solution

Planning and Risk Register Management

Predict360 Third-Party Risk and Compliance Management Solution enables organizations to categorize and manage their third-party relations with the help of an effective third-party risk management process in a risk register. This enables an initial risk assessment during the third-party evaluation phase. This feature ensures a structured approach to identifying and assessing third-party risks.

Enhanced Due Diligence and Selection

The TPRM solution facilitates requesting, evaluating, and storing third-party documents like SOC Reports in a central repository. It utilizes third-party risk intelligence to assess various risk factors for each potential third party, including financial, cyber, ESG, OFAC, etc. The centralized document retrieval and management system streamlines the process of comparing third parties to select the best option.

Contract Management and Documentation

Managing third-party documentation and contracts is streamlined with Predict360 Third-Party Risk and Compliance Management Solution. It establishes a third-party risk management process for centralizing and tracking all third-party documentation and contracts in a single place, ensuring comprehensive oversight and efficient management of these critical documents through third-party risk management software.

Ongoing Monitoring and Compliance Testing

Predict 360 Third-Party Risk and Compliance Management Solution makes it much easier to conduct ongoing risk assessments, compliance tests, and analysis of third-party risk trends. It includes features for scheduling periodic risk assessments and continuously tracking third-party risk metrics, ensuring organizations stay ahead of potential risks.

Termination and Offboarding Workflows

Predict360 Third-Party Risk and Compliance Management Solution provides configurable workflows for offboarding third parties, including standardized procedures for notification, transitioning responsibilities, records handoff, and final exit procedures.

Wrapping Up

To conclude, our exploration of the dramatic evolutions in third-party risk management processes, it’s clear that the landscape is rapidly changing. The insights from the EY Global Third-Party Risk Management Survey and the capabilities of advanced solutions like Predict360 Third-Party Risk and Compliance Management Solution highlight a pivotal shift in how organizations approach third-party risks.

The 4 dramatic transformations which have been discussed include the following:

- Centralization and Integration

- Utilization of External Resources

- Risk Tiering and Focused Oversight

- Technological Advancements

The challenges of modern third-party risk management processes demand more than traditional methods. Organizations need solutions that are not only comprehensive but also adaptable and forward-looking. This is where technology-based solutions like Predict360 Third-Party Risk and Compliance Management Solution come into play. This third-party risk management software offers a range of functionalities – from planning and risk assessment to ongoing monitoring and compliance testing – all integrated into a single platform.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.