Home/ Blog / Top 6 Foremost Practices for Effective Third-Party Risk Management

The importance of effective third-party Risk Management (TPRM) must be addressed in the current era, where financial organizations’ ecosystems are progressively becoming interdependent and complex. The EY Global Third-Party Risk Management Survey, a thorough study involving senior executives from diverse industries, offers profound insights into the evolving landscape of TPRM. This survey highlights the growing magnitude of TPRM in today’s corporate world and sheds light on the challenges and opportunities it presents.

The survey takeaways highlighted that most companies acknowledge the cruciality of TPRM yet require assistance with its successful execution. This gap is mainly because of the shifting nature of risks, the criticality of managing numerous effective third-party risk management associations, and regulatory pressures. The study explores that TPRM is a strategic function and regulatory checkbox that can notably influence a business’s competitive edge and resilience.

One of the standout revelations from the survey is the pivotal role of technology in revolutionizing TPRM. The adoption of third-party risk management technology has emerged as a critical trend, offering organizations the tools to manage risks more proactively and efficiently. This technological pivot is not just a response to the growing complexity of risks but also a strategic move to harness the full potential of third-party relationships.

This blog will explore the six foremost practices for effective third-party risk management, integrating risk and compliance management solutions, and the strategic importance of 3rd party risk management in contemporary business circumstances.

6 Leading Methods for Effective Third-Party Risk Management

Implementing a structured and strategic approach is crucial to successful TPRM. We can identify six pivotal practices that stand out in managing third-party risks by drawing insights from the EY Global Third-Party Risk Management Survey.

1- Define Objectives and Scope

A successful TPRM program begins with clearly defining its objectives and scope. An effective third-party risk management program can be established with developed operational frameworks, including the NIS2 Directive, digital operational resilience, or the operational resilience framework, which can offer a holistic foundation.

Such frameworks provide IT, cybersecurity, business continuity planning guidelines, and third-party dependency management. A gap analysis and impact evaluation can refine your approach as well.

2- Comprehensive Third-Party Inventory Management

Recognizing, documenting, and sustaining an up-to-date inventory of your third-party relationships is critical. This step guarantees a clear view of all the external entities involved in your operations, leading to more efficient monitoring and management.

3- Development of Policies and Procedures

Navigating the challenge of internal coordination, often quoted as a significant pain point, is essential for effective third-party risk management. Establishing comprehensive policies and procedures facilitating smooth collaboration among internal stakeholders is critical to a successful TPRM strategy.4- Enhanced Ongoing Monitoring

Sustaining third-party risk management is not a one-time activity. It requires continuous monitoring to ensure dynamic risk reporting and management in the organization’s structured third-party risk management framework. Regularly updating your risk assessments of third parties can help identify and mitigate risks proactively.

5- Establishing a Strong Governance Structure

TPRM requires input from several teams and functional departments within a company. Developing a well-documented governance structure, particularly with a standardized policy supplemented by adherence to local laws for enterprises operating across diverse jurisdictions, is critical for effective third-party risk management.

6- Leveraging Technology and Automation

Integrating automation and external data providers into the supplier lifecycle enhances the efficiency of TPRM programs. Cross-functional workflows involving vendor evaluation, purchasing, cyber risk assessment, and supply chain resiliency benefit significantly from technological integration, leading to better risk management and reporting.

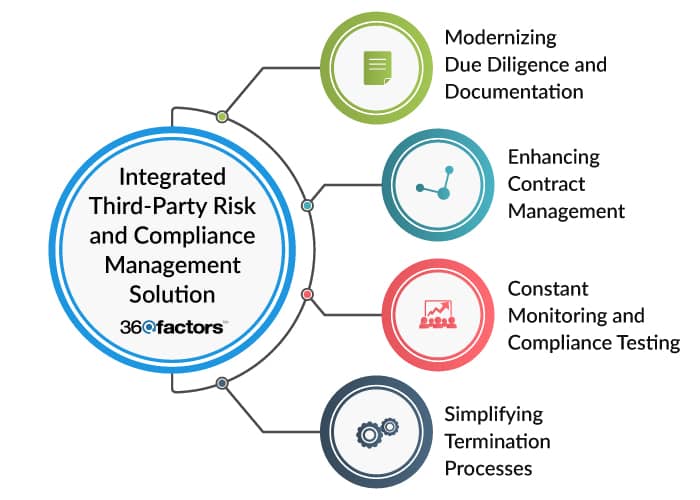

Integrated Third-Party Risk and Compliance Management Solutions

In the advancing landscape of third-party risk management (TPRM), integrating technology-based solutions has become necessary for efficiency and effectiveness. Predict360 TPRM, a Third-Party Risk and Compliance Management Solution, exemplifies how technology can revolutionize TPRM.

Predict360 Third Party Risk and Compliance Management Solution leverages predictive analytics to enhance effective third-party risk management. Its comprehensive approach allows organizations to track and anticipate risks, ensuring a proactive stance in risk management.

Streamlining Due Diligence and Documentation

Predict360 TPRM improves due diligence by allowing the evaluation and secure storage of third-party risk management documents, such as SOC reports. Its centralized document management system is critical for ongoing monitoring and compliance with regulatory standards.

Enhancing Contract Management

Predict360 TPRM offers effective third-party risk management features that streamline the management of third-party documentation and contracts. It establishes a process for centralizing and tracking all third-party documentation, ensuring that all contracts and related activities are managed efficiently.

Continuous Monitoring and Compliance Testing

The tool monitors third-party relationships, including regular risk assessments and compliance testing for your vendors and third-party business partners. This ongoing vigilance is crucial in a landscape where third-party risks can rapidly evolve out of nowhere.

Simplifying Termination Processes

Predict360 TPRM also addresses the need for standardized, configurable workflows for terminating third-party relationships, ensuring a smooth and compliant offboarding process.

Conclusion

To conclude our discussion of effective third-party risk management (TPRM), it’s clear that the landscape of managing third-party relationships is becoming complex and dynamic. The practices and technologies we’ve discussed are not just strategies but essential components for safeguarding an organization’s integrity, reputation, and operational resilience.

In this blog, we delved into the six leading practices for successful TPRM, each offering unique insights and strategies:

- Defining clear objectives and scope aligned with established operational resilience frameworks.

- Maintaining a comprehensive third-party inventory for better oversight.

- Developing robust policies and procedures to streamline internal coordination.

- Enhancing ongoing monitoring for dynamic risk management.

- Establishing a solid governance structure to ensure cohesive and effective third-party risk management efforts.

- Implementing technology and automation, particularly third-party risk management software solutions like Predict360 Third-Party Risk and Compliance Management Solution, to bring efficiency and predictive capabilities into the TPRM processes.

Effective TPRM is more than just a compliance requirement; it’s a strategic activity contributing significantly to an organization’s overall condition and success. Organizations can avoid potential pitfalls by effectively managing third-party risks and unlocking new opportunities for growth and collaboration. The ability to manage these risks effectively is a testament to an organization’s resilience, adaptability, and commitment to excellence.

As we move forward in an increasingly interconnected business world, the importance of effective third-party risk management will only grow. Organizations that embrace these practices and integrate advanced technological solutions such as Predict360 Third-Party Risk and Compliance Management Solution will be better positioned to navigate the complexities of third-party relationships.

Technological solutions enable more effective TPRM and streamline reporting to senior leadership. Integrating AI allows more accurate risk assessments and predictive insights, enhancing the overall TPRM process.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.