Home/ Blog / How to Build Digital Risk Insights for Successful Risk Management

In the current, swiftly evolving digital environment, every click, swipe, and tap produces valuable data. As we live on the cusp of digitalization, financial enterprises are at a crossroads. On one side, there is the temptation of harnessing the large volume of data to make well-informed decisions, and on the other side, the looming shadow of possible risks that come with it.

Visualize a landscape where financial organizations can forecast potential risks before they emerge. Data-driven predictive tools can be used for proactive strategies to help your business build digital risk insights that are meaningful and robust. But why is it so critical for the present financial environment? And how can companies smoothly integrate it into their operations?

This blog will bring you to the informative journey of the transformative world of digital risk insights, exploring its importance and the 7 building blocks that make it possible. Whether you’re a risk management executive, a CEO, or simply someone intrigued by the digital evolution of risk management, this guide promises a comprehensive look into the future of risk assessment in the digital era.

Introduction to Digital Risk Insights and Its Importance for Financial Institutions

There are several opportunities for financial enterprises to build digital risk insights. From AI-driven investment approaches to online banking, digital transformation has revolutionized how we perceive and interact with the economic landscape.

But with such developments come new challenges, especially in risk management. This is an area where the importance of digital risk insights is highlighted the most.

What Are Digital Risk Insights?

At their core, digital risk insights are associated with the data-driven understanding and forecasting of potential risks and opportunities in the digital environment. It’s not just restricted to detecting existing risks but also utilizes the power of data to forecast them, understand their implications, and devise approaches to navigate or reduce them. Using risk analysis software to get relevant digital risk insights is the best way to get this done.

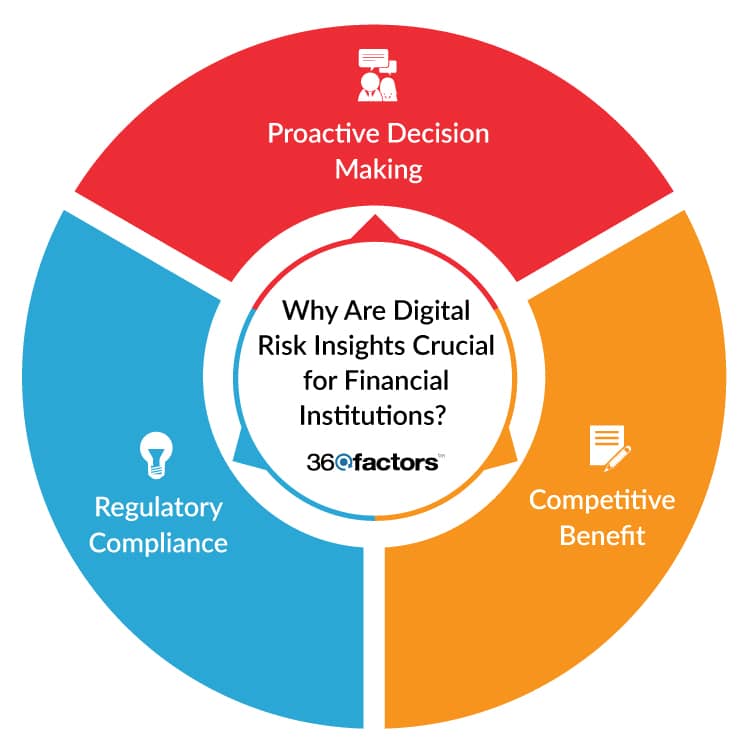

Why Are They Crucial for Financial Institutions?

Proactive Decision Making

With the proficiency to build digital risk insights, financial enterprises can move from a reactive approach to a proactive one. Instead of responding to risks and threats after they occur, institutions can expect and prepare for them, guaranteeing smoother operations and improved customer trust.

Competitive Benefit

In a saturated market, having a robust digital risk insight framework can set an institution apart from its competitors. Such businesses are leveraging digital tools and ensuring they are used responsibly and safely, allowing them to build competitive advantage.

Regulatory Compliance

As regulatory bodies worldwide become more stringent about digital operations, a clear understanding of digital risks ensures institutions remain compliant, avoiding potential legal pitfalls and the associated financial repercussions.

Building Digital Risk Insights Can Be a Game-changing Experience for Key Stakeholders

Navigating the digital world can be tricky for many organizations because of the overwhelming amount of information. But what if there was an appropriate guide to help people through this confusing digital space? Digital Risk Insights provides clear guidance in this complex digital landscape.

For Risk Executives

Gone are the days when risk management was about examining plenty of paperwork and manual analyses. With the power to build digital risk insights, executives can now focus on strategic, high-value decisions. Routine tasks can be automated. Advanced analytics can be generated by setting up risk indicators, a task that was once considered unmanageable.

For CEOs and Heads of Business

Decision-making is an art, and with digital risk insights, it’s now backed by science. CEOs no longer rely solely on intuition or past experiences. An insightful visual tool powered by data offers strategic advice on risk-oriented business decisions. It’s like having a trusted advisor, always available, always informed, guiding your every move.

For Regulators

The shift is enormous. From poring over reports to accessing near-live data, regulators now have a more straightforward, real-time reason to build digital risk insights into the financial landscape. They allow quicker analyses, enhanced guidance, and a proactive approach to systemic risks.

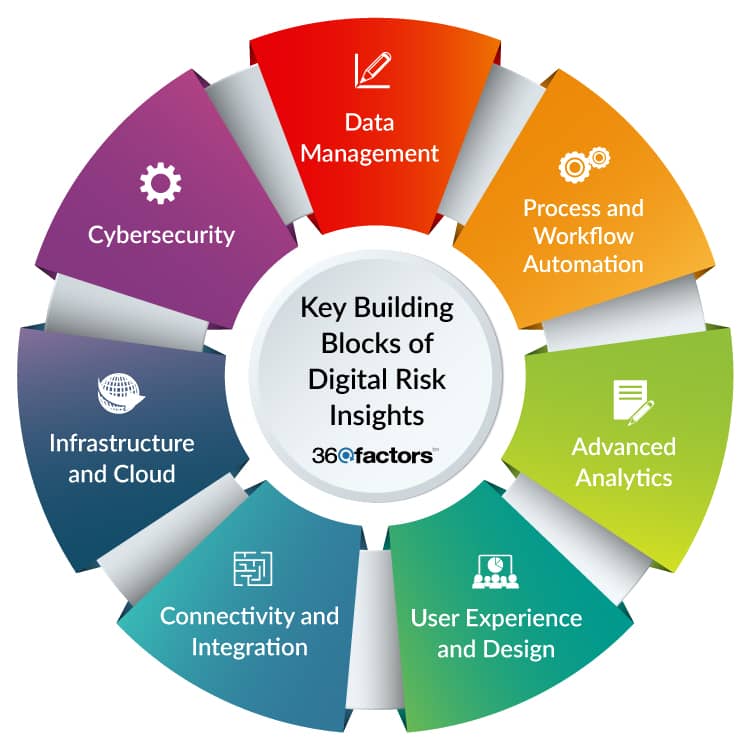

7 Key Building Blocks of Digital Risk Insights

Dealing with the complicated web of the digital landscape needs more than just apps and technologies; it requires a foundational knowledge of the main attributes that drive digital risk insights. Let’s discuss the seven essential building blocks that highlight a successful digital risk strategy:

Data Management

Data is the lifeblood of the digital age. However, with no appropriate structure and governance framework, raw data can lead to misrepresentation. Improved data governance allows financial enterprises to build digital risk insights and protocols that ensure data sources’ accuracy, stability, and reliability. As the types of data that we collect expand—from transactional data to social media views—risk management approaches must evolve to encompass these new data ranges.

Process and Workflow Automation

A new era of efficiency has accompanied digital transformation. AI-based risk assessment tools can now handle repetitive tasks, decreasing human error and freeing up personnel for more strategic work. But automation isn’t just about individual accountabilities—it’s about reconceptualizing entire workflows. Institutions can ensure seamless, competent risk insights by incorporating tasks into unified, intelligent workflows.

Advanced Analytics

The volume of data generated by businesses today is overwhelming. Traditional analytics methods are still valuable, but businesses must also build digital risk insights to assess and prepare for risks. Enter advanced analytics, leveraging the power of artificial intelligence and predictive modeling. These tools can identify patterns, forecast potential risks, and indicate mitigation strategies, offering a proactive approach to risk management.

User Experience and Design

No matter how critical they are, risk management tools are only as good as their usability. A well-crafted user interface is vital for such tools as it ensures that risk insights are available, understandable, and actionable. By prioritizing seamless user experience, organizations can ensure that stakeholders at all levels can easily navigate, grasp, and utilize the digital risk insights presented to them.

Connectivity and Integration

Organizations must build digital risk insights that easily incorporate data from the enormous and diverse digital ecosystem. From legacy systems to cutting-edge platforms, ensuring unified integration is crucial. This connectivity gathers data from one source or platform that can be used for analysis and informed decision-making on another, supporting a holistic, integrated approach to risk management.

Infrastructure and Cloud

The basis of any digital risk insights initiative is its infrastructure. Advanced risk analysis software needs a robust, scalable, and resilient infrastructure that is easily accessible to cross-geographical teams. With their integral scalability and flexibility, such cloud solutions are becoming the go-to for many institutions.

Cybersecurity

The more we digitize, the more we open ourselves to potential cybersecurity risks. Robust cybersecurity is non-negotiable to build digital risk insights in the currently challenging business environment. This includes reactive measures like firewalls and intrusion detection systems, as well as proactive strategies, such as threat hunting, regular audits, and continuous employee training.

Conclusion

Managing risk is a challenge in the developing business world. But it can also be an opportunity to enhance the strength of data, innovate with advanced technologies, and redefine the spirit of risk management for the versatile age. We explored the importance of digital risk insights, discussed its foundational building blocks, and understood that the future of risk management is transformative, not just digital.

The future of risk management is not just about identifying existing risks but risk prediction and navigating them proactively by building digital risk insights. Tools like Predict360 Risk Insights are taking charge in this transformative journey.

Predict360 Risk Insights stands out as a beacon of innovation in the dynamic world of risk management. Powered by Artificial Intelligence (AI), this solution incorporates internal and external data and supports risk prediction, offering a comprehensive view of the risk landscape.

Key Features of Predict360 Risk Insights:

- A user-friendly interface that identifies risks operating outside of tolerance levels and predicts emerging risks.

- Allows for mapping the customer’s existing risk register.

- Collects and monitors internal risk data, providing real-time insights.

- Links Key Risk Indicators with market and peer performance data, offering a holistic view of the risk environment.

- Analyzes external and internal data, allowing users to dive deep into the details and understand risk trends.

- Enables users to record and manage risk-related issues seamlessly.

Whether used as an integrated module of the Predict360 Risk and Compliance intelligence platform or as a standalone system to build digital risk insights for your business, Predict360 Risk Insights promises to modernize how financial institutions perceive and manage risks.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.